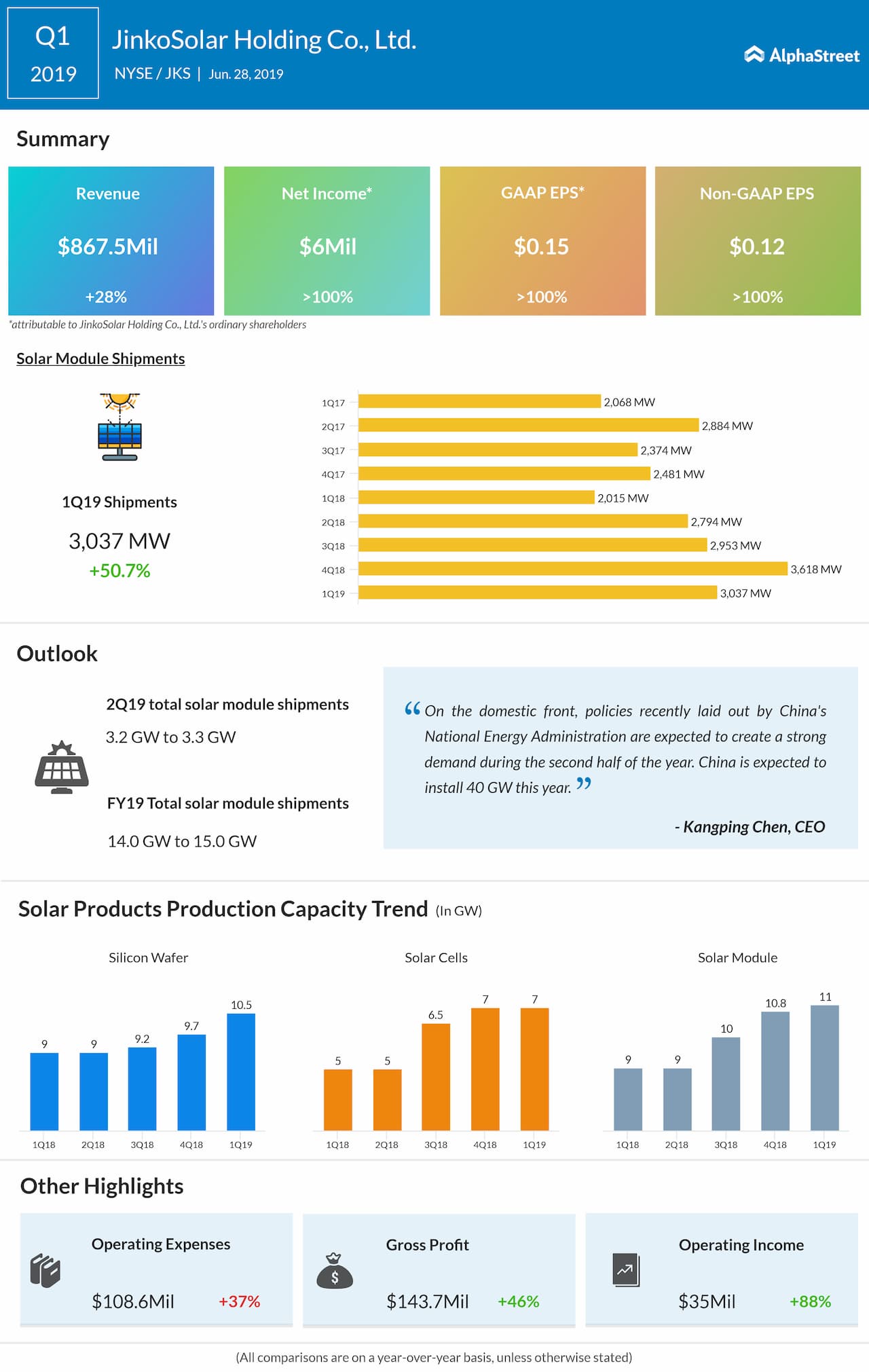

Net income attributable to ordinary shareholders was RMB40.2

million ($6 million) compared to RMB3.6 million in the prior-year quarter. Diluted

earnings per ADS were RMB1.016 ($0.152).

Adjusted net income was RMB33.3 million ($5 million)

compared to RMB11 million last year. Adjusted diluted earnings per ADS were

RMB0.840 ($0.124), ahead of projections of $0.10 per share.

JinkoSolar’s CEO Mr. Kangping Chen said, “We continue

to see strong demand from overseas markets and have secured the vast majority

of our order book for the rest of the year. The global solar market continues

to generate rapid and sustainable growth momentum as grid parity approaches, in

particular for our high-efficiency mono products which are continuously in

short supply. Our global distribution network allowed us to quickly meet

growing demand for our high-efficiency mono products over the past few quarters

as the market transitioned. We are accelerating the expansion of our

high-efficiency mono production capacity and estimate they will account for

over 60% of our total shipments for the year.”

Total solar module

shipments were 3,037 MW, up 50.7% from 2,015 MW in the year-ago quarter. As of

March 31, 2019, the company’s in-house annual silicon wafer, solar cell and

solar module production capacity was 10.5 GW (including 6.5 GW of mono wafers),

7 GW (including 5.4 GW of PERC cells) and 11 GW, respectively.

JinkoSolar expects

its annual silicon wafer, solar cell and solar module production capacity to

reach 15 GW (including 11.5 GW of mono wafers), 10 GW (including 9.2 GW of PERC

cells) and 16 GW, respectively, by the end of 2019.

For the second quarter of 2019, JinkoSolar estimates total solar module shipments to be in the range of 3.2 GW to 3.3 GW. For the full year of 2019, the company estimates total solar module shipments to be in the range of 14 GW to 15 GW.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.