High Demand

The demand for solar panels increased notably this year. The uptrend, combined with stable prices, will translate into earnings growth for manufacturers like JinkoSolar. However, margins could come under pressure from rising costs, thereby dragging the bottom line – though it will be offset by higher volumes to some extent.

It is estimated that the positive macroeconomic backdrop is conducive to growth as far as the alternative energy industry is concerned. After a short lull, the installation of solar power facilities is witnessing a rebound in the local market.

Headwinds

The company’s strained cash flow might weigh down on its capacity expansion initiatives. The recent escalation of the tariff war between Washington and Beijing does not bode well for the clean energy sector in the long run, especially the overseas operations. The sector has constantly been on the receiving end ever since the trade dispute popped up.

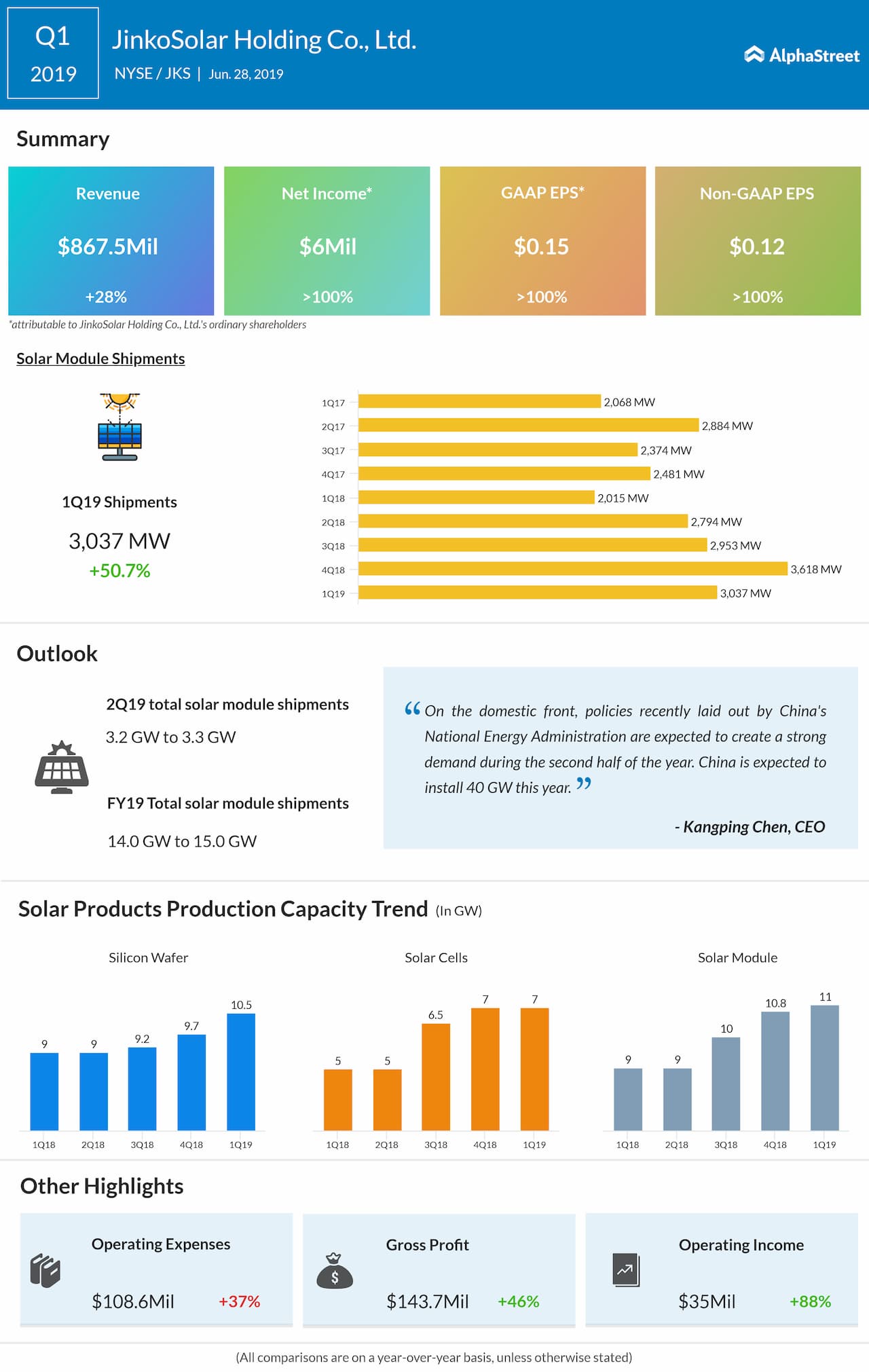

JinkoSolar’s’s earnings and revenues increased in double-digits to $0.12 per ADS and $867.5 million respectively in the first quarter and topped the estimates, supported by strong delivery growth. Total shipments jumped 51% annually to 53,037 MW.

Peer Performance

Underscoring the positive momentum in the sector, Canadian Solar (CSIQ) recently said it turned to profit in the second quarter from last year’s loss, helped by a 59% growth in revenues to about $1 billion. Among others, First Solar (FSLR) posted a narrower net loss for the second quarter, aided by an 89% revenue growth amid record module production and shipments.

Also see: JinkoSolar Q1 2019 Earnings Conference Call Transcript

JinkoSolar shares have stayed positive since the beginning of 2019, recovering from last year’s multi-year lows. The stock has gained 45% since last year.