Meanwhile, Wall Street is pessimistic about the bottom-line performance, amid concerns over the unfavorable pricing scenario and higher marketing and logistics expenses. Third-quarter profit is forecast to fall by 19% to $2.03 per share. Currently, the consensus analysts’ rating on the company’s stock is hold, while the majority among the remaining analysts recommend sell. The average price target is $101.67.

Wall Street is pessimistic about the bottom-line performance, amid concerns over unfavorable pricing and higher expenses

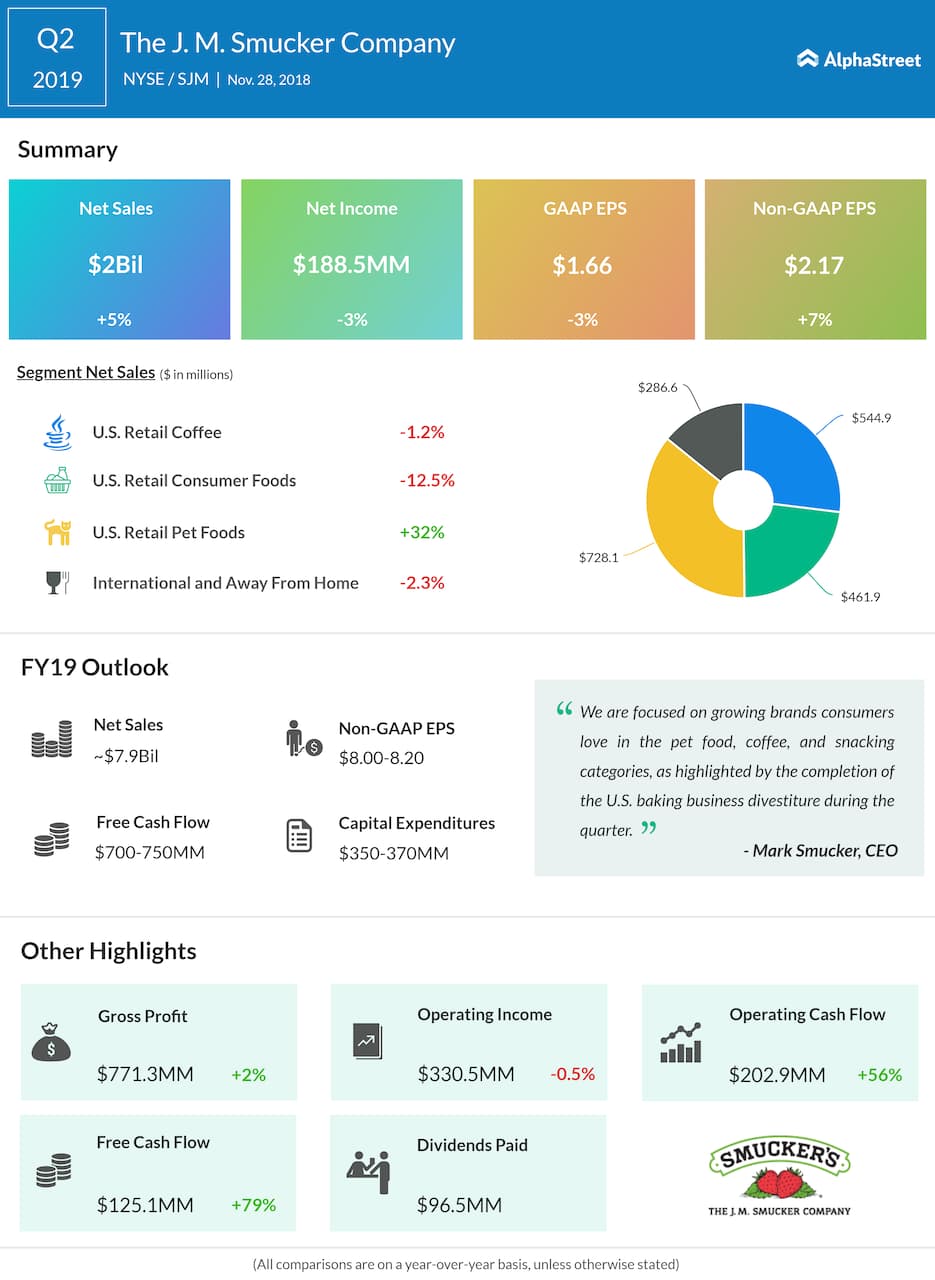

Taking a cue from its unimpressive performance in the second quarter, when profit and sales fell short of expectations despite a year-on-year increase, the company had lowered its full-year outlook in November last year. Though sales rose 5% to $2 billion in the second quarter it was mainly due to the Ainsworth acquisition, which was partially offset by lower price realizations. The 7.4% earnings growth, to $2.17 per share, came largely from lower expenses.

Of late, food companies are taking the M&A route to sustain growth, while devising strategies to cash in on the popularity of the brands they acquire. In most cases, they depend on external funding due to weakness in cash flow, and the high costs of availing credit often become a burden for them in the long run.

Related: Campbell Soup’s Q1 results beat estimates

The industry is going through a challenging phase, marked by dwindling demand and high transportation and input costs. Also, the companies are constantly under pressure to innovate and revise their business strategies.

Shares of JM Smucker, which have underperformed the market so far this year, closed the last trading session sharply lower. In the past twelve months, the stock maintained a steady downtrend and lost about 19%.