Q2 Report Due

After entering fiscal 2024 on a high note, the pharma giant is getting ready to publish its second-quarter results on Wednesday, July 17, at 6:20 am ET. The average earnings estimate of analysts following the company is $2.50 per share for Q2, excluding one-off items, vs. $2.56 per share in the prior year period. Sales are seen falling 19.3% year-over-year to $20.59 billion.

Joe Wolk, the company’s CEO, said at the Q1 earnings call, “We anticipate Innovative Medicine sales growth to be slightly stronger in the first half of the year compared to the second half given the anticipated entry of Stelara biosimilars in Europe midyear. For MedTech, we expect operational sales growth to be relatively consistent throughout the year. Looking ahead, we have many important catalysts in the pipeline that will drive meaningful near- and long-term growth across both Innovative Medicine and MedTech.”

Q1 Outcome

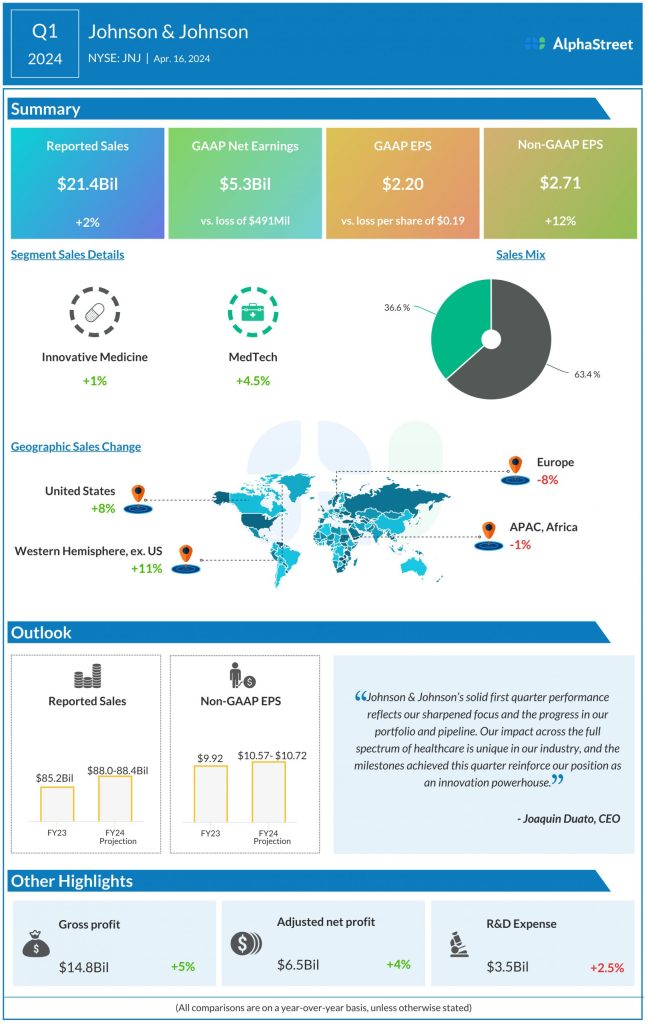

In the first three months of FY24, sales at the core Innovative Medicine business edged up 1% year-over-year and MedTech sales grew 4.5%. At $21.4 billion, total sales were up 2%, which translated into a 12% increase in adjusted earnings to $2.71 per share. Quarterly earnings have beaten estimates almost every quarter for more than a decade. The company invested around $3.5 billion in research and development in Q1, which represents about 17% of its sales.

For the whole of 2024, JNJ executives forecast sales in the range of $88.0 billion to $88.4 billion, compared to $85.2 billion a year earlier. Full-year adjusted profit is expected to grow about 7% to $10.65 per share, which is the mid-point of the $10.57-$10.72 per share guidance range.

Deals

Recently, the company signed an agreement to acquire medical device maker Shockwave Medical as part of expanding its cardiovascular portfolio. The deal comes on the heels of completing the acquisition of Ambrx, which develops engineered biologics using a genetic code technology platform, in a move aimed at strengthening the oncology portfolio.