JPMorgan

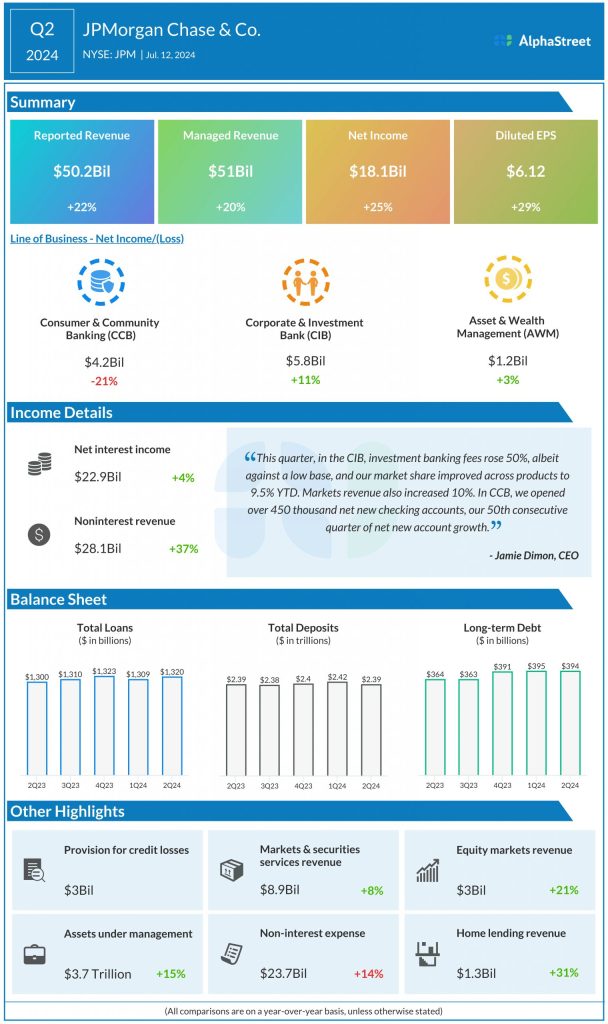

Net interest income grew 4% to $22.9 billion. Non-interest revenue rose 37% to $28.1 billion. Non-interest expense was up 14% to $23.7 billion. Provision for credit losses was up 5% to $3 billion.

CEO Jamie Dimon provided a cautious outlook on the economy. He stated that,

“While market valuations and credit spreads seem to reflect a rather benign economic outlook, we continue to be vigilant about potential tail risks. These tail risks are the same ones that we have mentioned before. The geopolitical situation remains complex and potentially the most dangerous since World War II — though its outcome and effect on the global economy remain unknown. Next, there has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. Therefore, inflation and interest rates may stay higher than the market expects.”

Wells Fargo

In Q2 2024, Wells Fargo’s total revenue rose 1% year-over-year to $20.7 billion, beating expectations of $20.2 billion. Net income dipped 1% to $4.9 billion. EPS grew 6% to $1.33, surpassing projections of $1.28.

Net interest income decreased 9% to $11.9 billion. Non-interest income increased 19% to $8.7 billion. Non-interest expense increased 2% to $13.2 billion.

“We continued to see growth in our fee-based revenue offsetting an expected decline in net interest income. The investments we have been making allowed us to take advantage of the market activity in the quarter with strong performance in investment advisory, trading, and investment banking fees. Credit performance was consistent with our expectations, commercial loan demand remained tepid, we saw growth in deposit balances in all of our businesses, and the pace of customers reallocating cash into higher yielding alternatives slowed.” – Charlie Scharf, CEO

Citigroup

Citigroup reported revenues of $20.1 billion for Q2 2024, up 4% year-over-year. Revenues were in line with market estimates. Net income increased 10% to $3.22 billion. EPS rose 14% to $1.52, beating projections.

Citigroup’s end-of-period loans were $688 billion at quarter-end, up 4% versus last year, largely reflecting growth in cards in US Personal Banking and higher loans in Markets and Services. End-of-period deposits were approx. $1.3 trillion at quarter-end, down 3% versus the previous year, mainly due to a reduction in Treasury and Trade Solutions, reflecting quantitative tightening.

“Services continued to grow, driven by solid fee growth increased activity in cross border payments and new client onboardings. Markets had a strong finish to the quarter leading to better performance than we had anticipated. Fixed Income was slightly down year-over-year and Equities was up 37%, driven by strong performance in derivatives. Banking was up 38% as the wallet rebound gained some momentum and we again grew share. Wealth is starting to improve. Growth in client investment assets drove stronger investment revenue, and our focus on rationalizing the expense base is starting to pay off. U.S. Personal Banking saw revenue growth of 6%, with all three businesses again contributing to the topline.” – Jane Fraser, CEO