JPMorgan Chase & Company (JPM) reported better-than-expected revenues for the fourth quarter of 2018 but missed estimates on earnings. The stock was down 2.4% in premarket hours on Tuesday.

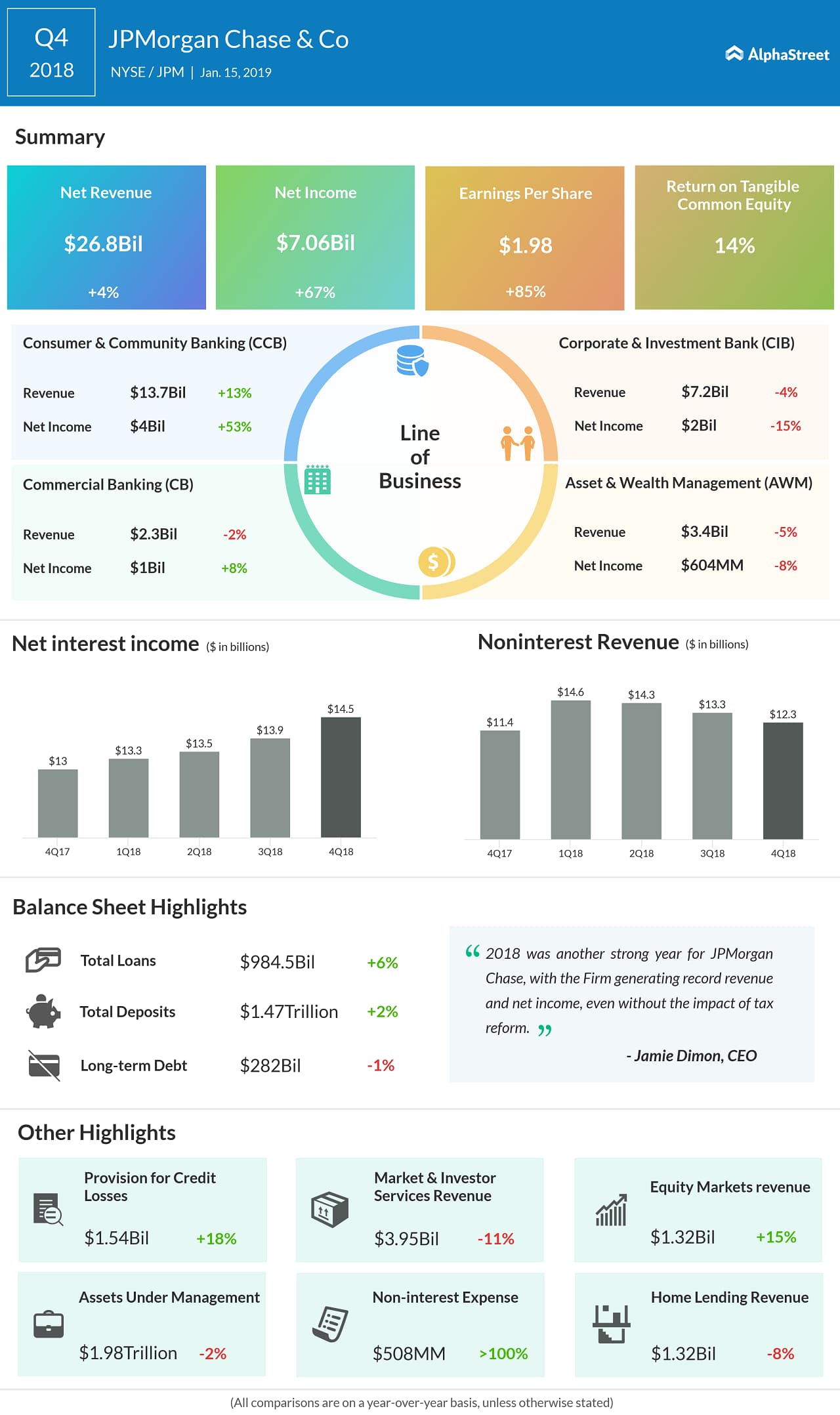

Reported revenues grew 7% year-over-year to $26.1 billion while managed revenues were up 4% to $26.8 billion. Net income increased 67% to a record $7.1 billion while EPS grew 85% to $1.98 from the same period a year ago.

Net interest income grew 9%, driven by higher rates and loan growth. Non-interest revenue dropped 1% to $12.3 billion. Non-interest expense rose 6%, driven mainly by investments in the business, including technology, marketing and real estate.

Also see: JPMorgan Chase Q4 2018 Earnings Transcript

The provision for credit losses increased by $240 million from last year to $1.5 billion in the quarter, driven by higher net reserve builds in the Consumer and Wholesale portfolios. Return on common equity was 12% in the quarter.

Earnings preview: JPMorgan will brave global headwinds in Q4

JPMorgan saw revenue declines across all its segments except for Consumer & Community Banking. In the Consumer & Community Banking segment, revenues benefited from higher net interest income on higher deposit and card margins and balance growth. Revenues in the Asset & Wealth Management segment were negatively impacted by lower market levels.

Banking stocks have faced pressures from a slowing economy, market volatility and the trade war. On Monday, JPMorgan’s rival Citigroup (C) reported fourth quarter results, beating earnings estimates but missing on revenues.