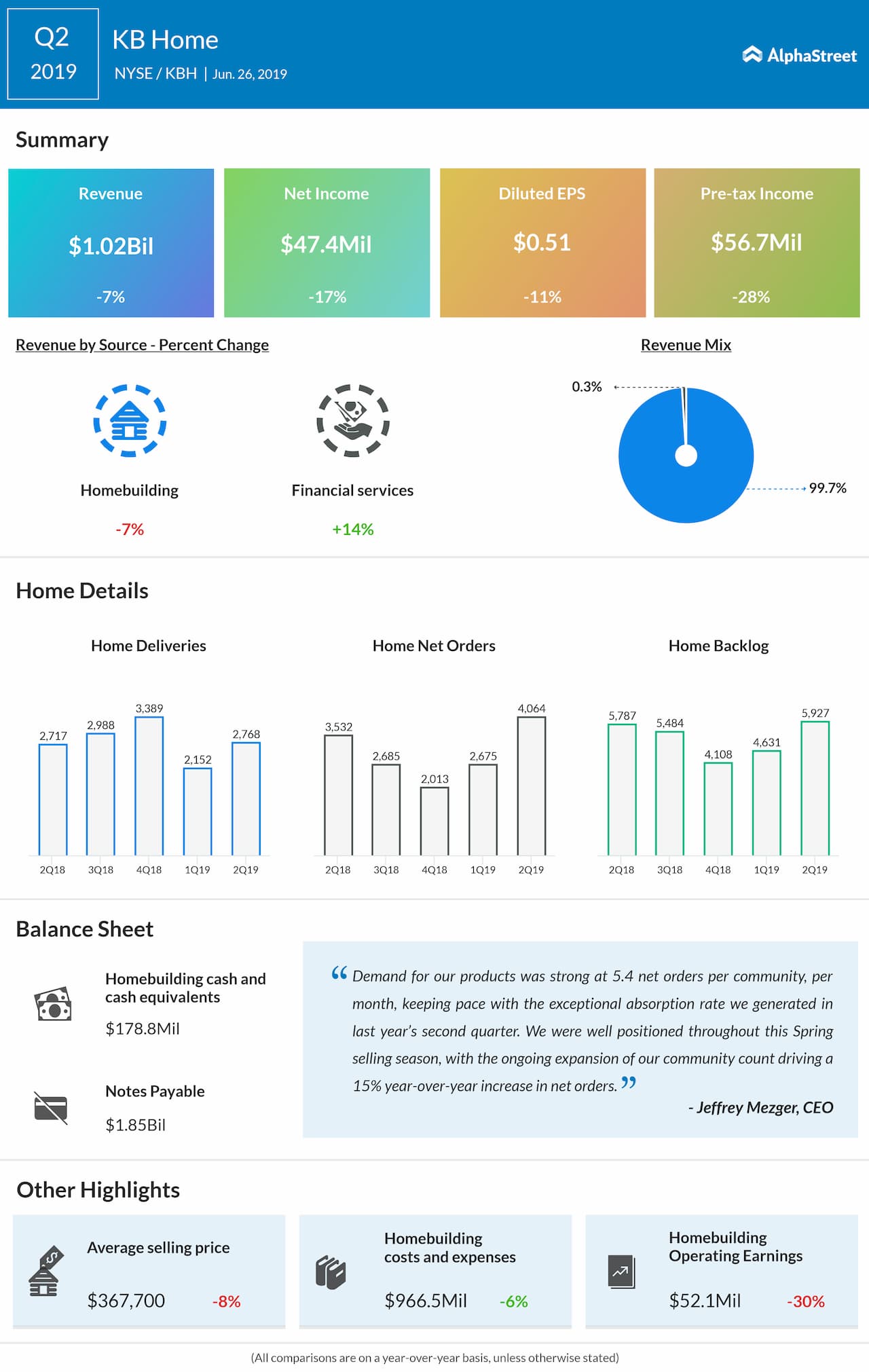

For the second quarter, analysts were expecting muted performance with revenue of $936 million, a 15% drop from last year and EPS of 40 cents, down 30% from the prior year period.

CEO Jeffrey Mezger commenting on the strong Q2 results said: “We are pleased with our second quarter performance, as we made significant progress on our Returns-Focused Growth Plan. Two of the key objectives of this Plan are to grow our business and strengthen our balance sheet.”

KB Home reiterated that the spring selling season is expected to be strong aided by community growth and improved orders. The second half of the year would benefit from the increase in sales, which is good news for investors.

Even though home deliveries improved 2%, West Coast continues to drag the growth from other regions. The decline in the average selling price of 8% is primarily to lower prices from the West Coast region and increased home deliveries from the low-cost regions.

Net orders and value grew double-digits across all four regions while average net orders per community came in at 5.4 months over 5.5 months in the prior year period. Backlog rose 2% to 5,927 units helped by growth in West Coast and Southeast regions.

Looking Back

In the first quarter, KB Home earnings exceeded analysts’ expectations while the revenue missed estimates due to decline in homebuilding revenue. Net income was $0.31 per share compared to a loss of $0.82 per share last year. However, revenue fell 7% to $811.5 million due to weaker housing sales.