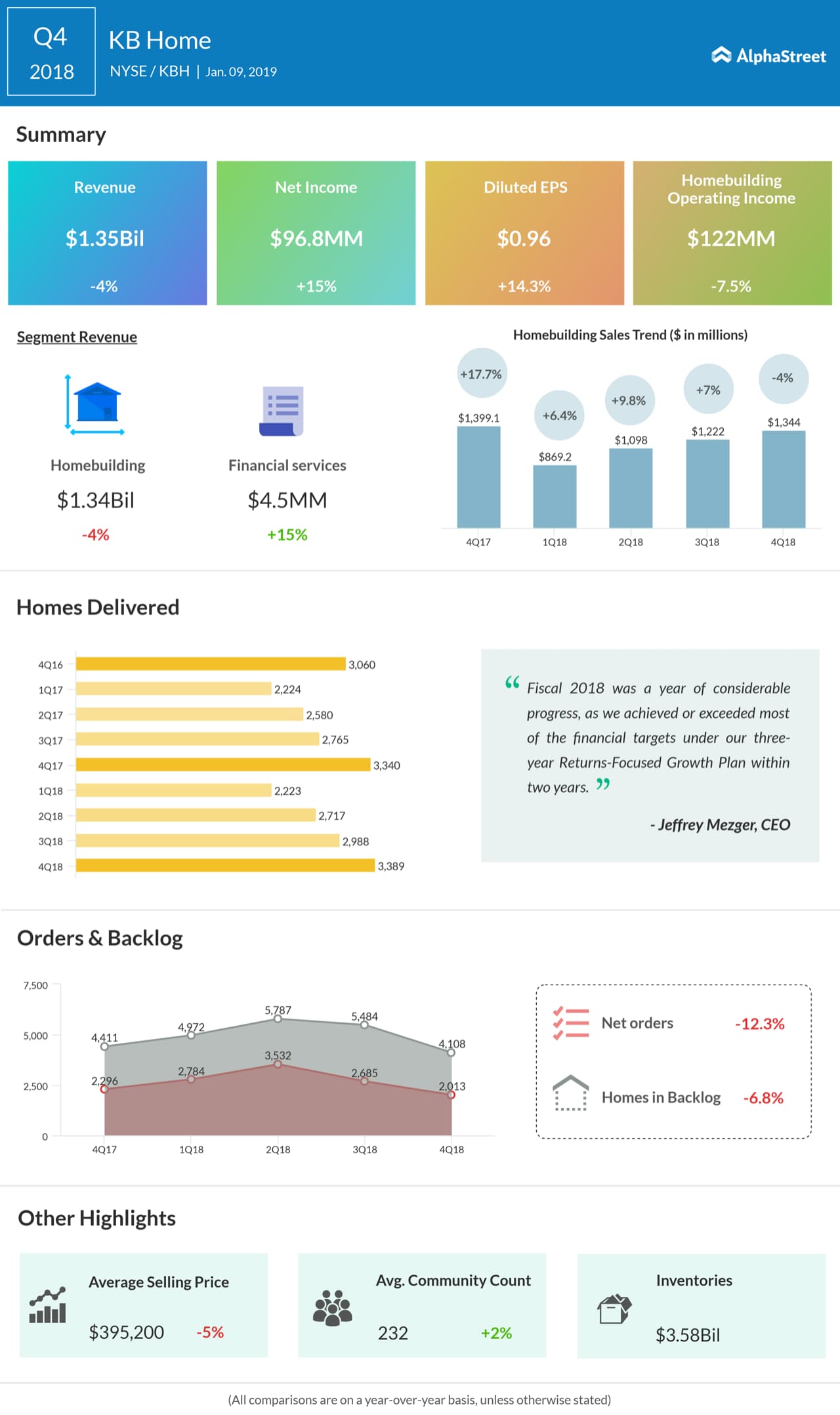

The company delivered a total of 3,389 homes during the quarter, up 1.5% compared to last year. The average selling price of a single residential unit declined 5% to $395,200 due primarily to a shift in geographic mix of homes delivered.

Net orders for the fourth quarter fell 12.3% to 2,013, and net order value dropped 21.1% to $738.3 million. The number of homes in ending backlog decreased 7% to 4,108 and ending backlog value plunged 14% to $1.43 billion. The decrease in backlog value reflects fewer homes in backlog and the lower average selling price of those homes due to a shift in geographic mix.

The company had total liquidity of $1.05 billion as of November 30, 2018, including cash and cash equivalents of $574.4 million. Inventories increased by 10% to $3.58 billion. Stockholders’ equity increased by $161.2 million to $2.09 billion.

Shares of KB Home ended Wednesday’s regular session up 4.12% at $21.98 on the NYSE. The stock has fallen over 35% in the past year and over 1% in the past three months.

We’re on Flipboard! Follow us to receive the latest stock market, earnings, and financial news at your fingertips