KB Home (NYSE: KBH) reported a 27% jump in earnings in the fourth quarter of 2019 helped by higher revenue as well as lower costs and expenses. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

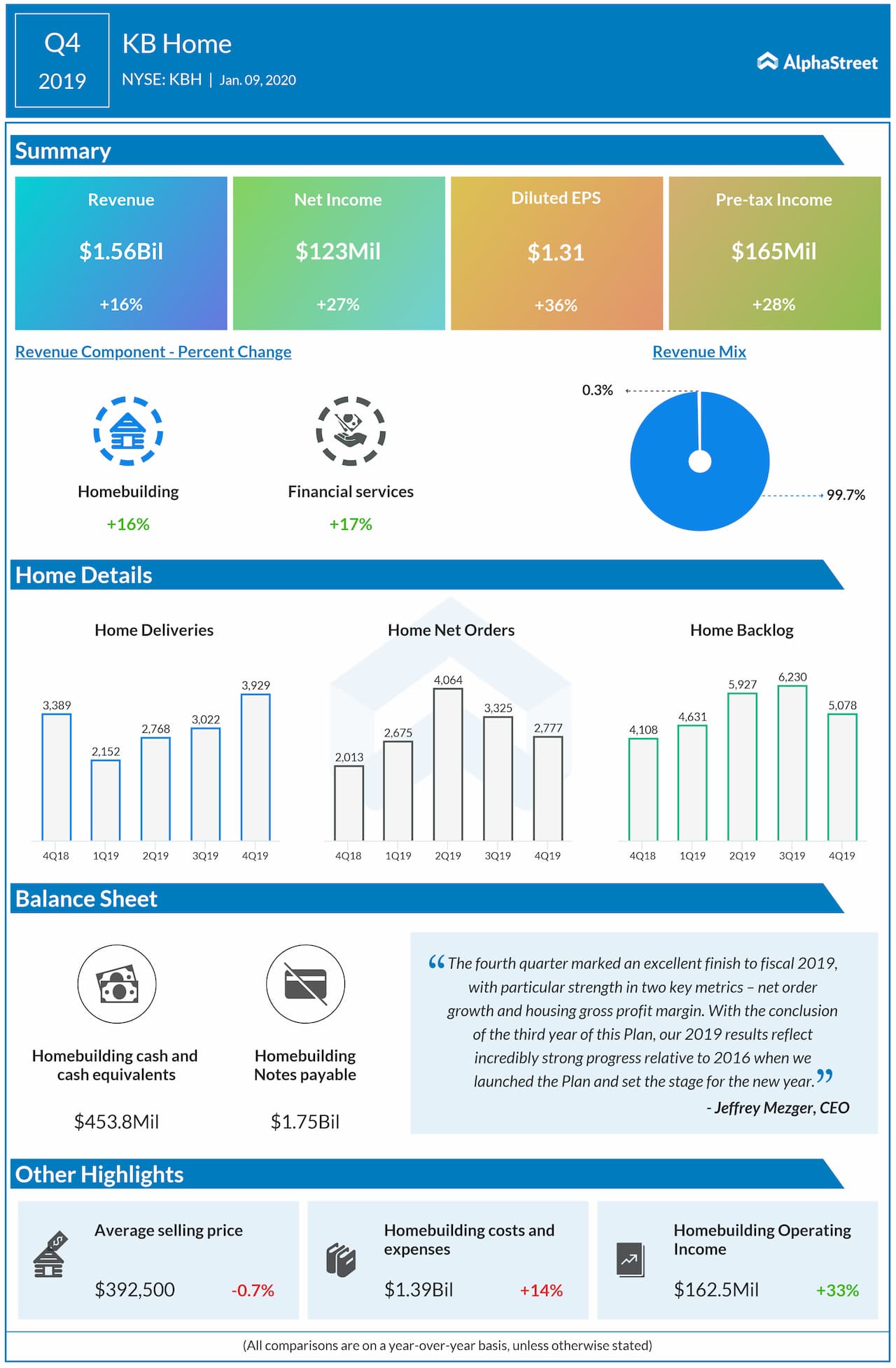

Net income jumped by 27% to $123.2 million or $1.31 per share. Revenue grew by 16% to $1.56 billion. The results were beneficial by the net order growth and housing gross profit margin.

The total pre-tax income grew by 28% to $165 million, which included a charge for the early extinguishment of debt. Excluding this charge, pretax income jumped by 33% to $171.8 million.

Homes delivered increased 16% to 3,929 while the average selling price declined slightly to $392,500. Net orders for the quarter increased 38% to 2,777, with net order value up 43% to $1.06 billion. The strong demand for built-to-order products along with limited inventory in served markets drove net order higher by 38%.

The net orders growth was backed by a rise in community absorption pace to 3.7 net orders per month, its highest fourth-quarter pace in many years, along with a 9% growth in community count.

The average community count for the quarter increased 9% to 253. Ending community count grew 5% to 251. The cancellation rate as a percentage of gross orders improved to 22% for the quarter from 28%.

The company’s ending backlog rose 24% to 5,078 homes. The ending backlog value grew to $1.81 billion, up 26% from $1.43 billion, with increases in all four regions.

As of November 30, 2019, the company had total liquidity of $1.23 billion, while notes payable stood at $1.75 billion. The debt to capital ratio improved by 740 basis points to 42.3% while the net debt to capital ratio is at 35.2%.