Healthy Cash Flow

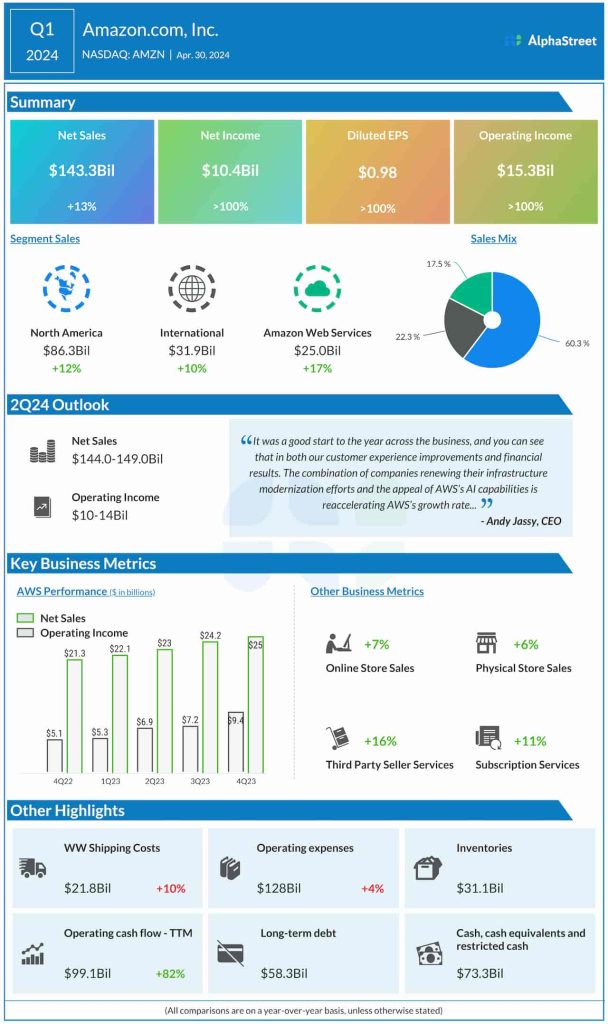

The company generated a whopping $100 billion of operating cash flow for the trailing twelve months, representing an 82% growth. Free cash flow was around $50 billion. The growing demand for cloud services, with enterprises renewing their infrastructure modernization efforts, and AWS’s advanced AI capabilities are accelerating growth for Amazon’s cloud business. By continued AI deployment in other areas like logistics and product recommendations, the company is seeing significant benefits in efficiency and customer satisfaction.

From Amazon’s Q1 2024 earnings call:

“We’ve continued to inspect our fulfillment network for additional opportunities and are working on several areas where we believe we can lower costs even further while also improving customer experience. One example of this is our work to increase the consolidation of units into fewer boxes. As we further optimize our network, we’ve seen an increase in the number of units delivered per box, an important driver for reducing our cost.”

First-quarter net sales increased to $143.3 billion from $127.4 billion in the prior-year period and came in above Wall Street’s forecast. Sales increased across all operating segments, with Amazon Web Services registering the biggest annual growth of 17%. For the second quarter, the company expects sales to be in the range of $144 billion to $149 billion, which represents a 7-11% increase compared with Q2 2023.

Q1 Profit Beats

Reflecting the strong top-line growth, net income rose to $10.43 billion or $0.98 per share in the March quarter from $3.17 billion or $0.31 per share a year earlier and exceeded analysts’ estimates. For the June quarter, the management forecasts operating income between $10.0 billion and $14.0 billion, vs. $7.7 billion in the prior-year period.

Extending the post-earnings upswing, Amazon’s shares traded higher throughout Wednesday’s session. The stock is up 20% since the beginning of the year.