Sales miss, earnings beat

Category performance

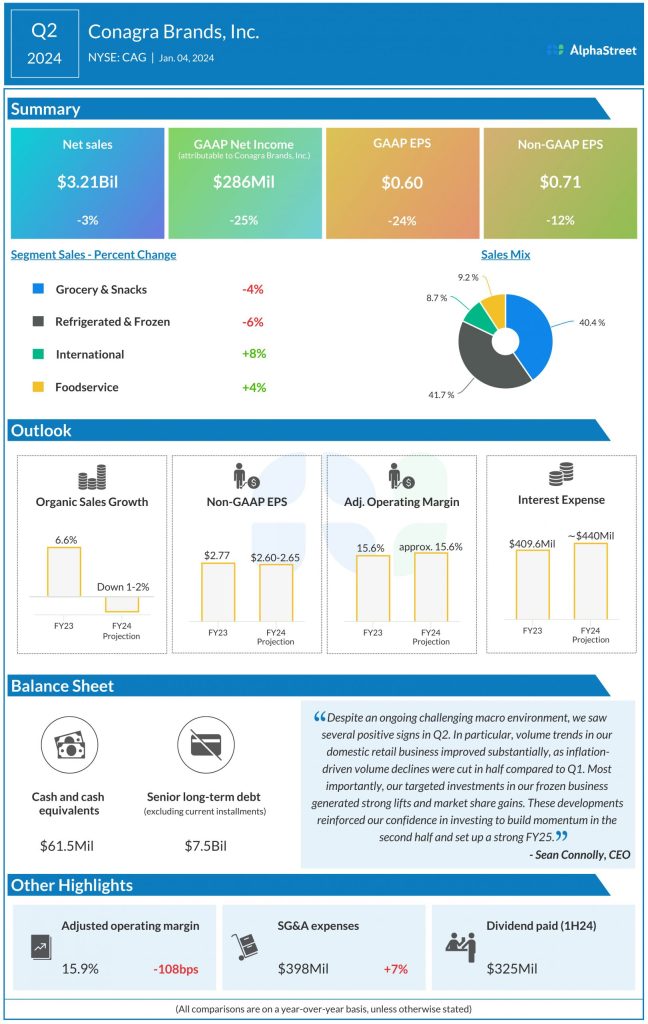

In Q2, Conagra’s organic sales decline was driven by a 2.9% drop in volume, mainly due to lower consumption trends. Volumes across the Grocery & Snacks and Refrigerated & Frozen segments were impacted by lower consumption trends leading to declines of 3.7% and 3.3%, respectively.

Sales decreased 4.1% in the Grocery & Snacks segment and 5.8% in the Refrigerated & Frozen segment in Q2. However, the company gained dollar share in snacking and staples categories such as microwave popcorn, chili, and hot cocoa as well as categories like frozen sides and frozen breakfast.

Sales in the International and Foodservice segments increased 8% and 4% respectively, with the International segment benefiting from volume growth of 3.3%, driven by strong performance in the Mexico business. The Foodservice segment saw price/mix increase by 6.8%, fueled by inflation-driven pricing actions, but volumes dropped 2.5%.

Lowered outlook

Conagra lowered its outlook for organic sales growth and adjusted EPS for the full year of 2024. The revised guidance reflects year-to-date performance, expectations for a slower volume recovery, and increased brand investments during the latter half of the year. The company now expects organic sales to decrease 1-2% compared to FY2023, versus its previous expectation for a growth of approx. 1%. Adjusted EPS is now expected to range between $2.60-2.65 versus the prior range of $2.70-2.75.