Stock Flat

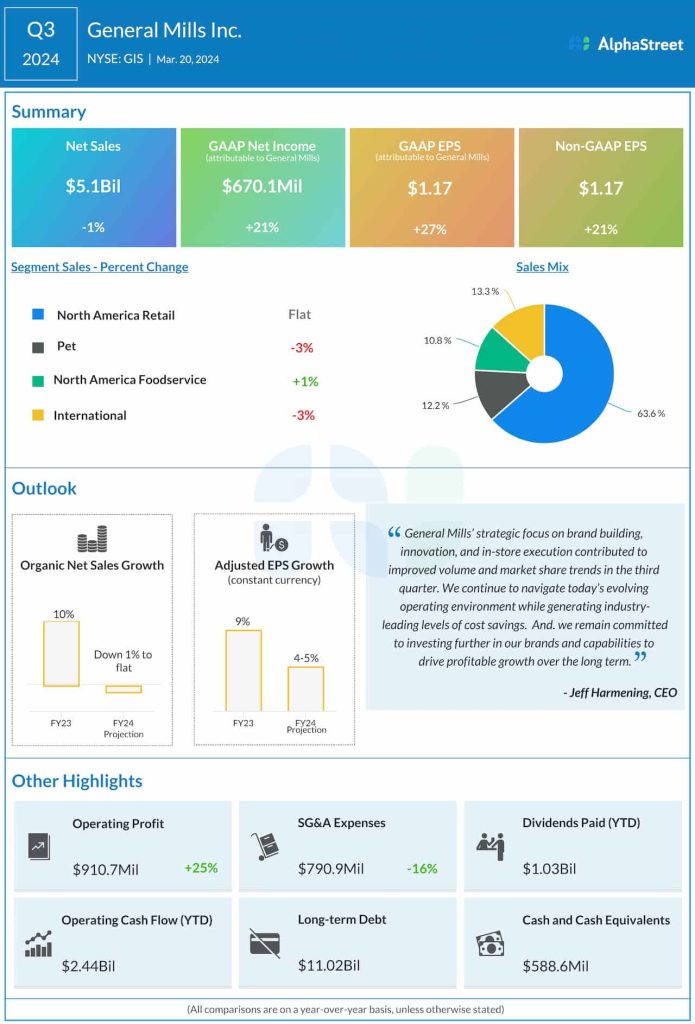

Despite weaker-than-expected volume recovery and pricing pressures, there has been an improvement in margins lately, mainly reflecting the company’s cost-saving efforts. The management said it expects full-year organic net sales to range between down 1 percent and flat. Both adjusted operating profit and adjusted earnings per share are forecast to rise 4-5% in constant currency in fiscal 2024, even as the company anticipates continued pressure on sales from weak consumer trends. The revised guidance is below the outlook issued by the leadership earlier.

From General Mill’s Q3 2024 earnings call:

“We’re competing effectively and we thought that we would. And a lot of this is driven by lapping some pricing from a year ago and our ability to continue to execute well. We have innovated well. We have grown distribution. We have done — we’re executing our plan well. As we look to the fourth quarter, I mean, there are some timing issues as we talked about with expense — the timing of expenses. But broadly speaking, we would expect our third quarter sales to kind of play out in the same magnitude that we saw in the third quarter.“

Mixed Outcome

Net sales edged down to $5.1 billion in the third quarter when organic sales dropped 1%. The weak top-line performance reflects lower sales in the International and Pet segments. Net earnings attributable to General Mills was $670.1 million or $1.17 per share in Q3, compared to $553.1 million or $0.92 per share in the year-ago quarter. Adjusted earnings per share increased to $1.17 per share from $0.97 per share. The company has a good track record of beating analysts’ sales and earnings estimates, and the latest quarter was no different.

GIS opened the last trading session around $70 and traded lower for most of the day. The stock has lost about 19% in the past twelve months.