Better-than-expected results

Business performance

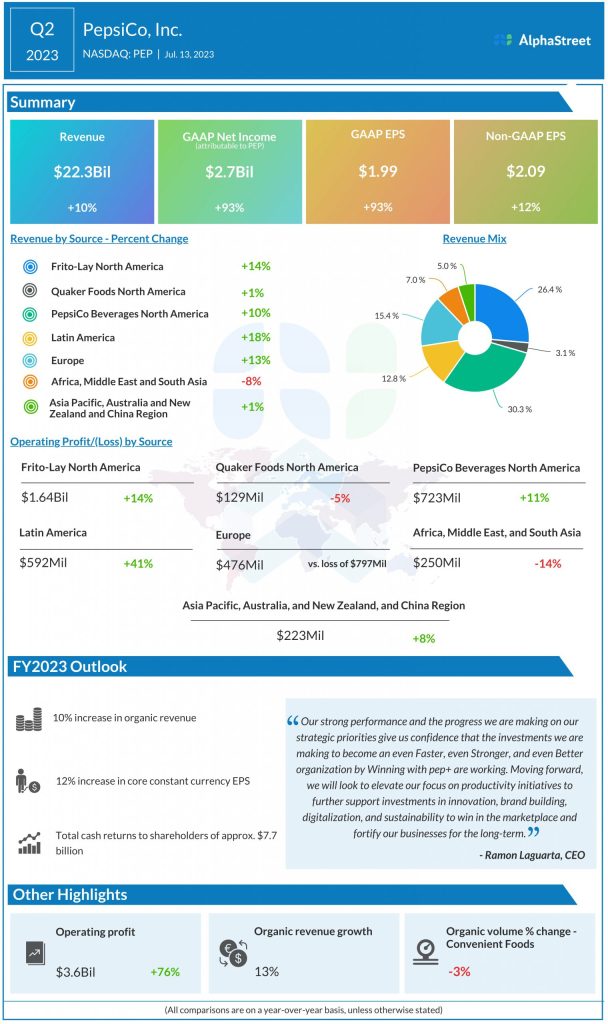

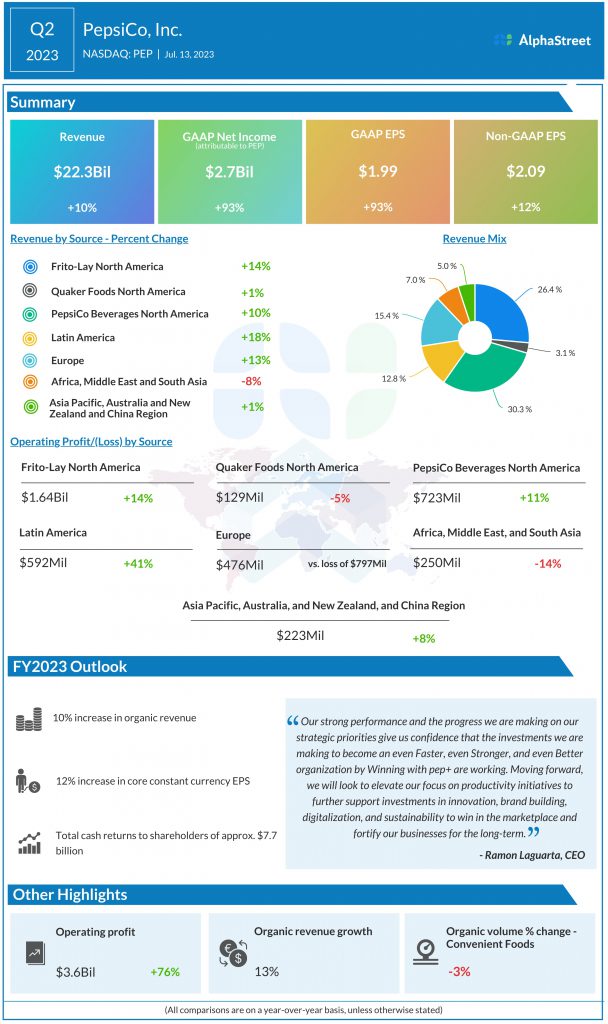

In Q2, PepsiCo witnessed strong growth across its segments and categories. Organic revenue grew 11% in its North America division and 15% in its International division. The global convenient foods category recorded a 15% growth in organic revenue during the quarter while the beverages category saw a growth of 11%.

The Frito-Lay North America segment posted organic revenue growth of 14%, helped by double-digit growth in popular brands such as Lay’s, Doritos and Cheetos as well as emerging brands such as PopCorners and SunChips. The company continued to gain share in the savory and salty snack categories as well. The business saw strong revenue growth across all channels including large-format, foodservice, and convenience and gas.

Organic revenue in the Quaker Foods North America division grew only 2% this quarter versus a double-digit increase last year. However, the company gained share and posted double-digit revenue growth in categories like lite snacks, grits, and pancake mixes and syrups. PepsiCo Beverages North America grew organic revenue by 10% with gains in Gatorade, Pepsi, and Rockstar.

PepsiCo’s International convenient foods business saw organic revenues grow by 17% in Q2 while the beverages business witnessed revenue growth of 13%. The company recorded double-digit revenue growth in developed markets like Australia and the UK as well as emerging markets like Mexico, Turkey and Poland.

Raised outlook

Based on its strong performance, PepsiCo raised its guidance for full-year 2023. The company now expects organic revenue to grow 10% compared to its previous outlook of 8%, and core constant currency EPS to grow 12% versus the earlier expectation of a growth of 9%. Core EPS for FY2023 is now expected to increase 10% to $7.47 compared to FY2022. The earlier outlook was for core EPS of $7.27, reflecting a 7% increase.