Results beat estimates

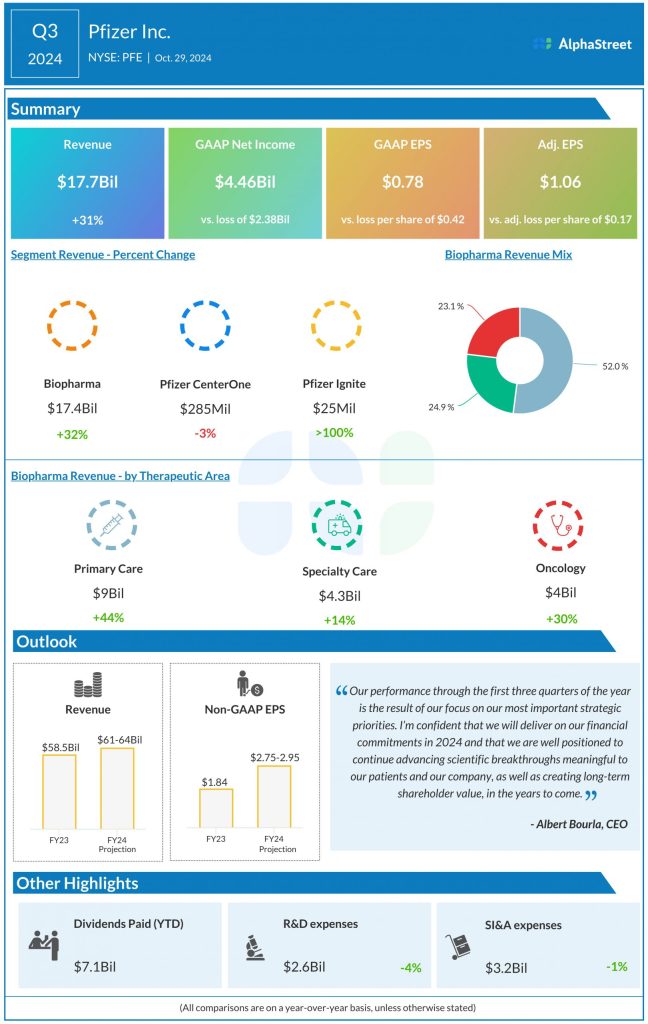

For Q3, the company reported GAAP earnings of $0.78 per share compared to a loss of $0.42 per share last year. Adjusted EPS was $1.06 compared to a loss of $0.17 per share last year. Pfizer’s top and bottom line numbers beat expectations.

Business performance

Pfizer’s COVID-19 products were significant contributors to revenue growth in Q3 2024. Its oral treatment Paxlovid generated $2.7 billion in revenue, driven by strong demand, mainly in the US. Its COVID-19 vaccine Comirnaty saw revenues grow 9% year-over-year operationally to $1.4 billion.

Excluding contributions from Comirnaty and Paxlovid, revenues totaled $13.6 billion, reflecting a growth of 14% YoY operationally. Seagen contributed global revenues of $854 million. Revenues from the Vyndaqel family grew 63% operationally, driven by strong demand across the US and international developed markets.

Eliquis recorded 9% growth operationally while Xtandi was up 28%. Nurtec ODT/Vydura saw growth of 45% operationally, driven mainly by strong demand in the US as well as recent launches in international markets.

This growth was partly offset by revenue declines for Xeljanz and Ibrance. Xeljanz global revenues fell 35% operationally, mainly due to a drop in prescription volumes. Ibrance revenues decreased 12% operationally, mainly due to lower demand as a result of tough competition, and price decreases in certain international developed markets.

Guidance hike

Pfizer raised its guidance for the full year of 2024 on the back of its strong year-to-date results. The pharma giant now expects total revenues of $61-64 billion versus its previous outlook of $59.5-62.5 billion. Adjusted EPS is now expected to be $2.75-2.95 versus the previous range of $2.45-2.65.

The revised outlook includes approx. $10.5 billion in anticipated revenues for Comirnaty and Paxlovid. Excluding revenues from the COVID-19 products, the company expects operational revenue growth of 9-11% for FY2024.