Sales and earnings beat expectations

Business performance

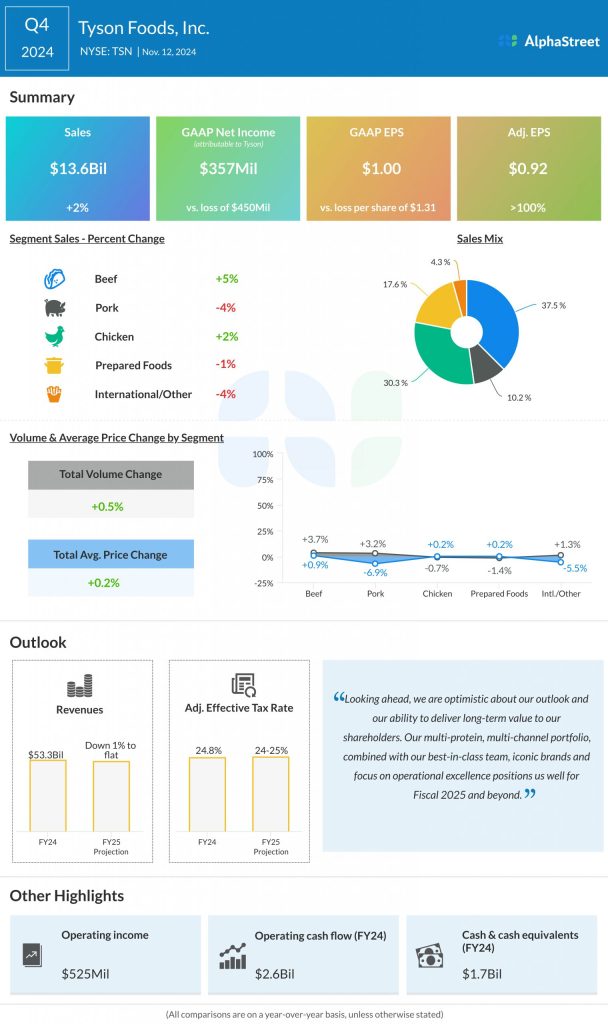

In Q4, sales in the beef segment increased 5% YoY to $5.2 billion, while sales in the chicken segment rose 2% to $4.2 billion. Sales for pork, Prepared Foods, and International/Other all witnessed declines.

Volumes for beef and pork rose 3.7% and 3.2%, respectively in Q4 while chicken and Prepared Foods saw declines in volume of 0.7% and 1.4%, respectively. International/Other saw volume rise by 1.3%. Average sales price for pork fell 6.9% while for International/Other, it fell 5.5%. Beef, chicken, and Prepared Foods saw increases in price.

Adjusted operating income (AOI) for the chicken segment was the highest at $356 million followed by Prepared Foods at $205 million. AOI for pork was $19 million while for International/Other, it was $3 million.

Adjusted operating margin for the chicken and Prepared Foods segments were the highest at 8.4% and 8.3%, respectively. The pork segment achieved adjusted operating margin of 1.3%.

Outlook

The United States Department of Agriculture (USDA) anticipates an increase in domestic protein production during fiscal year 2025 compared to fiscal year 2024. USDA projects domestic production for beef to decrease approx. 2% in FY2025 compared to the previous year. Domestic production for pork is expected to increase approx. 2%, while for chicken it is projected to increase 3%.

Tyson expects sales to be down 1% to flat in FY2025 compared to FY2024. Total adjusted operating income is expected to range between $1.8-2.2 billion for the year.

For the beef segment, the company anticipates an adjusted operating loss of $0.4 billion to $0.2 billion. In the pork segment, AOI is expected to be $0.1-0.2 billion. AOI for chicken is projected to be $1.0-1.2 billion while for Prepared Foods, it is expected to be $0.9-1.1 billion.