Stock Rallies

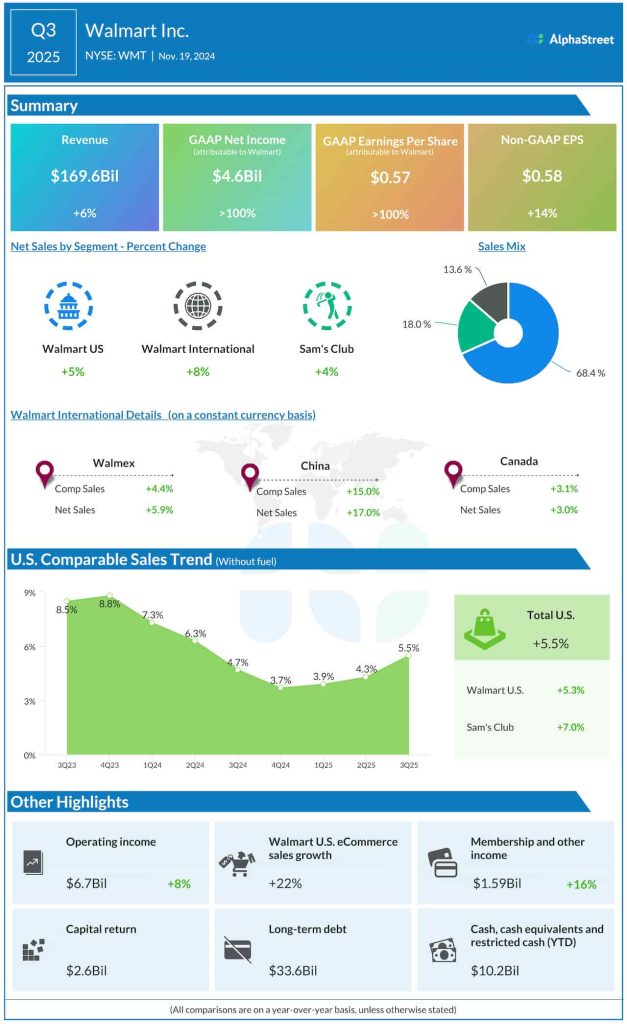

In the October quarter, total sales increased to $ 168.0 billion from $159.44 billion in the comparable period last year. Earnings, on an adjusted basis, increased to $0.58 per share in Q3 from $0.51 per share last year. Net income attributable to the company was $4.58 billion or $0.57 per share in the third quarter, compared to $453 million or $0.06 per share in Q3 2024.

Broad-based Growth

Reflecting the management’s aggressive efforts to ramp up the digital platform, e-commerce sales climbed 22% during the three months. Sales and comparable sales grew across the Walmart US, Sam’s Club, and International Segments, including China and Canada. US comparable store sales growth accelerated for the third consecutive quarter. Earnings and revenue beat estimates, continuing the trend seen for over two years.

Strong pricing power has helped the store chain consistently expand the market for its grocery and other consumer essentials segments by attracting price-conscious customers through the Everyday Low Price strategy. At the same time, Walmart’s extensive store network and efficient logistics system allow it to effectively compete with others like Costco and Target.

From Walmart’s Q3 2025 earnings conference call:

“We’re broadening our assortment, improving customer experience, and earning their trust while seeing share gains as a result. We’re also realizing benefits from the investments we’ve made in our core omni-retail business and seeing improved profitability with newer businesses. We’re executing on our strategy and the business model is delivering as it’s designed to do, with operating income growing faster than sales, and yet there is much more opportunity ahead.”

Lifts Guidance

Expecting the current momentum to continue through the final months of the year, Walmart’s leadership raised its full-year sales growth guidance to 4.8-5.1% from the earlier forecast of 3.75-4.75%. The full-year EPS guidance has been increased to $2.42-2.47 from $2.35-2.43 the management had predicted a few months ago. The strong momentum, both in the legacy business and e-commerce platform, indicates that Walmart is headed for a strong holiday season.

Walmart’s shares traded above their 12-month average price so far in the second half of the year. The stock traded up 4% on Tuesday afternoon.