Commenting on the quarter’s performance, President Kim Dang stated, “Led by the Natural Gas Pipelines segment, our commercial, financial, and operating performance in the second quarter was very strong.”

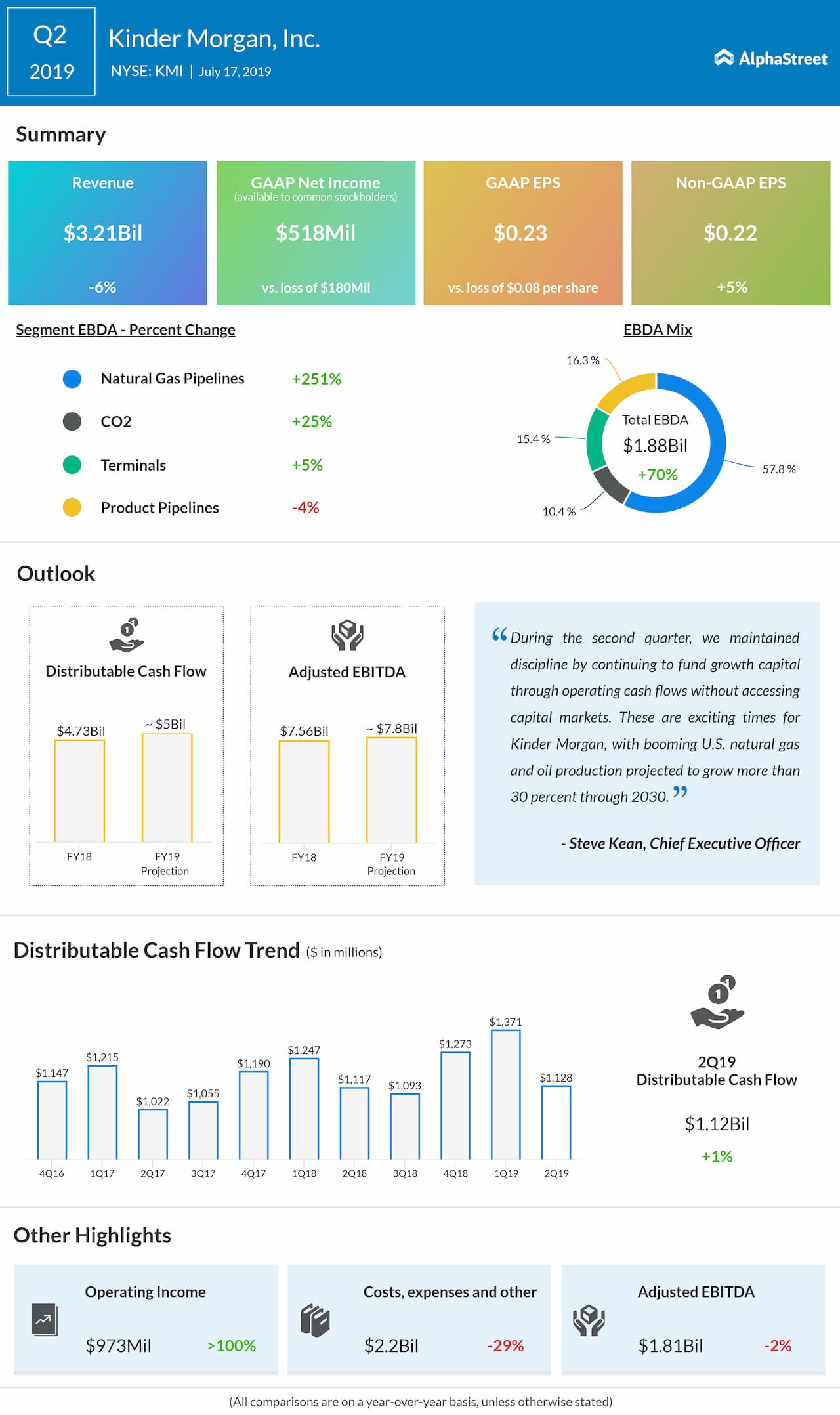

Distributable cash flow (DCF) grew modestly to $1.13 billion from $1.12 billion backed by lower cost of funding and solid results from the Natural Gas segment. On a per-share basis, DCF was flat at 50 cents per share with a surplus of $559 million post dividend payments.

The company added $400 million worth of new projects with the total backlog at the end of Q2 coming in at $5.7 billion. However, this is a decrease of $400 million from the last quarter. Even though Natural Gas Pipelines brings in the majority of the new orders, other divisions performance has been a concern for investors.

Projects Update

Last month, the Texas court has given the nod to the firm to resume work on the $2 billion natural gas pipeline from Western Texas to the Gulf Coast. Kinder Morgan is confident of completing the Gulf Coast Express Pipeline project and Permian Highway Pipeline project by October this year, which would help the firm to ship more natural gas from the Permian Basin.

The midstream major also added that the Elba Liquefaction Project is behind schedule. However, it is about to start the first liquefaction train for service, which was supposed to have commenced in May.

Looking Back

Last quarter, the pipeline giant reported flat revenues while earnings growth was aided by a 12% increase from the natural gas pipeline division. The company also guided the distributable cash flow of $5 billion and adjusted EBITDA of $7.8 billion for the fiscal 2019 period. It also plans to invest $3.1 billion in growth projects and joint ventures.

Get access to timely and accurate verbatim transcripts that are published within hours of the event