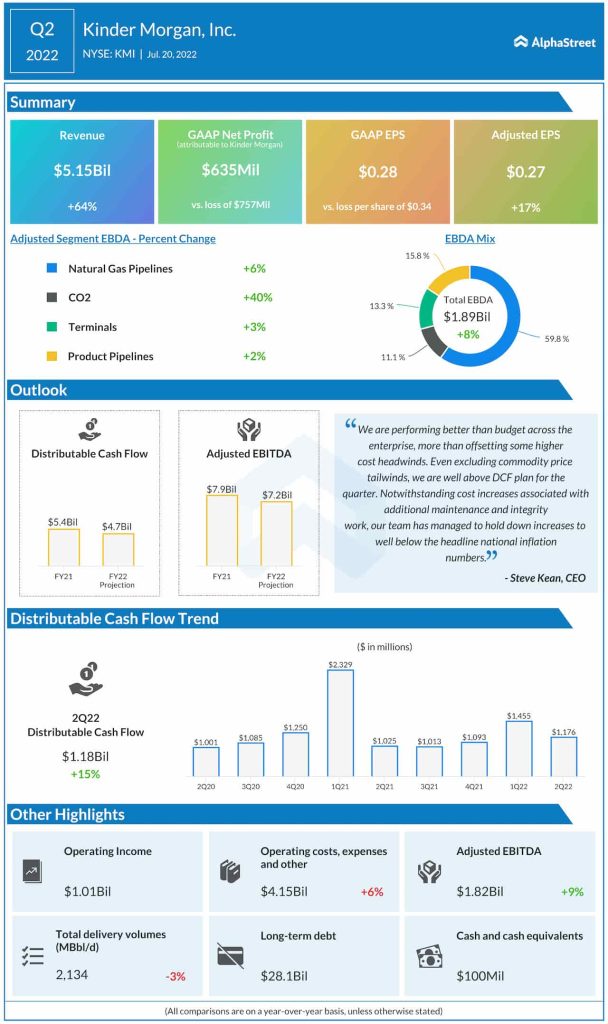

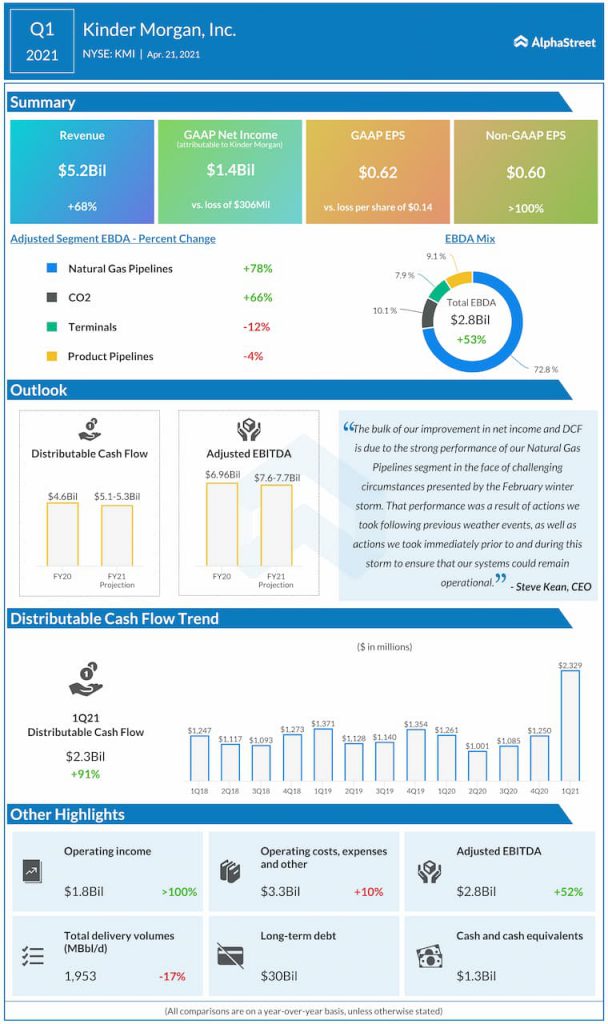

Second-quarter profit, excluding special items, moved up to $0.27 per share from $0.23 per share in the corresponding period of last year. The latest number matched Wall Street’s projection. Net income attributable to shareholders was $635 million or $0.28 per share, compared to a loss of $757 million or $0.34 per share last year.

The positive bottom-line performance reflects a 64% surge in revenues to $5.15 billion. The company also provided its guidance for the full fiscal year.

Kinder Morgan Q2 2022 Earnings Call Transcript

“As we have for the last six years, we continue to live within our cash flow and expect to continue to fund expansion capital opportunities with the cash flow we generate. We also expect to meet or improve on our debt metric goal and return excess cash to our shareholders through a strong dividend and opportunistic share repurchases,” said the company’s executive chairman Richard Kinder.