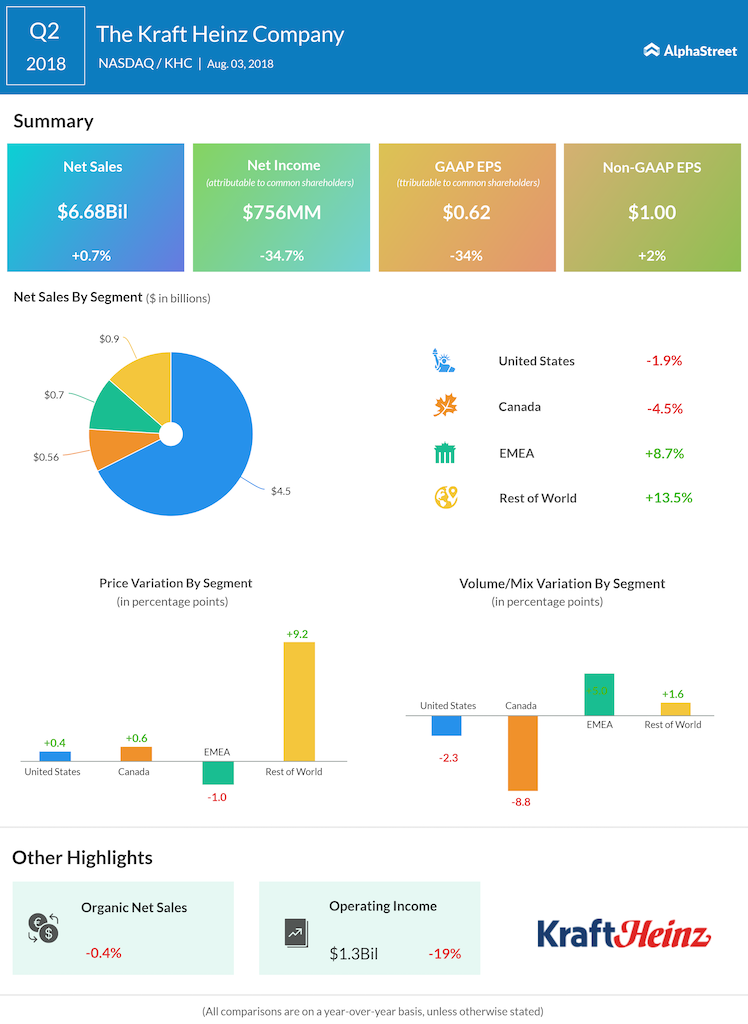

Net sales edged up 0.7% annually to $6.69 billion and surpassed expectations, while organic net sales declined 0.4%. The top-line benefitted from acquisitions & divestitures and favorable exchange rates. Continuing the recent trend, sales declined in the US and Canada but increased in other geographical regions.

Net sales edged up 0.7% annually to $6.69 billion and surpassed expectations, while organic net sales declined 0.4%. The top-line benefitted from acquisitions & divestitures and favorable exchange rates. Continuing the recent trend, sales declined in the US and Canada but increased in other geographical regions.

“We believe we are now in a position to drive sustainable top-line growth from a strong pipeline of new product, marketing and whitespace initiatives that are backed by investments in capabilities for brand and category advantage,” said CEO Bernardo Hees.

Reported earnings dropped sharply during the quarter, hurt mainly by non-cash impairment charges

In recent years, the company’s revenues were negatively impacted by the changing consumer habits even as it continued to lose market share to the smaller players entering the market.

RELATED: Campbell rallies on rumored deal with Kraft

The company said it expects the ongoing product revamp and marketing efforts will revive sales momentum by year-end, overriding the squeeze on profitability from the rising cost inflation.

The market has been upbeat ever since Kraft Heinz hinted at fresh merger talks with rival food company Campbell Soup (CMP), a proposal that was shelved and revised several times in recent months. It is speculated that Kraft would benefit significantly from the synergies if the company adds Campbell into its fold.

Kraft Heinz shares lost about 31% over the past twelve months. The stock, which had gained momentum ahead of the earnings release, rose sharply in the pre-market trading Friday.