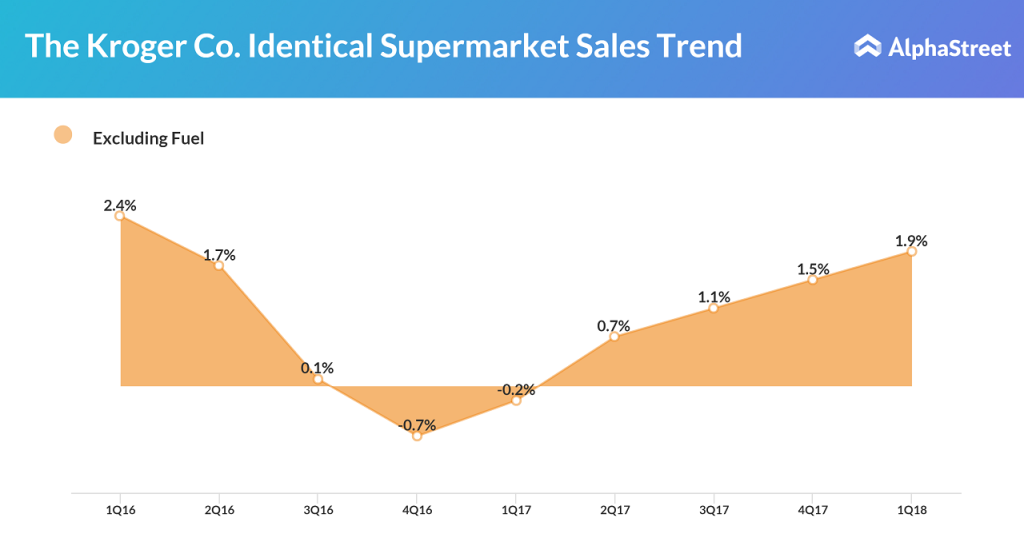

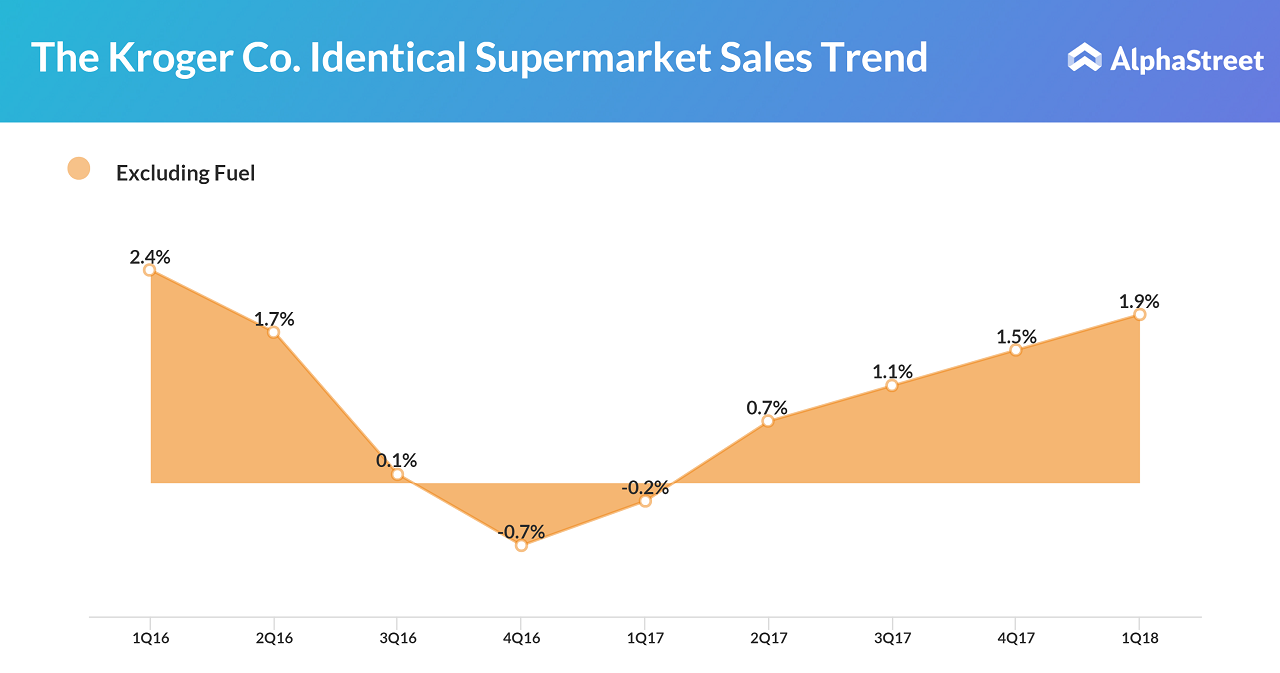

During the pre-market hours, the company’s stock rose 7.52% to $28.15. Kroger, which recently entered into a deal with Ocado, expects identical sales growth, excluding fuel, to range from 2% to 2.5% in 2018.

It raised the lower end of the EPS guidance to $3.64 – $3.79 from $3.59 – $3.79. Kroger also raised the bottom end of its adjusted earnings guidance to $2.00 – $2.15 per share for 2018, from $1.95 – $2.15 announced previously.

Related: Kroger invests in UK firm Ocado to boost digital business

“We are on track to generate the free cash flow and incremental FIFO operating profit that we committed to in Restock Kroger. We are confident in our ability to deliver on our plans for the year and our long-term vision to serve America through food inspiration and uplift,” said CEO Rodney McMullen.

Kroger has been aggressively investing in acquiring firms to strengthen its digital business. According to the recent deal with Ocado, Kroger will incorporate the UK retail giant’s technology into its grocery and food distribution business, along with 5% ownership in the company. This will help the Cincinnati-based retailer in fighting back against Amazon (AMZN).

Related: Kroger gobbles up Home Chef in second acquisition of the week

It also acquired a private meal-kit company Home Chef, thereby making its presence in the meal-kit market that is dominated by Blue Apron (APRN).