Revenue

Earnings

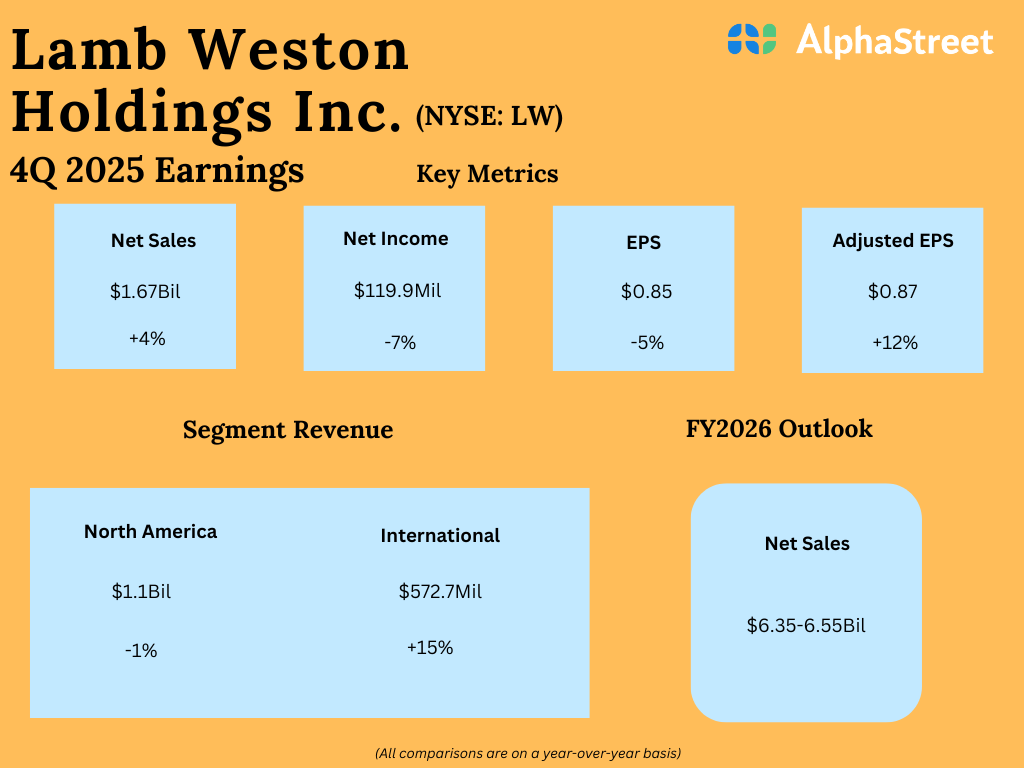

The consensus target for earnings per share in Q1 2026 is $0.53, which implies a 27% drop from the prior-year quarter. In Q4 2025, adjusted EPS rose 12% YoY to $0.87.

Points to note

Lamb Weston is seeing strong global demand for French fries. It also sees opportunities for innovation with growth in food delivery, expansion of QSR formats, and the increasing usage of air fryers in at-home cooking. LW expects its category to continue to see strong demand in fiscal year 2026, with customers prioritizing French fries as a menu and an at-home item.

Lamb Weston’s business gained momentum in the second half of fiscal year 2025 helped by customer wins and retention. In Q4, the company saw volume growth helped by contract wins across all its channels and geographies. However softness in global restaurant traffic trends continued to be a headwind.

In Q4, restaurant traffic declined in the low-single-digits in the US and UK, which are LW’s biggest markets. QSR, or quick-service restaurants, traffic was down 1% in the US, while traffic at QSR chains specializing in hamburgers was down 2%. Restaurant traffic was down 3% in the UK, and relatively flat in other key international markets during the fourth quarter.

The company does not expect to see an improvement in global restaurant traffic trends in FY2026 compared to FY2025 levels, but it anticipates customer momentum that started in the latter half of FY2025 to continue. LW expects the carryover pricing actions taken last year to have a negative impact on sales in the first half of FY2026. This may be reflected in the Q1 results.

Lamb Weston is expected to benefit from the actions it is taking under its Focus to Win strategy. These include focusing investments on priority global markets and segments, strengthening customer partnerships, reducing costs and focusing on innovation.