“

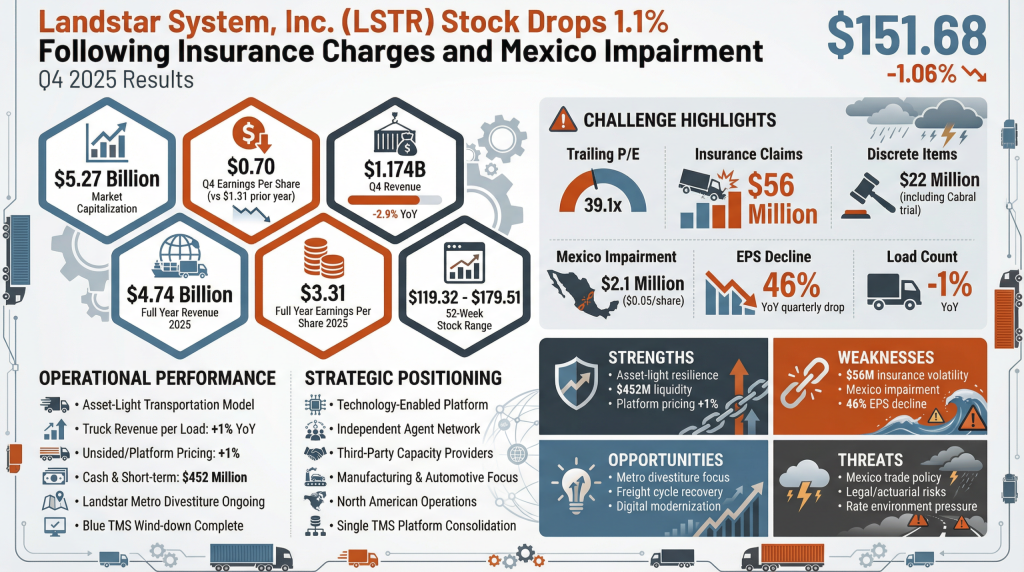

Shares of Landstar System, Inc. (LSTR) fell 1.06% to $151.68 on Wednesday, following the release of fourth-quarter 2025 results. The stock has traded in a 52-week range of $119.32 to $179.51. Recent pressure stems from a combination of highly elevated insurance claims and non-cash impairment charges related to the divestiture of the company’s Mexican operations. […]

· January 28, 2026

Shares of Landstar System, Inc. (LSTR) fell 1.06% to $151.68 on Wednesday, following the release of fourth-quarter 2025 results. The stock has traded in a 52-week range of $119.32 to $179.51. Recent pressure stems from a combination of highly elevated insurance claims and non-cash impairment charges related to the divestiture of the company’s Mexican operations.

Landstar System, Inc. is a technology-enabled, asset-light provider of integrated transportation management solutions. It offers specialized transportation services, including truckload, unsided/platform, and power-only services, through a network of independent agents and third-party capacity providers. Landstar primarily serves the manufacturing, automotive, and consumer goods sectors in North America.