Revenue and profits

Market trends

Lennar and KB Home are optimistic on trends in the housing market. Inflation and high interest rates have kept families from buying new homes or upgrading to bigger homes. The reduction in interest rates is expected to boost demand for housing and improve affordability for home buyers.

Against a tough economic backdrop, homebuilders have been offering various incentives to enable buyers to purchase homes. While these incentives have been fueling housing demand for a while now, lower interest rates are expected to bring forth a stronger and more broad-based demand cycle.

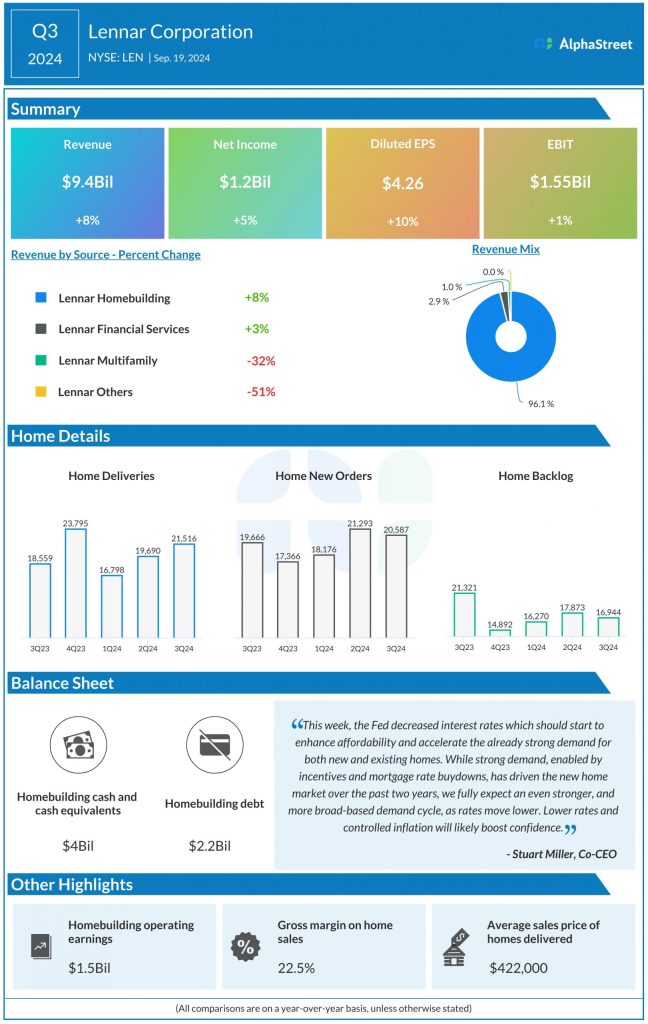

Lennar’s new orders increased 5% to 20,587 homes and its deliveries increased 16% to 21,516 homes in Q3 2024. The average sales price of homes delivered was $422,000, down 6% from last year, due to higher incentives and product mix. Its backlog at the end of the quarter stood at 16,944 homes with a dollar value of $7.7 billion.

KB Home delivered 3,631 homes in the third quarter of 2024, up 8% from last year. Its net orders remained flat at 3,085. Average selling price rose 3% to $480,900. Ending backlog homes totaled 5,724, with a value of $2.92 billion.

Outlook

For the fourth quarter of 2024, Lennar expects its new orders to range between 19,000-19,300 homes and deliveries to range between 22,500-23,000 homes. Average sales price is expected to be about $425,000. KBH projects its housing revenue for Q4 2024 to be $1.94-2.04 billion. It expects average selling price to increase by $23,000 YoY to approx. $510,000, driven mainly by a higher proportion of deliveries from its higher-priced West Coast region.