Strong housing market

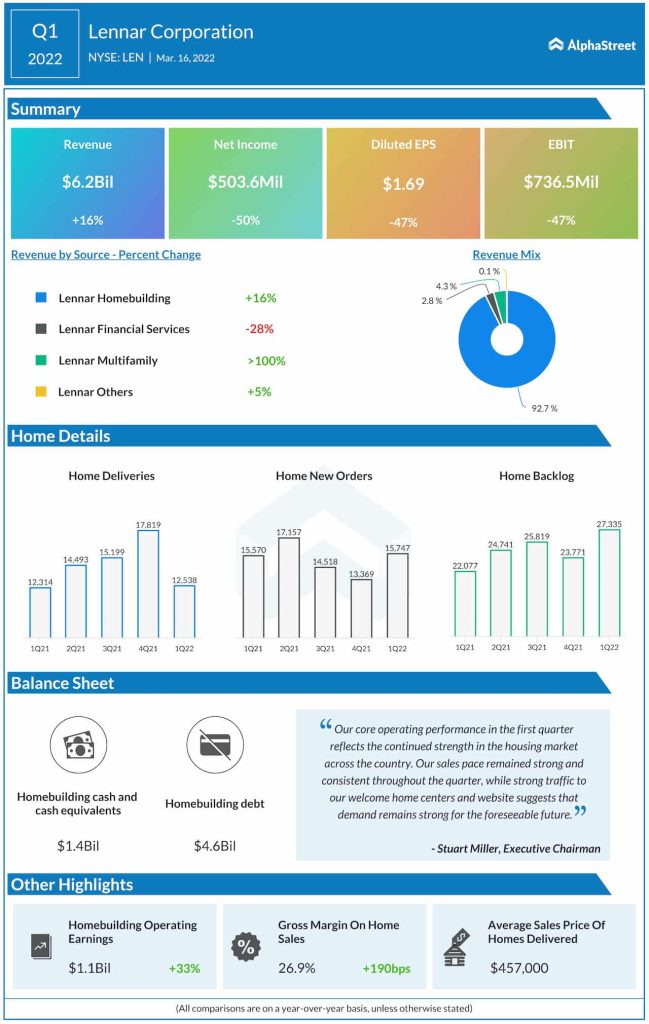

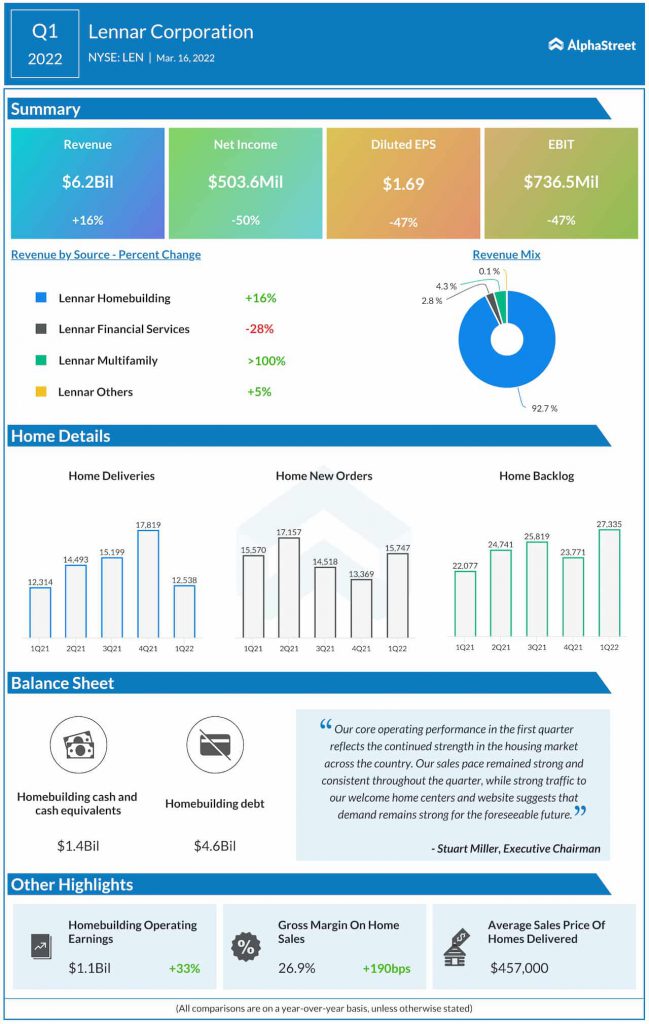

During the first quarter, Lennar’s new orders and deliveries were solid in each of its operating regions. New orders increased 1% to 15,747 homes and deliveries rose 2% to 12,538 homes. Markets like Florida and Atlanta are benefiting from limited inventory and strong job creation.

On its quarterly conference call, Lennar stated that Florida is seeing core local demand as well as in-migration from the Northeast, Midwest, and West Coast, which is driving sales pace and price. The Orlando market is benefiting from a rebound in tourism.

Texas is another strong market seeing in-migration from the East and West. Its pro-business economy is driving corporate relocations and job growth. Similar trends are visible in Colorado. In the first quarter, Lennar’s community count increased 4% year-over-year. The company expects its community count to build throughout the year and is projecting to end 2022 with a low double-digit increase in community count year-over-year.

Supply chain

Lennar continues to deal with supply chain disruptions as well as impacts from inflation on construction costs. The Omicron variant led to labor shortages during Q1, particularly in January, which then eased in February. There continue to be constraints in categories such as electrical equipment, HVAC condensers, and cabinets.

The supply chain challenges during Q1 led to increased cycle times and higher direct construction costs. The average cycle time increased approx. two months year-over-year and two weeks sequentially from Q4. Direct construction costs were up 23% YoY, and lumber accounted for around 60% of this increase.

Looking to the balance of the year, Lennar is focused on accelerating starts to give it more inventory under construction. This will provide a cushion against expanding cycle times, giving the company more opportunity to complete homes in line with its plans. The company aims to deliver 68,000 homes in 2022.

Outlook

Looking into the second quarter of 2022, Lennar expects market conditions to remain the same with strong demand and limited inventory driven by supply chain headwinds. Against this backdrop, the company expects new orders to range from 17,800 to 18,200 homes and deliveries to range from 16,000 to 16,300. Average sales price should be about $470,000. The company expects EPS of $3.80-4.00 per share for Q2.

Click here to read the full transcript of Lennar Corporation’s Q1 2022 earnings conference call