Revenue and profitability

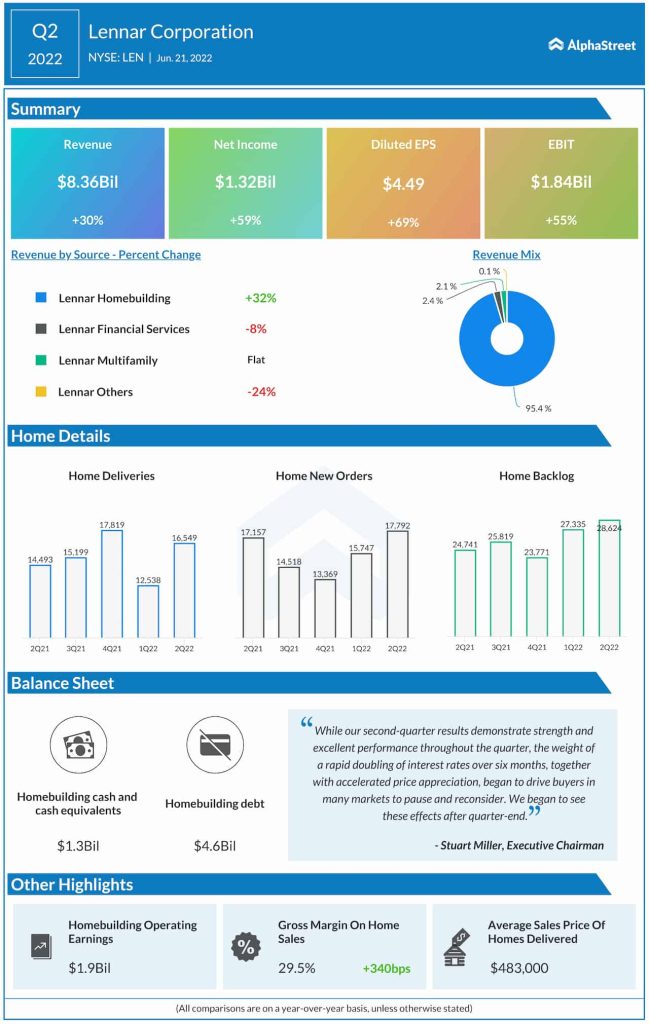

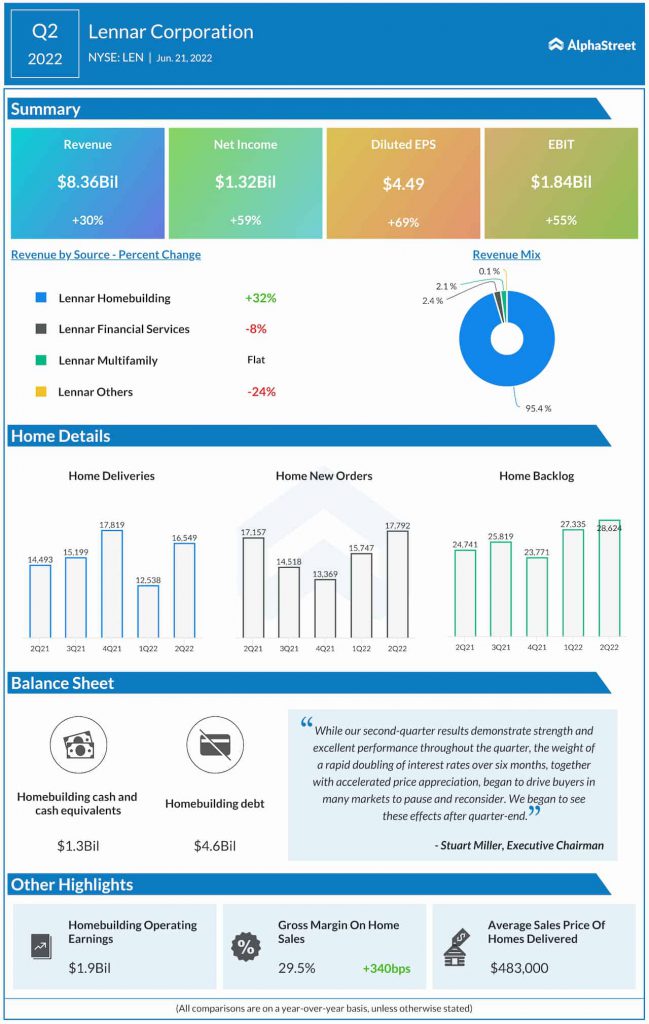

Lennar’s revenue increased 30% year-over-year to $8.4 billion in the second quarter of 2022. Revenues from home sales were up 33%, driven mainly by double-digit increases in the number of home deliveries and average sales price. The company’s earnings increased 69% to $4.49 per share on a GAAP basis and 59% to $4.69 per share on an adjusted basis.

Demand and market conditions

The housing market has seen a weakening due to the effects of inflation and increases in interest rates which have reduced affordability. Even so, demand remains reasonably strong as buyers still have down payments and attractive credit scores. Household formation has seen a rise while supply remains limited.

To deal with the evolving landscape, Lennar plans to stick to its core strategy of selling homes by adjusting pricing to market conditions and maintaining reasonable volume. In Q2, the company’s deliveries increased 14% to 16,549 homes while new orders rose 4% to 17,792 homes. Lennar is selling its homes later in the construction cycle to maximize prices and offset potential cost increases.

Through June, the homebuilder witnessed the spike in mortgage rates and economic headwinds take a toll on its new orders, traffic, sales incentives and cancellations in many of its markets. Markets such as Florida, New Jersey and Chicago saw minimal impacts benefiting from low inventory.

Markets such as Atlanta, Colorado and Philadelphia saw modest softening in pricing and slowdown while markets such as Minnesota, Los Angeles and Sacramento saw a more significant market softening. Higher priced locations witnessed a pullback in sales. The company adjusted prices in some communities and saw an uptick in sales. As the markets remain fluid, Lennar continues to make adjustments.

Outlook

For the third quarter of 2022, Lennar expects new orders to range between 16,000 and 18,000 homes. Deliveries are estimated to range between 17,000 and 18,500. Average sales price is expected to be slightly higher than the Q2 number of $483,000. Gross margin is projected to be 28.5-29.5%. EPS in Q3 is estimated to be $4.55-5.45.