Quarterly numbers

Business performance

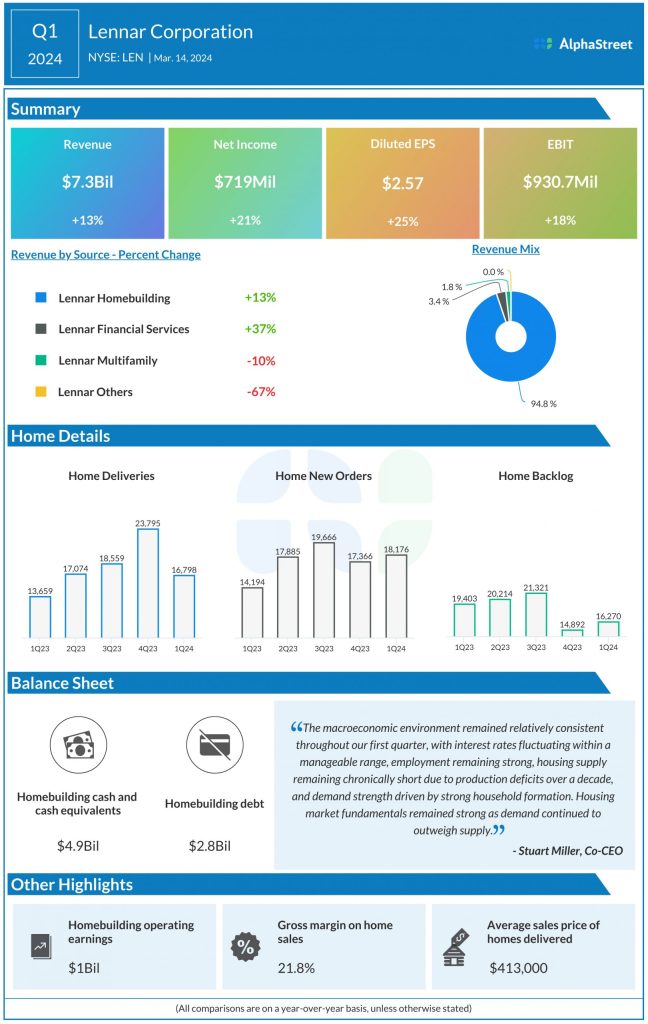

As stated on the quarterly conference call, the macroeconomic environment remains relatively strong for new homebuilders. There is strong demand for housing, supported by low unemployment levels and fairly strong consumer confidence. However, housing supply remains short and affordability continues to be restrained by higher interest rates and inflation.

In this environment, Lennar has been focusing on keeping its production pace and sales pace closely aligned. The company has also been adjusting prices and offering incentives to enable affordability. Purchasers, in turn, have been responding to higher sales incentives. This led to a growth of 28% in new orders and 23% in deliveries for the homebuilder during the first quarter.

Lennar delivered 16,798 homes in Q1 while new orders totaled 18,176 homes. Average sales price decreased 8% to $413,000 during the quarter, mainly due to higher incentives and product mix. The company had a backlog of 16,270 homes at the end of the quarter.

Outlook

For the second quarter of 2024, Lennar expects new orders to range between 20,900-21,300, as it continues its strategy of keeping its production pace and sales pace steadily aligned. Deliveries are estimated to range between 19,000-19,500 homes while average sales price is estimated to range between $420,000-425,000. Gross margin is expected to be about 22.5%. The company expects EPS to range between $3.15-3.25 for Q2 2024.