Quarterly numbers

Market trends

As stated on its quarterly conference call, Lennar is seeing strong demand for housing although affordability remains a constraint. There is a short supply of affordable houses and consumers, who anticipate cost of housing to stay elevated, are willing to purchase or rent what they can afford. The market, in turn, is wooing customers with price adjustments, higher incentives, and reduced production costs to boost affordability.

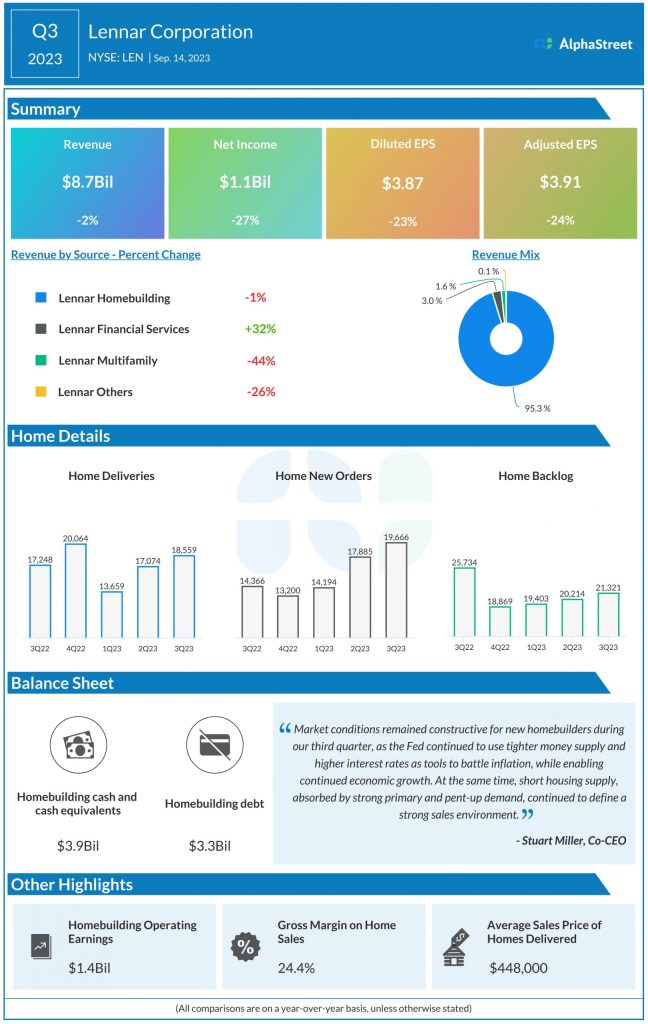

The company saw new orders increase 37% YoY in Q3 to 19,666 homes with new orders dollar value up 30% to $8.6 billion. Deliveries increased 8% to 18,559 homes. Net average sales price of homes delivered dropped to $448,000 in Q3 from $491,000 in the same period last year.

Lennar believes there will continue to be a limited supply of new homes due to the scarcity of developed land and high development costs. This will limit available inventory thereby continuing the imbalance between supply and demand.

Outlook

For the fourth quarter of 2023, Lennar expects new orders to range between 16,200-17,200 homes while its inventory count is expected to increase in the mid-single-digit percentage range YoY. Deliveries for Q4 are estimated to range between 21,500-22,500 homes while average sales price is expected to remain relatively flat to the third quarter as the company continues to price to market and offer incentives to match affordability. EPS is expected to range between $4.40-4.75 for the fourth quarter.