Quarterly numbers

Business performance

On its quarterly conference call, Lennar stated that the overall macroeconomic environment remains constructive for homebuilders. There is a strong demand for housing but it remains constrained by factors such as affordability, interest rates and a chronic housing shortage.

There needs to be an affordable price point, along with interest rate support, for customers to make transactions. In order to reduce these affordability constraints, homebuilders are offering incentives such as interest rate buydown, closing costs pickup and price reductions.

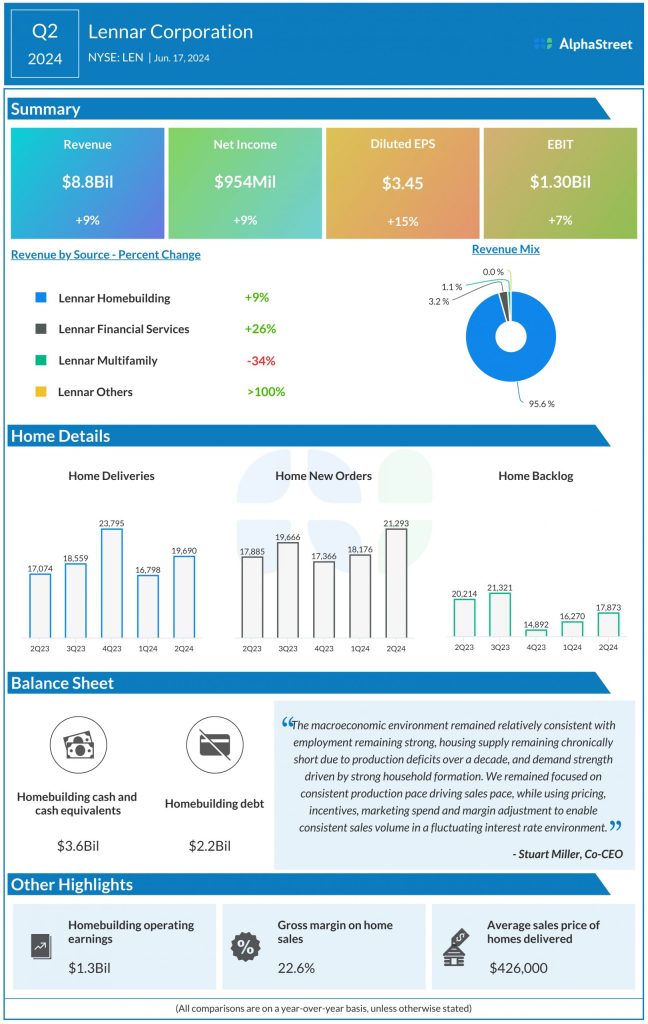

In Q2, Lennar’s revenue from home sales increased 9% year-over-year to $8.4 billion. New orders grew 19% to 21,293 homes while deliveries rose 15% to 19,690 homes. The company ended the quarter with a backlog of 17,873 homes with a dollar value of $8.2 billion. Average sales price decreased 5% year-over-year to $426,000. Gross margins on home sales rose 10 basis points to 22.6%.

Lennar has been focused on driving consistent production and sales, and it plans to continue producing volume and adding to market supply. The homebuilder believes the normalization of interest rates will activate pent-up demand. It believes it is well positioned to drive growth as demand for affordable housing remains strong.

Outlook

For the third quarter of 2024, Lennar expects both new orders and deliveries to be in the range of 20,500-21,000 homes. Average sales price is expected to range between $420,000-425,000. Gross margin on home sales is expected to be about 23%.

For the full year of 2024, Lennar expects to deliver 80,000 homes, which would represent a year-over-year growth of 10%. Gross margin is expected to remain consistent with the previous year.

Lennar’s shares have dropped 6% in the past three months.