What to Expect

Lennar’s August-quarter results are slated for release on September 14 after regular trading hours. The consensus earnings estimate is $3.51 per share, which represents a 30% decrease from the prior-year period. Total revenue is expected to decline 6.1% annually to $8.45 billion. In a recent statement, the management predicted that new orders would be in the range of 18,000 to 19,000 units in the third quarter and deliveries in the 17,750-18,250 range.

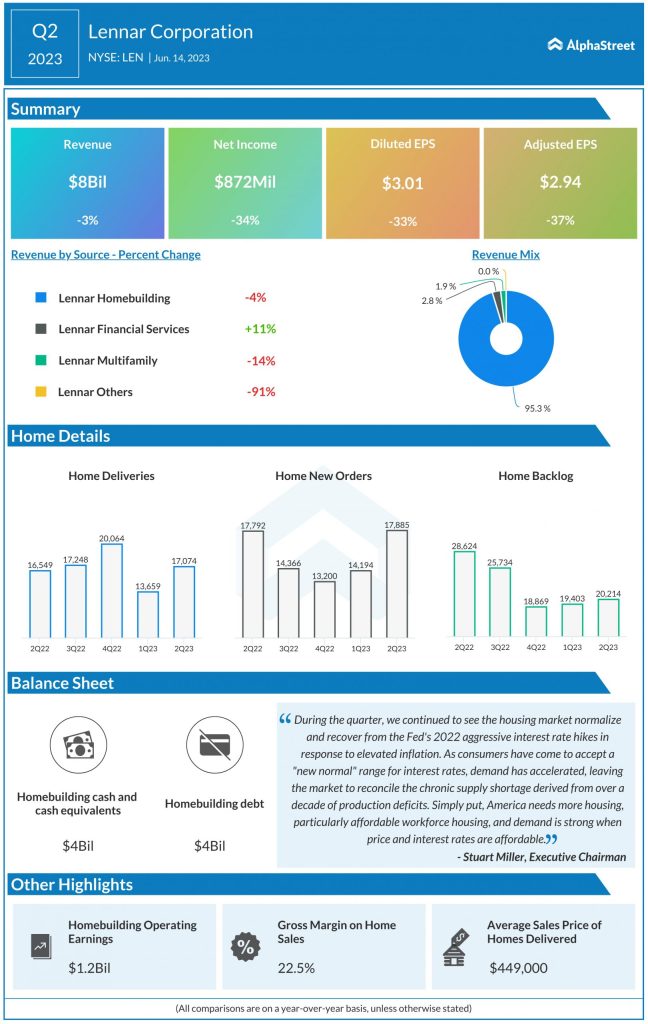

Commenting on the Q2 results, Lennar’s executive chairman Stuart Miller said, “The net price of homes has moderated through price reductions, together with the use of interest rate buydowns and other incentives. And the net average sales price has stabilized and not gone higher, nor lower for that matter, even as demand has returned. We have seen in our numbers that net average sales prices on home closings have dropped approximately 10% or 11% on home sales from the peak of approximately $500,000 in 2022 to approximately $450,000 now, and we expect that pricing is going to remain constant throughout the year.”

Mixed Q2

For the second quarter, the company reported total revenues of $8 billion, which is slightly lower than the $8.3 billion it generated in the same period last year. Net earnings attributable to Lennar were $872 million, or $3.01 per share, compared to $1.3 billion, or $4.49 per share last year. Adjusted EPS dropped to $2.94 but topped expectations, marking the seventh beat in a row. The company delivered 17,074 homes during the three-month period and received new orders for 17,885 homes.

On Monday, Lennar’s shares traded close to $120, which is above their 52-week average price. The stock is up 30% since the beginning of the year.