The housing market continued to adjust prices, incentives and production costs to help customers with their home purchases. This has led to a moderation in the net price of homes and the net average sales price has stabilized without any upward or downward movement.

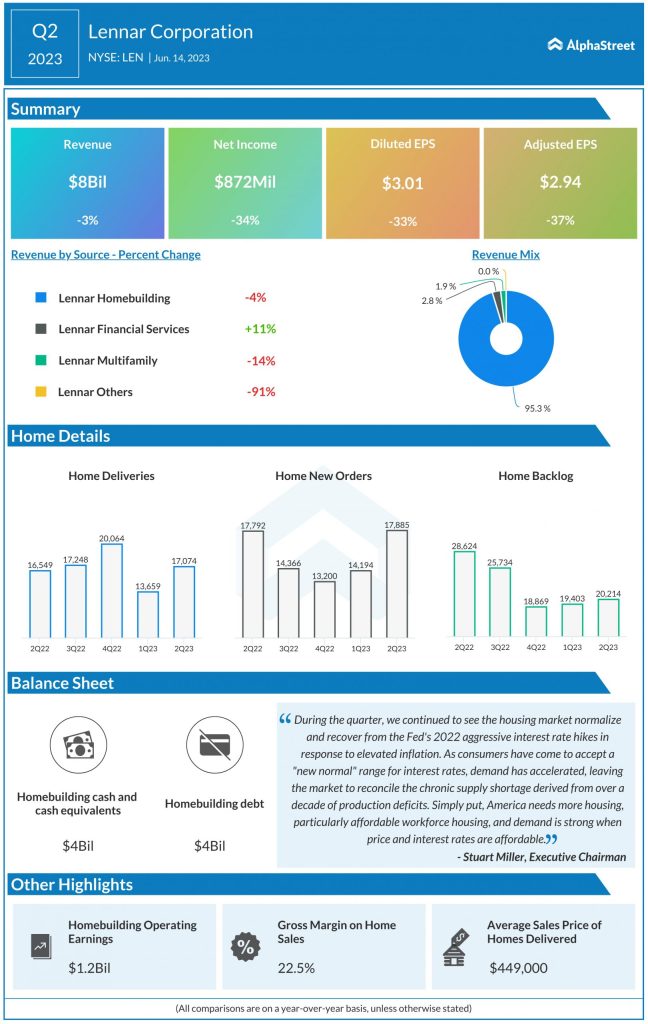

In Q2 2023, Lennar’s revenues from home sales decreased 4% YoY to $7.6 billion, mainly due to a 7% drop in average sales price of home deliveries. Gross margins on home sales dipped to 22.5% from 29.5% last year due to a decrease in revenue per square foot, caused by the company pricing homes to market as well as an increase in costs per square foot.

Strategies

As stated on its quarterly conference call, Lennar’s strategy has been to maintain its targeted start phase, continue to sell homes, and adjust its pricing to reflect market conditions. The company is using its price-to-market strategy to find the market clearing price of each of its homes on a community-by-community basis. In Q2, Lennar’s new sales orders increased 1% YoY and 26% sequentially.

During the second quarter, the company saw strong performance in markets such as Florida, New Jersey, Dallas, Houston and San Diego. On its call, Lennar said these markets are benefiting from low inventory and new sales in these markets reflect more normalized incentives.

However in markets such as Jacksonville, Orlando, Chicago and Colorado, despite sequential improvements, the company has had to make higher price adjustments and offer more incentives to maintain the sales momentum.

Lennar has been working on reducing its costs to align with the current sales price environment. The company has also been focusing on reducing land exposure and becoming asset light. Currently 70% of its land is controlled while 30% is owned. Through these strategies, the company believes it can successfully navigate the current environment.

Outlook

For the third quarter of 2023, Lennar expects new orders to range between 18,000-19,000 homes and deliveries to range between 17,750-18,250 homes. The Q3 ending community count is projected to be flat on a sequential basis while the average sales price is expected to be consistent with Q2. Gross margin in Q3 is expected to be 23.5-24%.