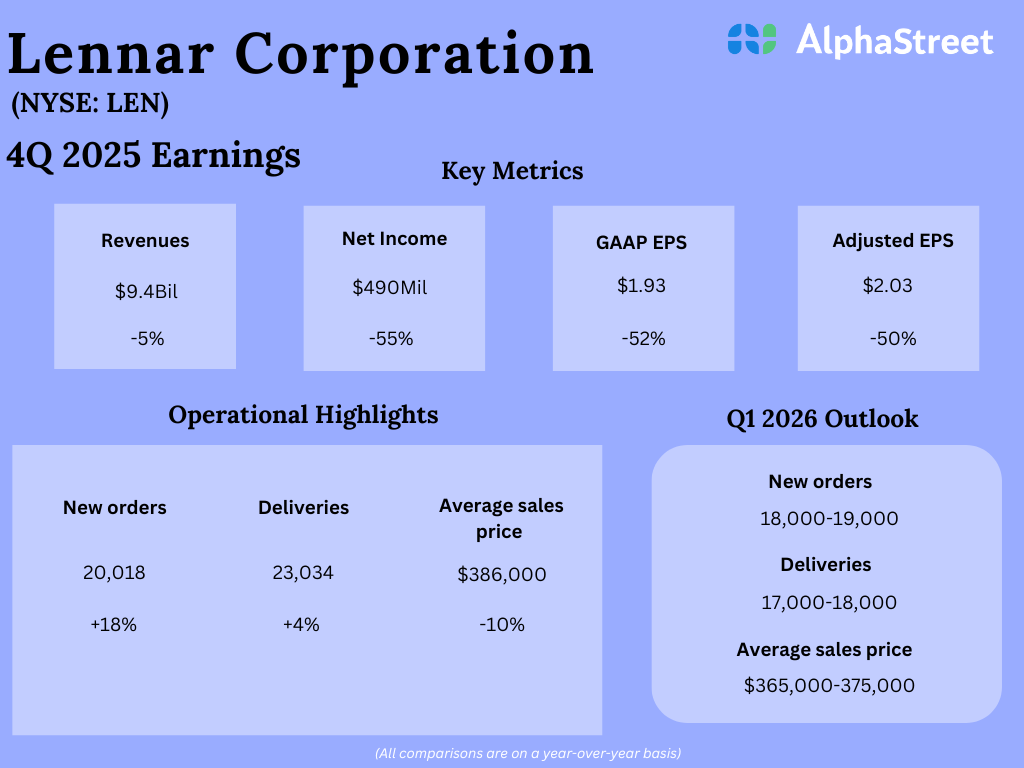

Decline in revenue and earnings

Interest rates fail to provide relief

As stated on its earnings call, Lennar had previously mentioned that a decline in interest rates could point to a recovery in the housing market but this did not happen due to affordability constraints and a weak consumer sentiment. Even though mortgage rates witnessed a slight moderation, inflationary pressures and concerns over job security held homebuyers back. The October-November government shutdown exacerbated the bleak sentiment.

Lennar’s fourth quarter performance was impacted by these subdued market conditions and affordability concerns. The company faced difficulty in maintaining sales volume and had to provide additional incentives to achieve its sales pace and avoid building up inventory. This in turn hurt its margins.

In Q4, new orders increased 18% to 20,018 homes and deliveries were up 4% to 23,034 homes, but average sales price decreased 10% to $386,000 due to soft market conditions and higher use of incentives to drive sales. Gross margin fell to 17% in the quarter from 22.1% last year.

LEN has been focusing on increasing housing supply while also reducing costs to support affordability. The company believes it is well-positioned to provide an affordable supply of homes when demand is finally boosted by low interest rates or government-sponsored programs.

LEN expects its margins to remain pressured and sales and closings to be seasonally light next quarter. However, the company expects to benefit from its lower cost structure, efficient product offerings and strong market positions when a recovery finally takes place.

Light guidance

Due to the prevailing uncertainty in the operating environment, Lennar has given limited guidance for the first quarter of 2026. The company expects new orders to range between 18,000-19,000 homes and deliveries to range between 17,000-18,000 homes. Average sales price is expected to be $365,000-375,000. Gross margin is expected to be lower in Q1, ranging between 15-16%.