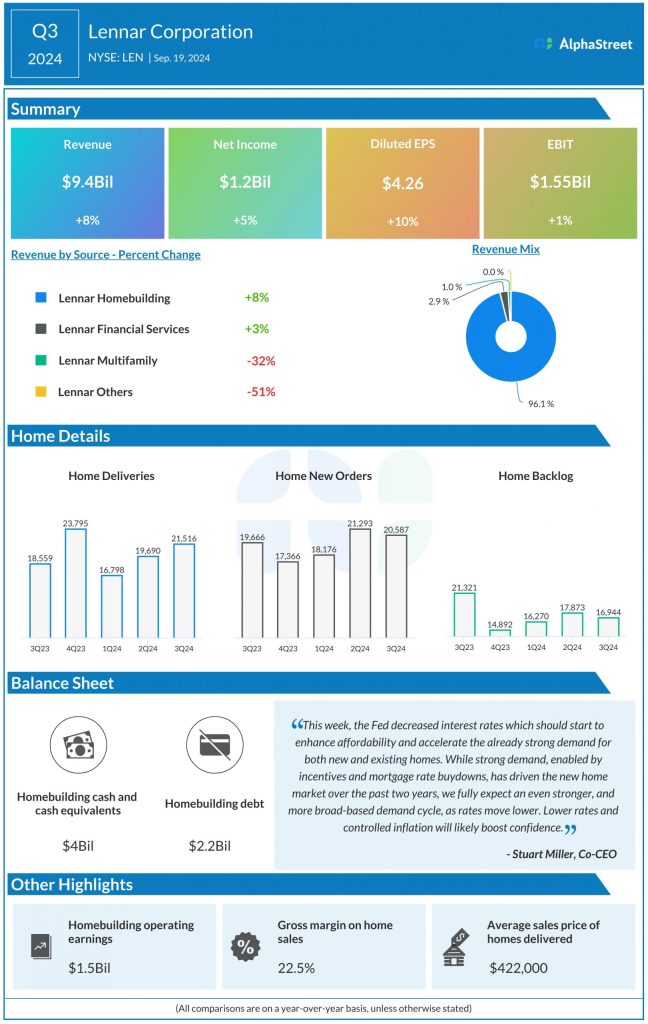

Revenue and earnings growth

Rate cuts and housing demand

The demand for homes has been strong for a while now but affordability was an issue due to interest rates and inflation. Homebuilders have been offering various sales incentives to make home purchases more affordable for buyers.

As mentioned on Lennar’s quarterly conference call, inflation and interest rates have hindered the ability of buyers to purchase new homes or to move to bigger homes to match growing families. Now with the recent reduction in interest rates, these hindrances can be expected to diminish. Lower interest rates are anticipated to accelerate demand for new and existing homes and improve affordability.

Consumer confidence has remained challenged in a tough economic environment. However, lower interest rates and controlled inflation are anticipated to boost this confidence, leading customers to prioritize shelter and purchase as affordability enables them to do so.

Lennar believes that while strong demand enabled by incentives and mortgage rate buydowns has driven the new home market over the past two years, an even stronger and more broad-based demand cycle can be expected as rates move lower.

In Q4, Lennar’s home deliveries increased 16% to 21,516 homes while new orders increased 5% to 20,587 homes. The average sales price of homes delivered was $422,000, down 6% from last year mainly due to higher incentives and product mix. The company ended the quarter with a backlog of 16,944 homes with a dollar value of $7.7 billion.

Outlook

For the fourth quarter of 2024, Lennar expects its new orders to range between 19,000 and 19,300 homes, representing a YoY growth of 10%. It expects deliveries to range between 22,500-23,000 homes. Average sales price is estimated to be $425,000. Gross margin in Q4 is expected to be flat with the third quarter. EPS is expected to range between $4.10-4.25.