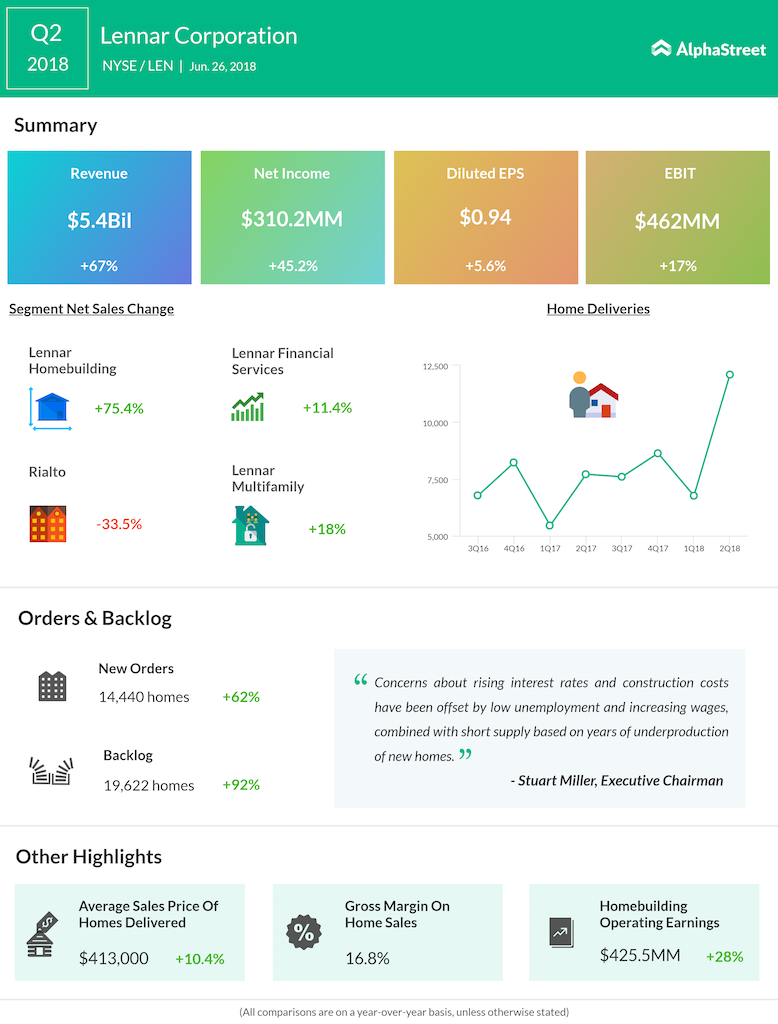

Lennar has also witnessed an improvement in its orders trend. During the quarter, new orders rose 62%, while Deliveries improved 57%.

“Concerns about rising interest rates and construction costs have been offset by low unemployment and increasing wages, combined with short supply based on years of underproduction of new homes. Demand remained strong as we continued to see pricing power support margins while affordability remained consistent,” said Stuart Miller, Executive Chairman.

The company, under the leadership of Rick Beckwitt, had earlier made it clear that it plans to divest its Rialto and multifamily business to stay in the pure homebuilding business. The company is in talks with banks to evaluate strategic alternatives for the two segments.