Over the years, Lockheed Martin has raised its dividend regularly, and it currently offers a bigger-than-average yield. The strong fundamentals and impressive dividend make it a favorite among long-term investors. But the high valuation should be taken into consideration before investing, at a time when stock markets are hit by macro uncertainties and rising interest rates.

Mixed Q1

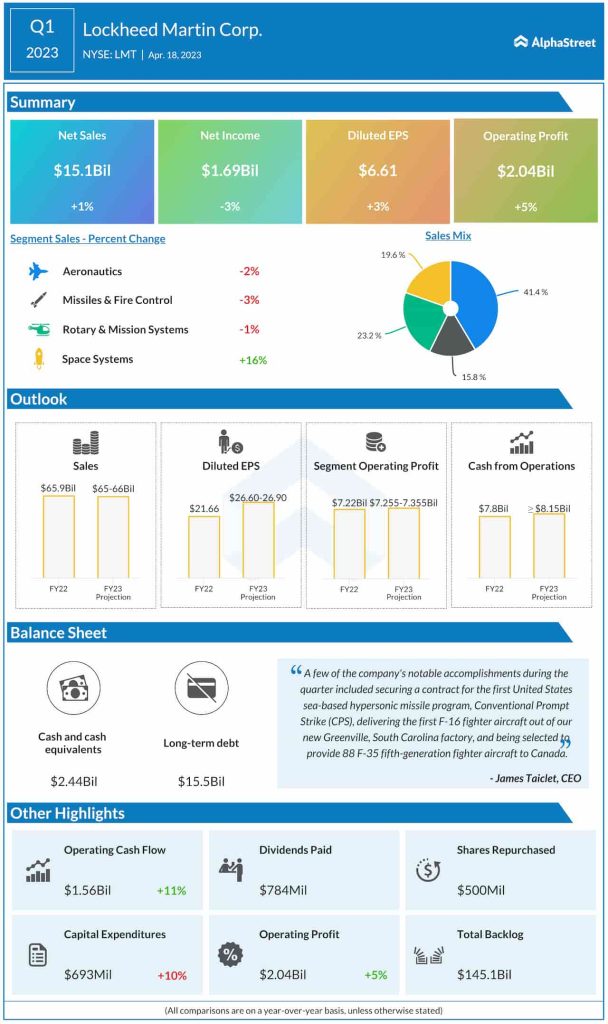

For the first quarter of 2023, the company reported muted sales growth and a decline in net profit as all the main operating segments experienced weakness. The management reaffirmed its full-year guidance, projecting a year-over-year increase in sales and adjusted earnings. During the quarter, it secured contract for the first United States sea-based hypersonic missile program. Also, it was selected to provide 88 F-35 fifth-generation fighter aircraft to Canada.

The Market

Of late, the company has been facing competition in the international market — Mitsubishi Heavy Industries of Japan and UK’s BAE Systems are building their own fighter aircraft. Going forward, the primary challenge facing the company will be competition from its European counterparts and also from the Global Combat Air Program, which is a multinational initiative led by the UK, Italy, and Japan to develop the next generation of fighter planes.

It is estimated that 2023 would be a modest year for Lockheed Martin, due to the lingering supply chain issues and the US government’s move to reduce defense spending. Beyond that, however, it looks poised to regain momentum in terms of contract wins and sales.

“We remain on track to achieve our full-year 2023 financial guidance and continue our robust approach to returning capital to shareholders, with $500 million in share repurchases and $784 million in dividends distributed in the first quarter. In addition, all of our Business Areas continue to develop mission-based solutions that are designed to be integrated into an open architecture using 21st-century digital technologies to elevate the deterrence posture of the United States and its allies. We are demonstrating these capabilities in partnership with commercial technology leaders across a number of disciplines,” said Lockheed Martin’s CEO Jim Taiclet.

Financials

In the first quarter, earnings came in at $6.61 per share and exceeded market watchers’ predictions for the third time in a row. Net sales edged up 1% annually to $15.1 billion during the three-month period. The company ended the quarter with cash from operations of $1.6 billion and a free cash flow of $1.3 billion.

Extending the uptrend that followed the earnings report, Lockheed Martin’s stock traded sharply higher on Tuesday. In the past twelve months, it has gained 13%.