Mixed results

Pressure in DIY, resilience in Pro

As mentioned on the company’s quarterly conference call, a key factor impacting the third quarter performance was the greater-than-expected pullback in DIY discretionary spending, especially in bigger-ticket categories.

Lowe’s generates 75% of its revenue from DIY customers so softness in this segment has a meaningful impact on the company. In Q3, categories like appliances, home décor, flooring, kitchen and bath were most impacted by lower DIY demand. Lowe’s saw pressure on sales of bigger-ticket items like appliances as consumers postpone their purchases.

Weakness in appliances impacts Lowe’s as this category makes up 14% of its sales. The company is working on offering affordable prices on appliances to consumers seeking value ahead of the holiday season. In addition, within categories like kitchen and bath, there appears to be a rising preference for private brand products among value-conscious customers.

The pressure in DIY discretionary projects and big-ticket transactions, along with lumber deflation and normalized appliance promotions, led to declines in comparable average ticket and comp transactions during the quarter. Comparable average ticket was down 0.5% and comp transactions were down 6.9% in Q3.

The softness in DIY was partly offset by positive comp transactions in Pro. The Pro segment makes up 25% of Lowe’s revenue and the company saw strong performance in Pro-heavy categories like building products, rough plumbing, and paint during the third quarter. The majority of Lowe’s Pro customers appear to have healthy project backlogs, which mostly include unavoidable repairs on aging homes. However, the uncertain macro environment remains a damper.

Even against this backdrop, Lowe’s has a bullish outlook for the home improvement industry over the medium to long term. It expects home prices to be supported by a supply/demand imbalance in housing. In addition, factors like millennial household formations, people choosing to age in place in their own homes, and an aging housing stock that will require repairs and remodels, are all expected to act as tailwinds.

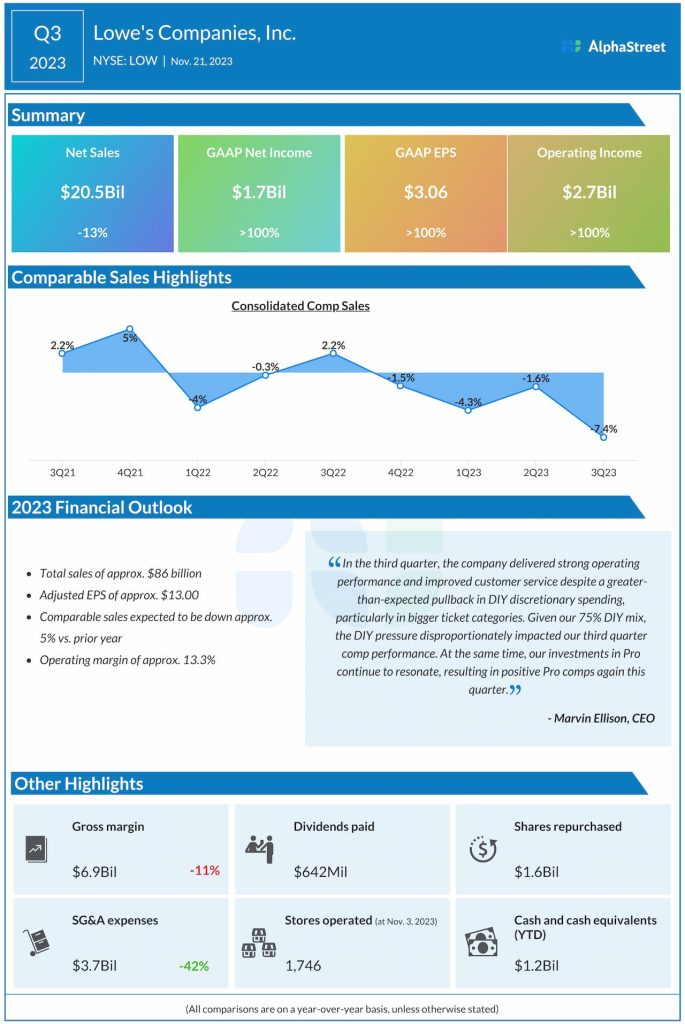

Lowered outlook

Lowe’s lowered its outlook for the full year of 2023 due to the pullback in DIY discretionary spending and the uncertainty related to the macroeconomic environment. The company now expects total sales of approx. $86 billion and adjusted EPS of around $13.00 for FY2023. Its previous expectations were for sales of $87-89 billion and adjusted EPS of $13.20-13.60. Comparable sales are now expected to decline 5% YoY versus the prior range of 2-4%.