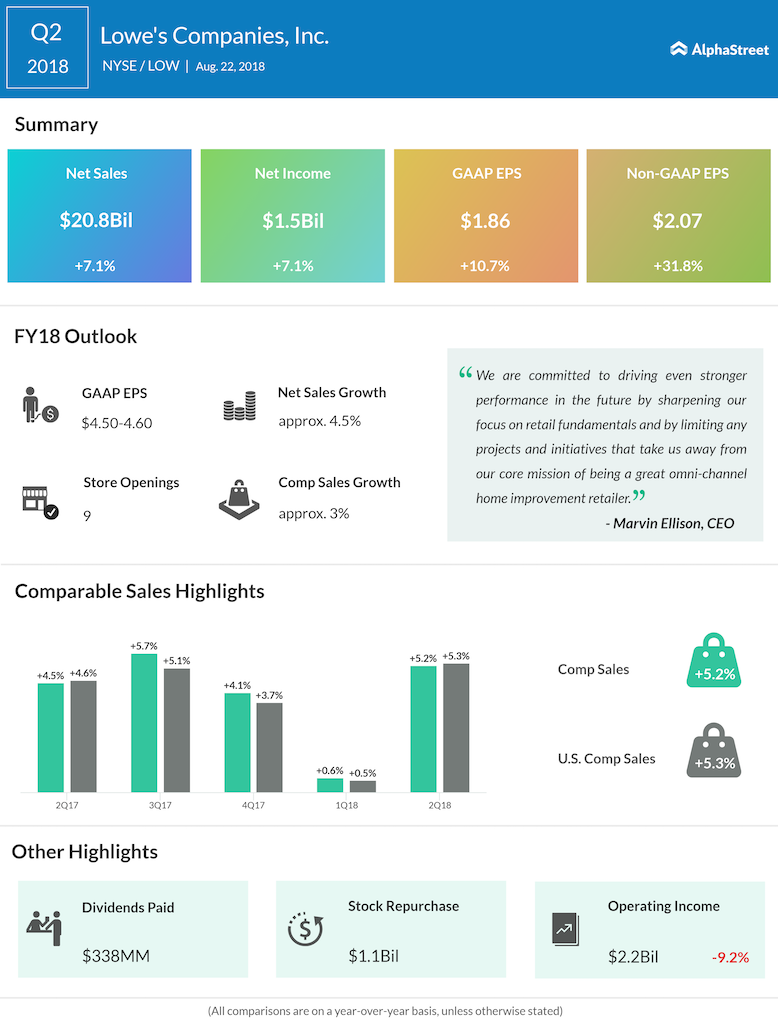

Net income improved to $1.5 billion or $1.86 per diluted share from $1.4 billion or $1.68 per diluted share in the prior-year period. Adjusted EPS increased 31.8% to $2.07.

For fiscal year 2018, Lowe’s expects total sales to increase about 4.5% and comparable sales to increase around 3%. Diluted EPS is expected to be $4.50 to $4.60.

Lowe’s has decided to exit its Orchard Supply Hardware business so that it can focus on its core home improvement operations. The company plans to close all 99 Orchard Supply Hardware stores in California, Oregon and Florida, as well as its distribution facility by the end of fiscal 2018. Lowe’s has partnered with Hilco Merchant Services to manage the process systematically.

The retailer expects to incur additional pretax costs of $390 million to $475 million associated with this in the second half of 2018.

Lowe’s had 2,155 home improvement and hardware stores in the US, Canada and Mexico as of August 3. The company plans to add around nine home improvement stores in 2018.

Last week, Lowe’s rival Home Depot (HD) reported quarterly results that beat expectations and lifted the stock. Home Depot’s comp sales rose 8% for its second quarter.

Related: Lowe’s Q2 2018 Earnings Transcript

Related: Lowe’s Q2 2018 Earnings Preview