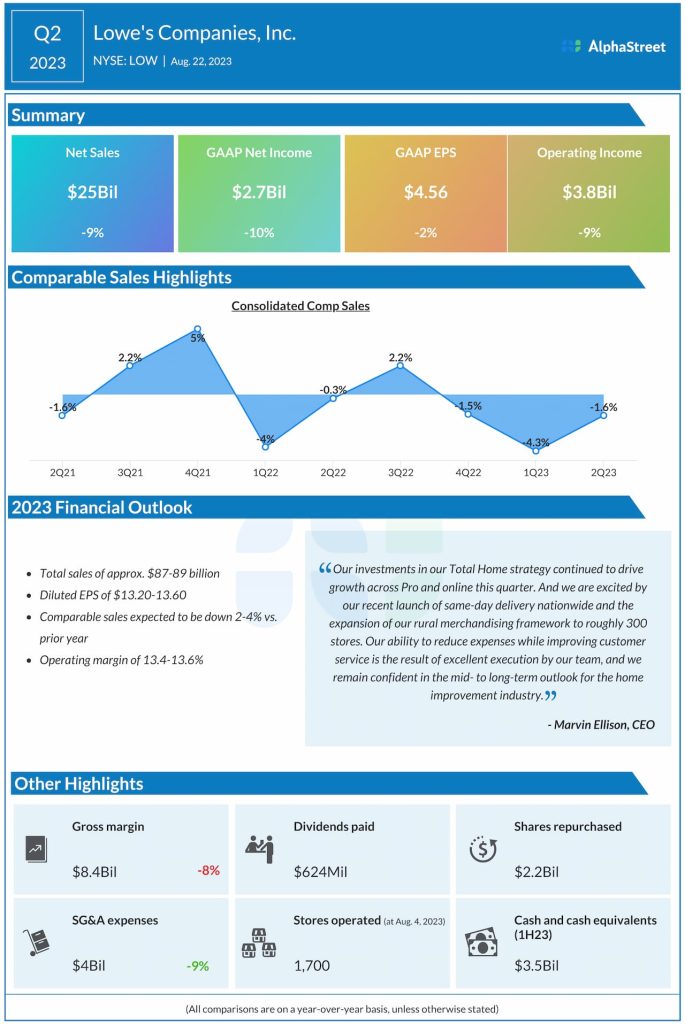

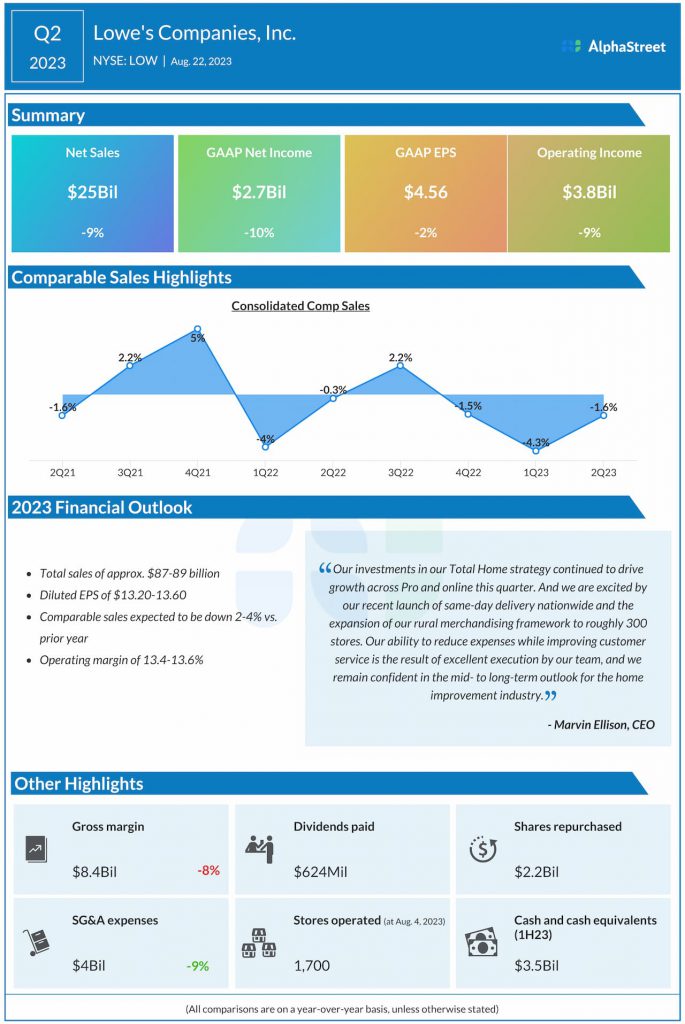

Sales and profitability

Market trends

In Q2, Lowe’s saw growth in categories like plumbing, building materials, paint, seasonal and outdoor living, lawn and garden, and hardware as it captured spring sales and witnessed strong broad-based demand in the Pro category.

On its quarterly conference call, Lowe’s stated that the two strongest demand drivers of its business are real disposable personal income and home price appreciation. In spite of a slowdown, home price appreciation remains 35% higher than pre-pandemic levels. Meanwhile, inflation and higher interest rates have put pressures on real disposable income, which have not fully abated.

Due to these factors, customers continue to be cautious with their spending, and are focusing on smaller repair and maintenance projects rather than big-ticket discretionary purchases. The company remains optimistic on the fact that home improvement projects are often postponed rather than cancelled thereby hinting at chances of a recovery in demand.

The aging housing stock will also lead to remodels and repairs and this, combined with factors like millennial household formation, aging in place, and remote work all give Lowe’s optimism on the mid to long-term outlook for the home improvement industry.

Outlook

Lowe’s expects net sales to range between $87-89 billion for the full year of 2023. Comparable sales are expected to be down 2-4%, reflecting impacts from lumber deflation. The company expects strength to continue in Pro and online while DIY discretionary purchases are expected to remain pressured. Adjusted EPS is expected to be $13.20-13.60 for the full year.