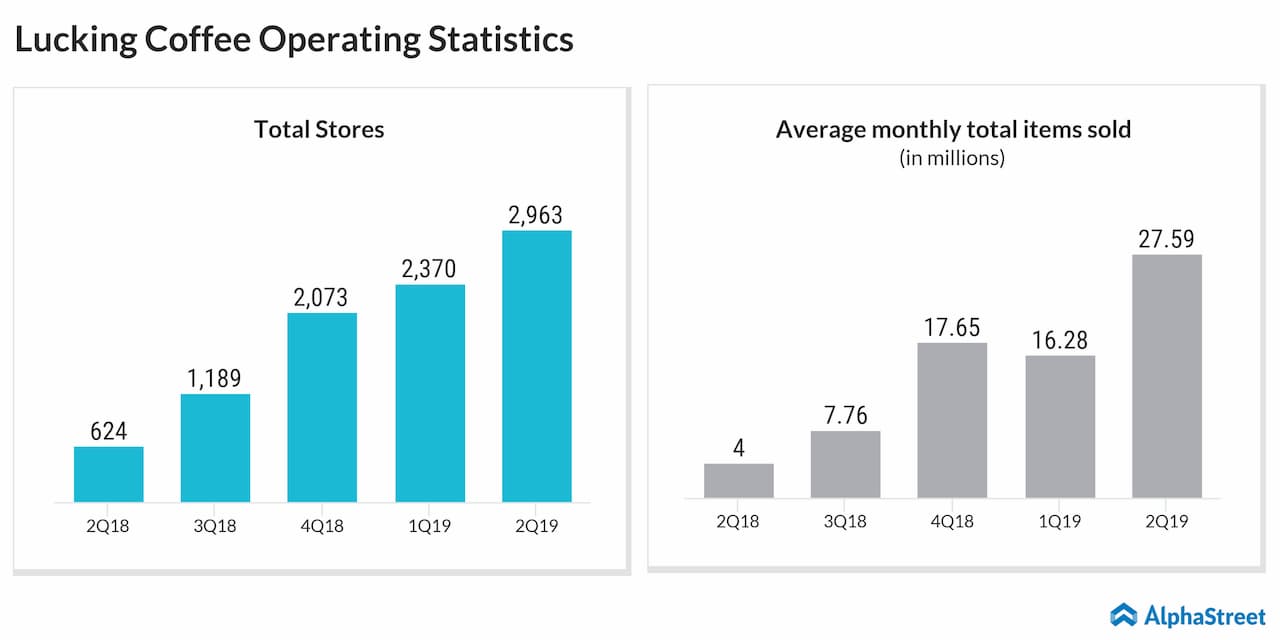

For the second quarter, new transacting customer acquired was 5.9 million. The cumulative number of transacting customers increased to 22.8 million from 2.9 million as of the end of the second quarter of 2018. Average monthly transacting customers soared by 411% to 6.2 million from 1.2 million a year ago, and average monthly total items sold jumped by 590% to 27.6 million.

The total number of stores at the end of the quarter was 2,963 stores, representing an increase of 374.8% from 624 stores at the end of the prior-year quarter. The company remained on track to become the largest coffee network in China in terms of the number of stores by the end of 2019. The company opened 593 net new Luckin stores during the second quarter.

Store level operating loss narrowed substantially to $8.1 million from last year as a result of benefits of scale and increased bargaining power, operating efficiency from technology, and higher store throughput. The company is on track to reach its store-level breakeven point during the third quarter of 2019.

For the second quarter, operating expenses increased by 244% due to increased economies of scale and its technology-driven operations. The increase was in line with business expansion. An increase in the number of stores and headcount drove store rental and other operating costs higher by 272%.

Also read: Sysco Q4 earnings review

The advertising expenses and delivery expenses dragged sales and marketing expenses higher by 119%. Also, business expansion, costs related to the company’s initial public offering, and share-based compensation to senior management dragged general and administrative expenses higher by 255%.

Looking ahead into the third quarter, the company expects net revenues from products to be in the range of RMB1.35 billion and RMB1.45 billion. This forecast reflects the company’s current and preliminary views.

On July 22, Luckin, which reached to the public during mid-May, signed a memorandum of understanding with Kuwait Food Company Americana K.S.C.C to establish a joint venture to launch a new retail coffee business in the Greater Middle East and India.

The company is intending to become a major competitor to Starbucks (NASDAQ: SBUX) while still needing to improvize on its size for keeping the clash stiff. Luckin strategically focuses on pick-up stores, which accounted for 92.5% of total stores as of June 30, 2019.