The Strategy

The business model goes beyond just selling products, rather the strategy is to market an entire lifestyle. In a sign that the method is yielding the desired result, an increasing number of customers return to the stores and a section of them use the products more like fashion apparel.

Read management/analysts’ comments on quarterly reports

Lululemon’s stock rose a whopping 15% within a few hours after last week’s earnings announcement, marking one of the biggest single-day gains ever. The shares have been trading sideways in the past few months, after withdrawing from last year’s all-time high and entering a volatile phase. Currently, LULU is one of the most attractive and safe investment options that long-term investors wouldn’t want to miss.

On Track

The management is aggressively pursuing its ambitious Power of Three X2 plan to accelerate international expansion. The plan, which envisages doubling revenue by 2026 through product innovation, guest experience, and market expansion, has been successful so far in terms of meeting targets. It is expected to create ongoing value for shareholders.

Lululemon’s CEO Calvin McDonald said in a recent statement, “our strategy is to solve for our guests’ unmet needs across their secondary sweat activities such as golf, tennis, and hike. We roll out targeted innovations while also leveraging the versatility of our core assortment. This not only builds our credibility within the activity, but it also allows us to drive overall sales while effectively managing SKUs. Our hike collection, which we launched in quarter two, is another example of how we are executing our play strategy well.”

Key Numbers

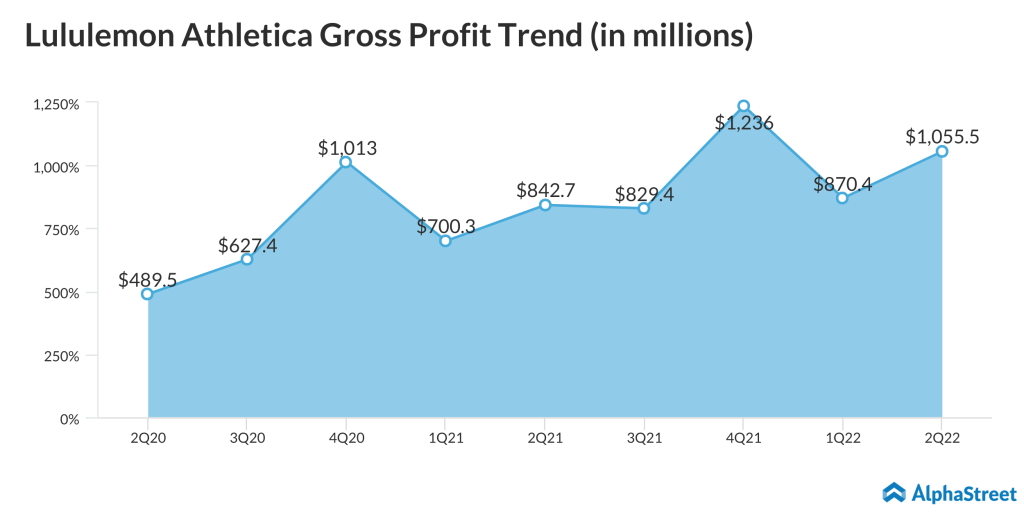

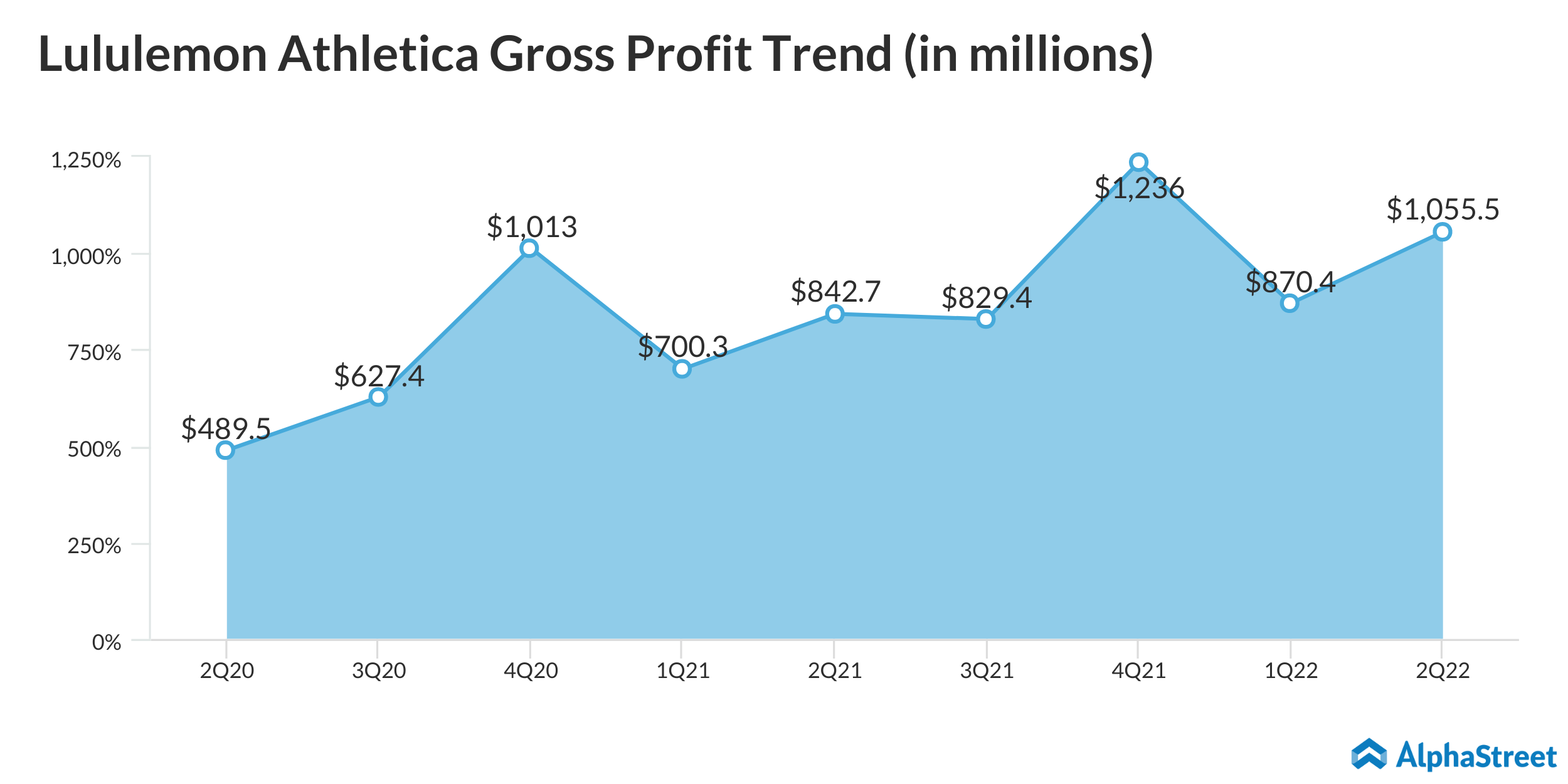

The retailer’s financial performance was quite impressive during the pandemic, with earnings and revenues exceeding the market’s projection regularly since early 2020. In the most recent quarter, revenues grew by a third to $1.87 billion, aided by a 23% growth in comparable store sales. As a result, net profit, adjusted for special items, moved up to $2.20 per share from $1.65 per share in the second quarter of 2021. The top line remains balanced across all operating segments and geographical regions, an ongoing trend that helped maintain stable growth

While the better-than-expected second-quarter numbers and the upbeat guidance have brought cheer to shareholders, the question is whether the uptrend would be maintained in the second half. It is very likely that Lululemon would stay resilient to the multiple challenges the market is currently facing. Successful execution of growth strategy and near-term targets like adding 75 new units to the store network this year show the business would stay on the growth path.

Target: A few factors to take into account if you are considering this major retailer

Lululemon’s stock got a major fillip following last week’s earnings release. The momentum was maintained in the following sessions, reflecting the upbeat investor sentiment.