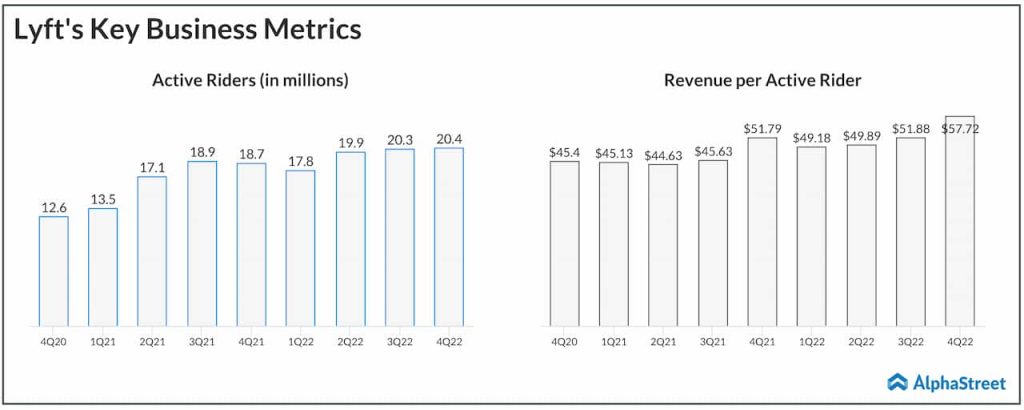

At $1.2 billion, fourth-quarter revenues were up 21% year-over-year. At the end of the quarter, the company had around 20.4 million active riders, up 9% year-over-year. Revenue per user rose 11% to $57.72.

Check this space to read management/analysts’ comments on quarterly reports

“The better marketplace balance we see today creates significant opportunities for long-term profitable growth. To take advantage of this opportunity we must ensure competitive service levels. Reinforcing our competitive position, servicing more demand, and reducing our fixed and variable costs will put us in the best position to deliver strong shareholder returns,” said Logan Green, chief executive officer of Lyft.