In its first quarterly announcement as a public company, Lyft (NASDAQ: LYFT) reported massive losses in Q1. First-quarter loss, adjusted for one-time costs, was $9.02 per share, much wider than the street expectation of $4.74 per share.

However, revenues almost doubled to $776 million, surpassing analysts’ projection of $740.21 million.

Lyft shares fell 3.4% during extended trading on Tuesday. The ride-sharing firm’s stock has been volatile since hitting the markets in March. It is down 15% till-date since its listing, well below the IPO price of $72.

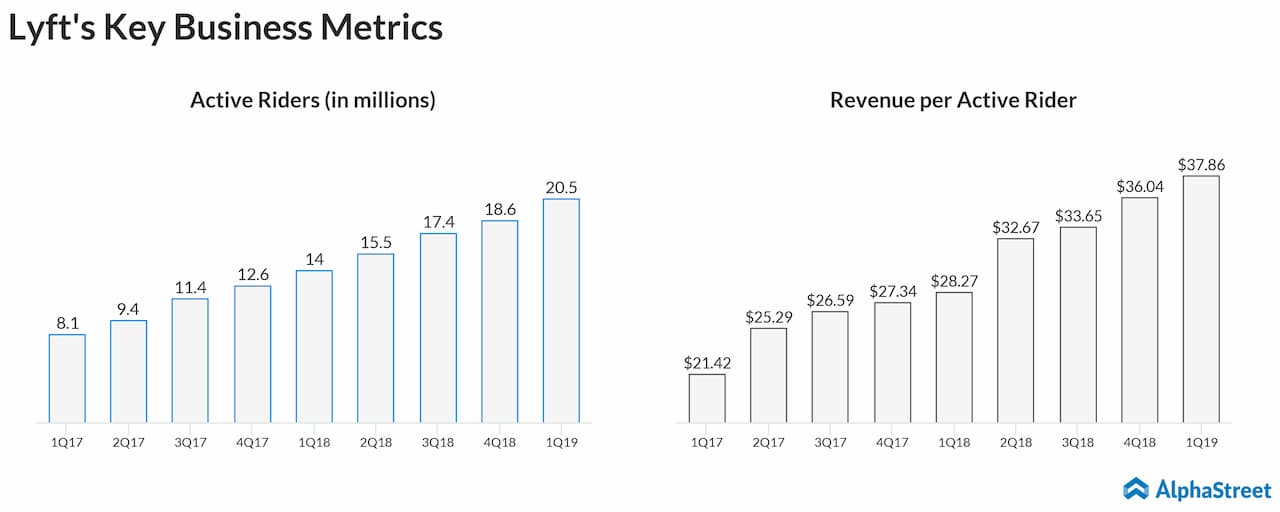

Lyft CEO Logan Green said, “Our performance was driven by the increased demand for our network and multi-modal platform, as Active Riders grew 46 percent and revenue grew 95 percent year-over-year.”

OUTLOOK

Lyft expects Q2 revenue in the range of $800 million to $810 million. For the full year, total revenue is estimated to be between $3.275 billion and $3.3 billion. The company also expects adjusted EBITDA loss for the full year to be between $1.15 billion and $1.175 billion.

Lyft has been focusing on multi-modal platform approach moving beyond ridesharing. Last November, it forayed into shared bikes and scooter domain in the US with the acquisition of Motivate. Lyft also has inked a partnership with Aptiv to bring autonomous vehicles to its fleet. Since the beginning of 2018, the company claims to have enabled 35,000 rides along with a safety driver.

READ: FERRARI SHIPMENTS JUMP 22% IN Q1

With Transportation as a service (TAAS) market still at its infancy across the globe, there is huge unmet demand for Lyft to expand its services. However, it faces intense competition from the likes of Uber, Via and Juno (owned by Gett) in the US and Canada.

On the autonomous vehicles front, the company is competing with firms like Waymo (owned by Alphabet), Baidu, Uber, and Zoox, etc.

Lyft’s rival Uber is planning its IPO on May 15 in the price range of $44 to $50 per share, with a valuation of $79.2 billion to $90 billion.