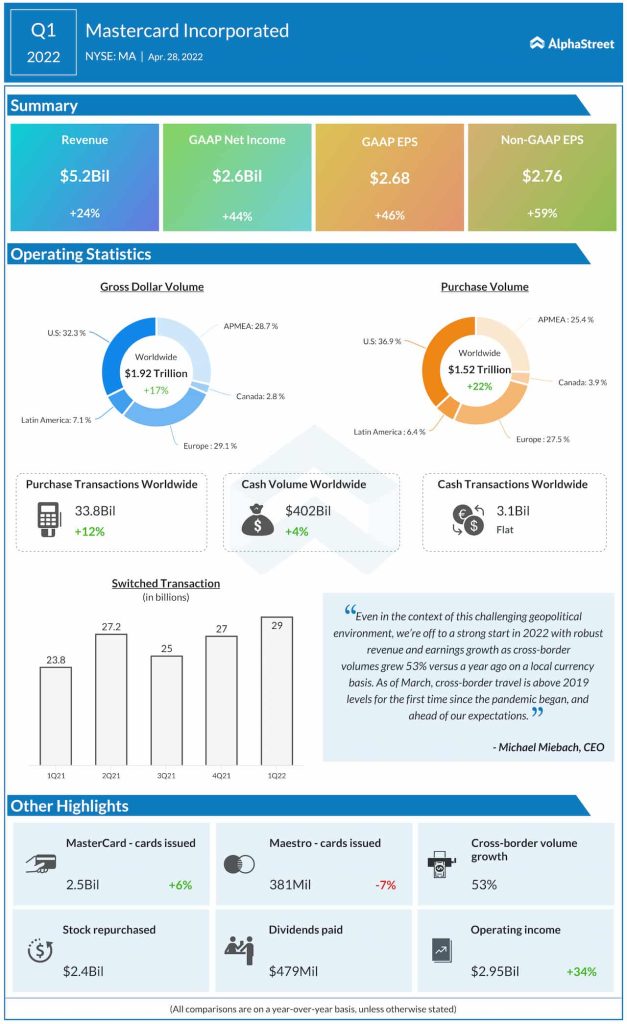

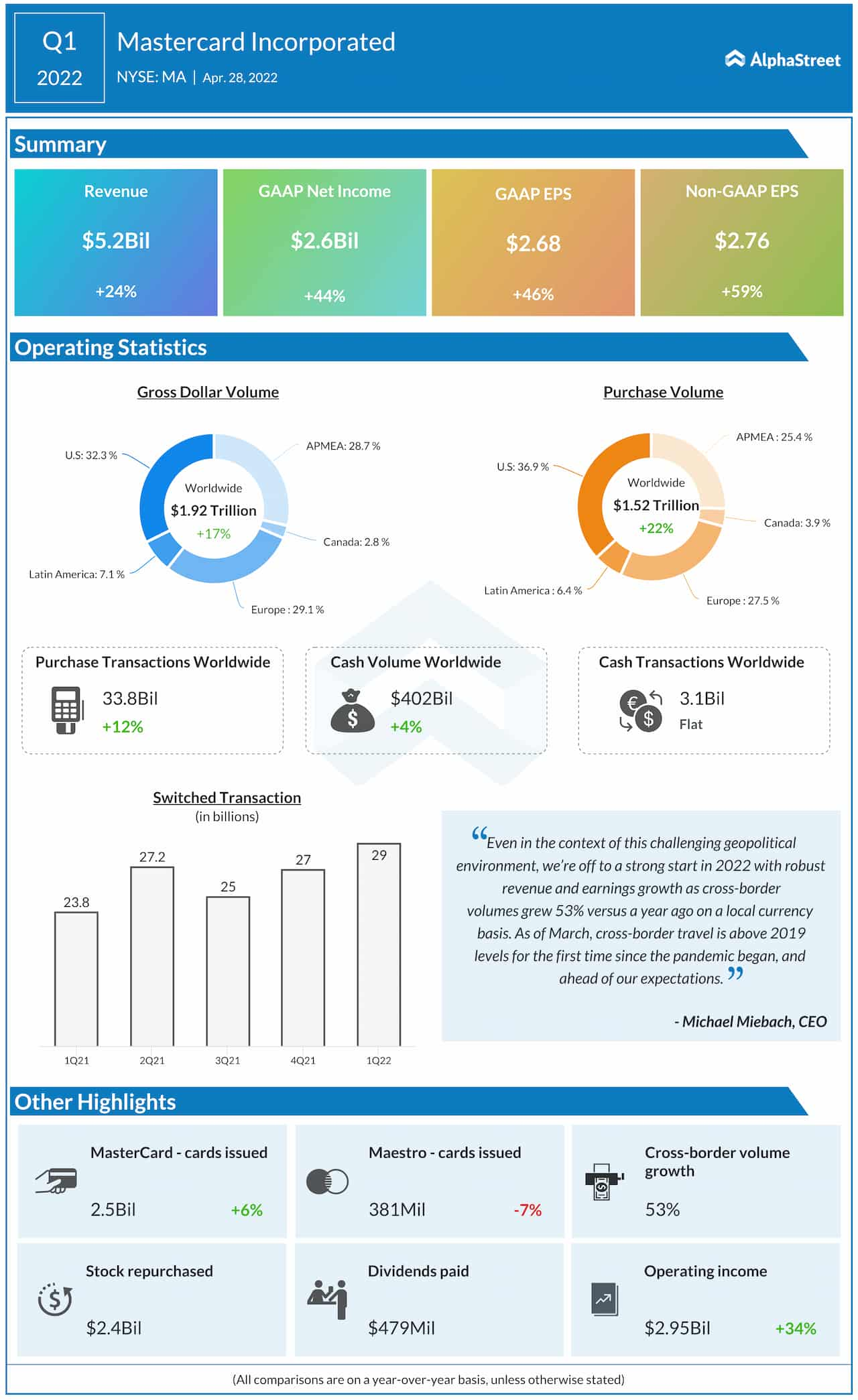

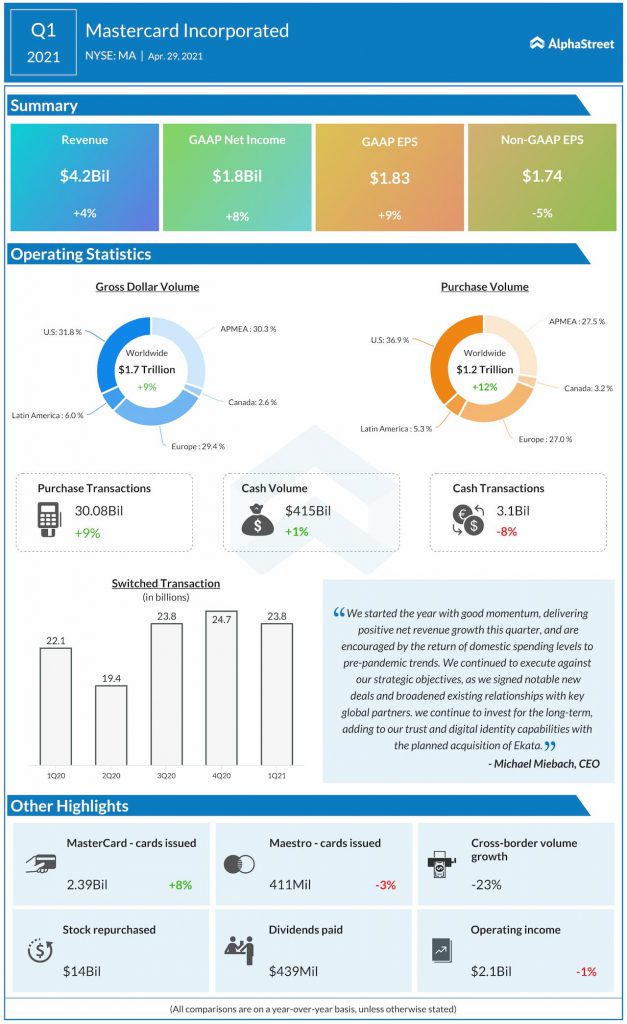

Adjusted earnings, excluding special items, climbed to $2.76 per share in the March quarter from $1.74 per share a year earlier and topped analysts’ estimates. First-quarter unadjusted net income rose to $2.6 billion or $2.68 per share from $1.8 billion or $1.83 per share in the same period of 2021.

At $5.2 billion, net revenues were up 24% year-over-year and well above the consensus forecast. Gross dollar volume increased 17% and purchase volume moved up 21%, on a local currency basis.

Check this space to read management/analysts’ comments on Mastercard’s Q1 2022 results

“We continue to make good progress against our strategic priorities, deepening relationships with key issuers and co-brand partners across the globe. We’re seeing strong traction in consumer and small business payments, Mastercard Installments, and our work across the digital asset space. This complements the continued growth of acceptance and the expansion of our services capabilities through our acquisition of Dynamic Yield,” said Michael Miebach, Mastercard’s CEO.