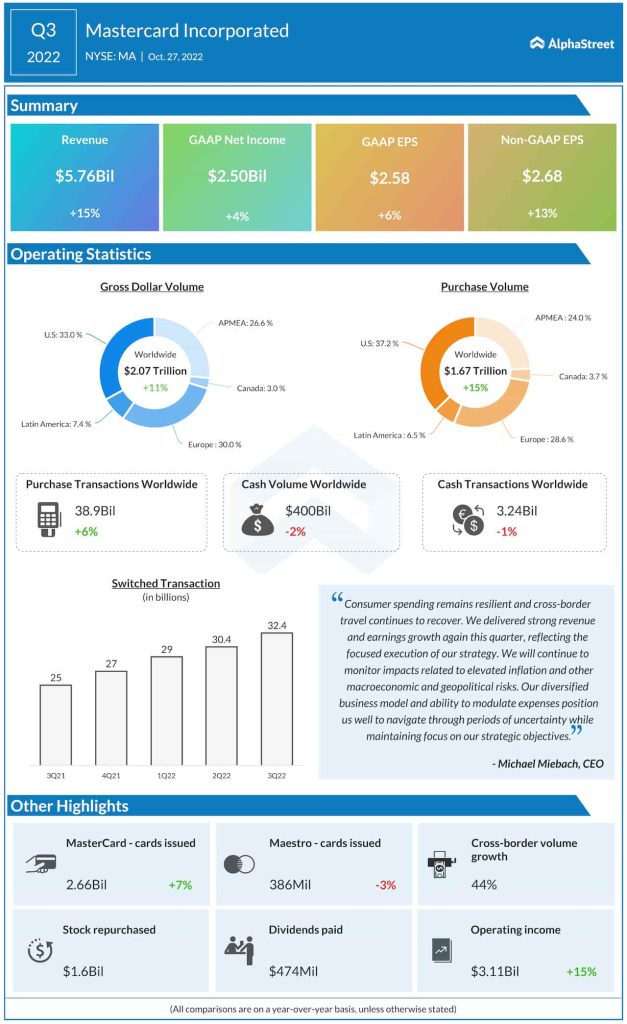

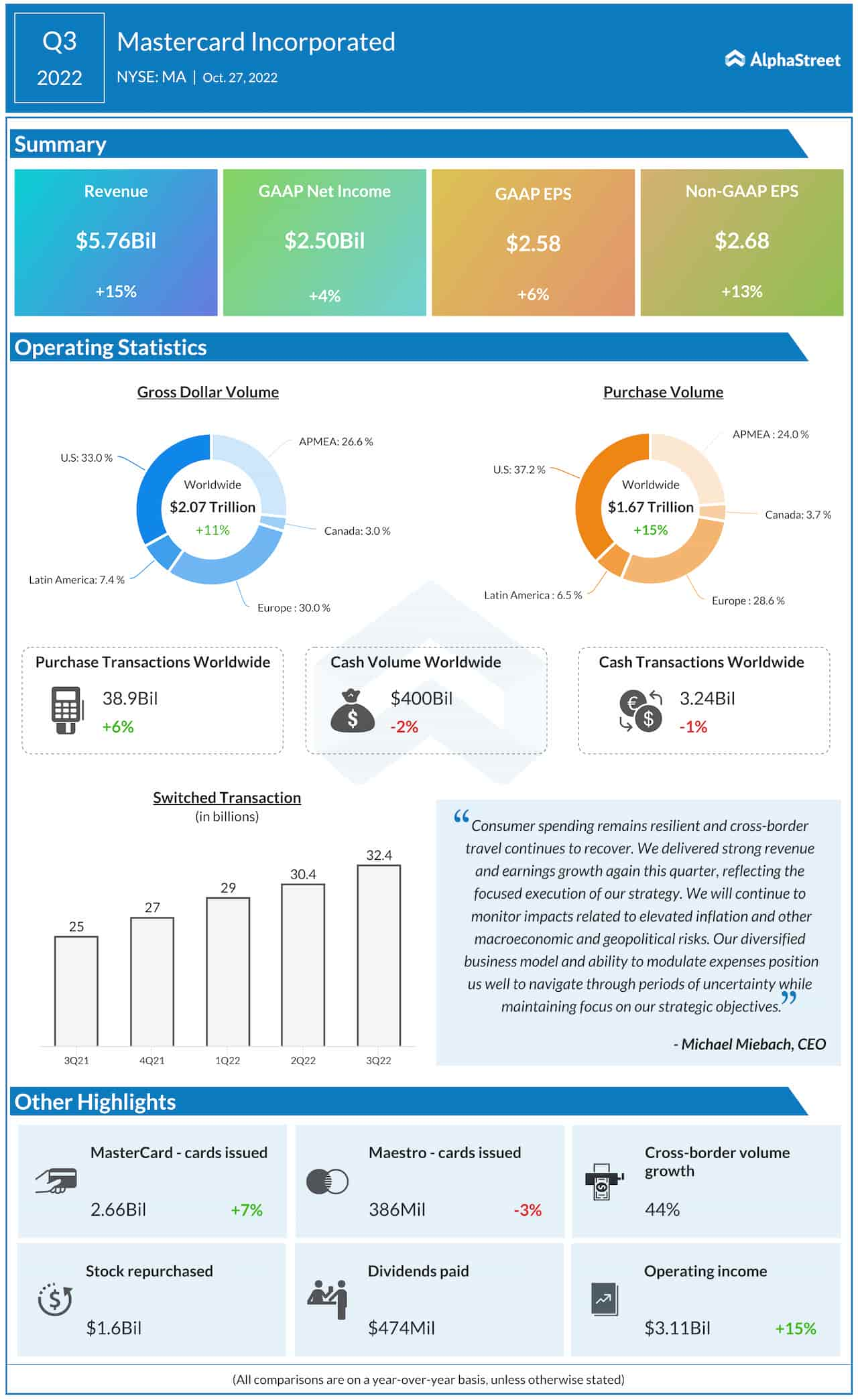

Adjusted earnings, excluding special items, climbed to $2.68 per share in the September quarter from $2.37 per share a year earlier and topped analysts’ estimates. Third-quarter unadjusted net income rose to $2.50 billion or $2.58 per share from $2.41 billion or $2.44 per share in the same period of 2021.

At $5.76 billion, net revenues were up 15% year-over-year and well above the consensus forecast. Gross dollar volume increased 11% and purchase volume moved up 15%, on a local currency basis.

Check this space to read management/analysts’ comments on Mastercard’s Q3 2022 results

“We will continue to monitor impacts related to elevated inflation and other macroeconomic and geopolitical risks. Our diversified business model and ability to modulate expenses position us well to navigate through periods of uncertainty while maintaining focus on our strategic objectives,” said Michael Miebach, Mastercard’s CEO.