People got the convenience of selecting and paying for things from the comfort of their homes and having it delivered to their doorsteps. Options like Cash-on-Delivery removed any further doubts on credibility. That’s how Amazon came and pulled the carpet from under the feet of many a traditional retailer.

And oh, how the mighty fell.

This year we saw bankruptcies of favorite businesses like Toys R Us and Claire’s with Sears and Stein Mart in doubtful territory. This is sad and frightening.

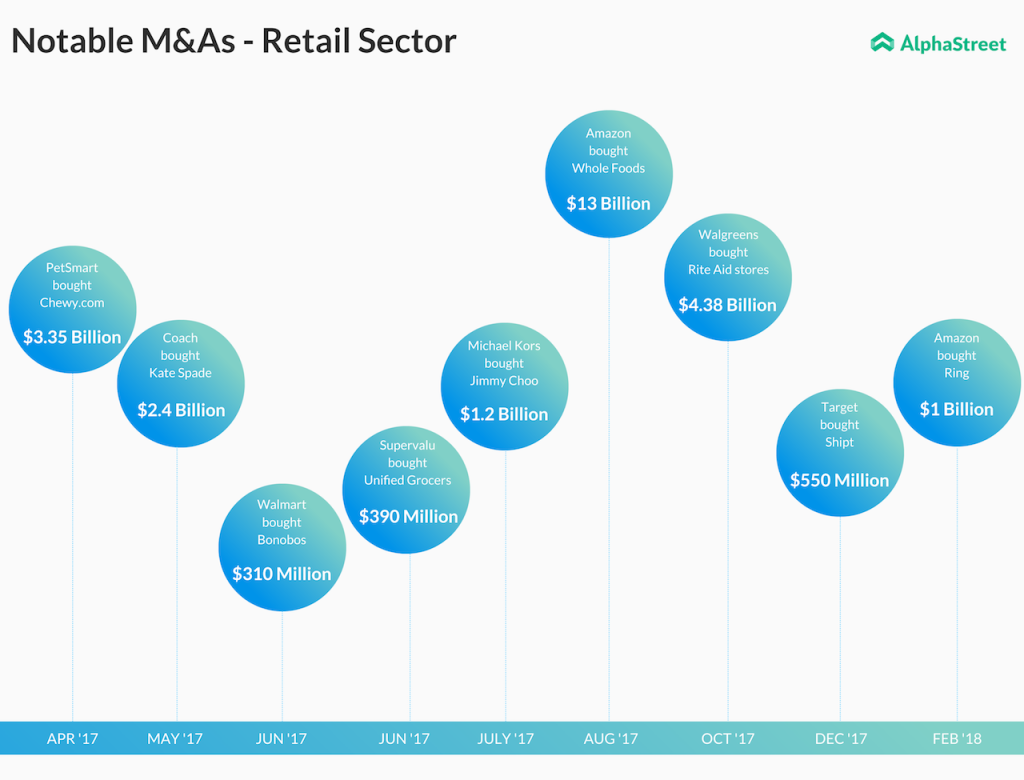

That’s why many top players have decided to opt for acquisitions to strengthen their positions. The one that sent the industry into a panic last year was the Amazon-Whole Foods deal. This one gave and is still providing traditional grocers nightmares. Although Amazon didn’t reveal much in its recent earnings release about how things are going with Whole Foods, it did mention that Whole Foods was the primary contributor to its physical store revenue. Also, Whole Foods prices are expected to decrease further. Amazon is still working its way through the grocery maze but rest assured, it will find the right path very soon.

Not so far behind is Walmart who acquired Jet.com last year in an attempt to boost its e-commerce business. Walmart is putting up a strong fight against Amazon, and it is one heck of a worthy opponent. Walmart is said to be joining forces with Flipkart to take on Amazon in India.

Other mergers in this industry include Michael Kors’ acquisition of Jimmy Choo and Coach’s (now Tapestry Inc.) acquisition of Kate Spade. Another notable merger proposal that fell through was the Staples-Office Depot deal.

However, things may not be that bad. A few recent analysis seems to indicate that the retail industry will see recovery and even growth this year. Many companies are revamping their strategies and increasing their focus on e-commerce to survive. These studies also state that traditional brick-and-mortar stores cannot and will not vanish that soon. They have to change their methods once in a while. It looks like everything is going to be just fine.