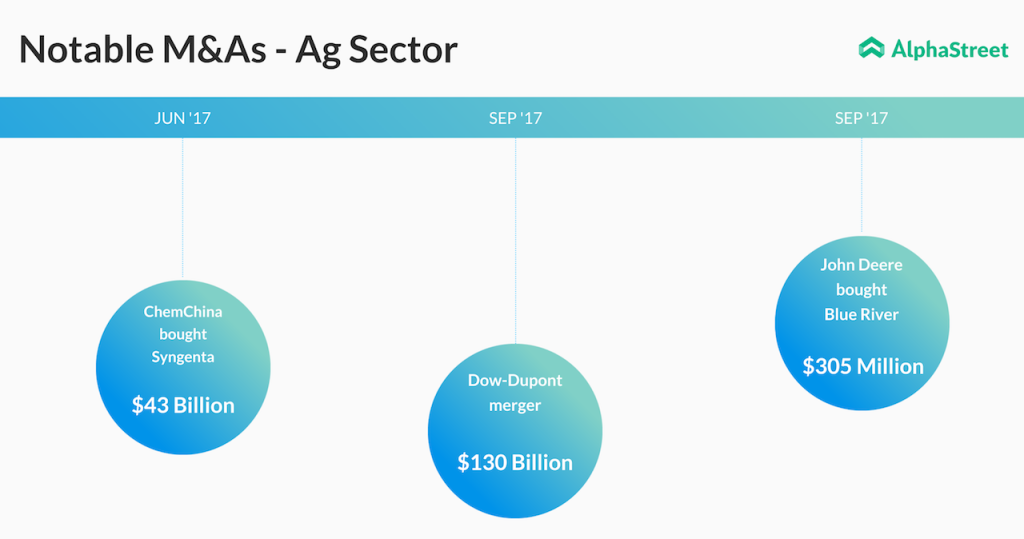

The big players in the agro-industry include Monsanto, Dow, Bayer, DuPont, and Syngenta. Of these, Dow and DuPont have already merged and Monsanto and Bayer are soon to follow suit. Syngenta meanwhile has been picked up by ChemChina. Who’s left?

Consolidation in the food and agro-industry is turning out to be a huge concern. How will things play out if only a few control the market? Some argue that it is necessary to team up and increase one’s strengths in order to deal with the demands of the food industry. There is a need to increase food production and the only way to do so is to join forces and make the most of it.

The Dow-DuPont merger wasn’t exactly smooth sailing. There were a lot of antitrust concerns, and multiple transactions were made to appease authorities. Finally, it managed to come through.

Monsanto-Bayer is no exception. This deal is likely to help Bayer become the most prominent supplier of seeds and crop chemicals. Monsanto already enjoys a strong position in seeds and herbicides. This is one royal wedding, and it seems to be getting all the necessary approvals.

Another argument is that the problem is not with food production but distribution. The big companies are accused of having caused enough harm to the environment and biodiversity through greenhouse gas emissions, genetically modified crops and excessive use of insecticides.

Let’s hope the lawmakers keep the already bad situation from getting worse and make every effort to improve it as well by making sure whatever deal is made, it is in the best interests of the average person.

Here’s a quick graphical take on the deals in the industry: