Results beat estimates

Business performance

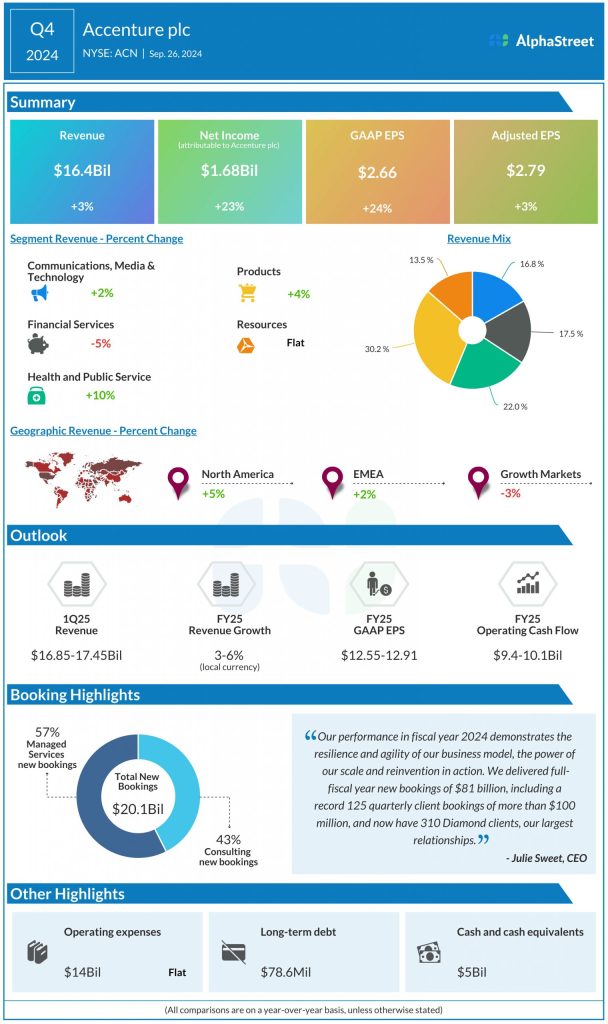

In Q4, Accenture recorded revenue growth across most of its segments and geographies. Consulting revenues rose 1% YoY to $8.26 billion while Managed Services revenues increased 5% to $8.15 billion.

The Communications, Media & Technology, and Products industry groups saw revenues grow in low to mid-single-digits to $2.75 billion and $4.95 billion, respectively. Health & Public Service revenue grew double-digits to $3.61 billion. Financial Services revenue fell 5% YoY to $2.87 billion while Resources revenue remained flat at $2.22 billion.

Revenues in North America grew 5% to $7.97 billion while EMEA revenues rose 2% to $5.64 billion compared to last year. Revenues in Growth Markets decreased 3% to $2.80 billion.

In the fourth quarter, Accenture’s new bookings increased 21% YoY to $20.1 billion. Consulting new bookings were $8.6 billion while Managed Services bookings were $11.6 billion.

Outlook

Accenture expects revenues of $16.85-17.45 billion for the first quarter of 2025, representing a YoY growth of 2-6% in local currency. For the full year of 2025, the company expects revenue growth of 3-6% in local currency. GAAP EPS is projected to increase 10-13% YoY to $12.55-12.91.

Dividend hike and share buyback

Accenture increased its quarterly dividend by 15% to $1.48 per share. The dividend is payable on November 15, 2024 to shareholders of record on October 10, 2024. Accenture’s share repurchases totaled $628 million in Q4 2024. The company’s Board of Directors approved $4 billion in additional share repurchase authority, bringing its total outstanding authority to approx. $6.7 billion. Accenture plans to return at least $8.3 billion in cash to shareholders through dividends and share repurchases in FY2025.