Results beat expectations

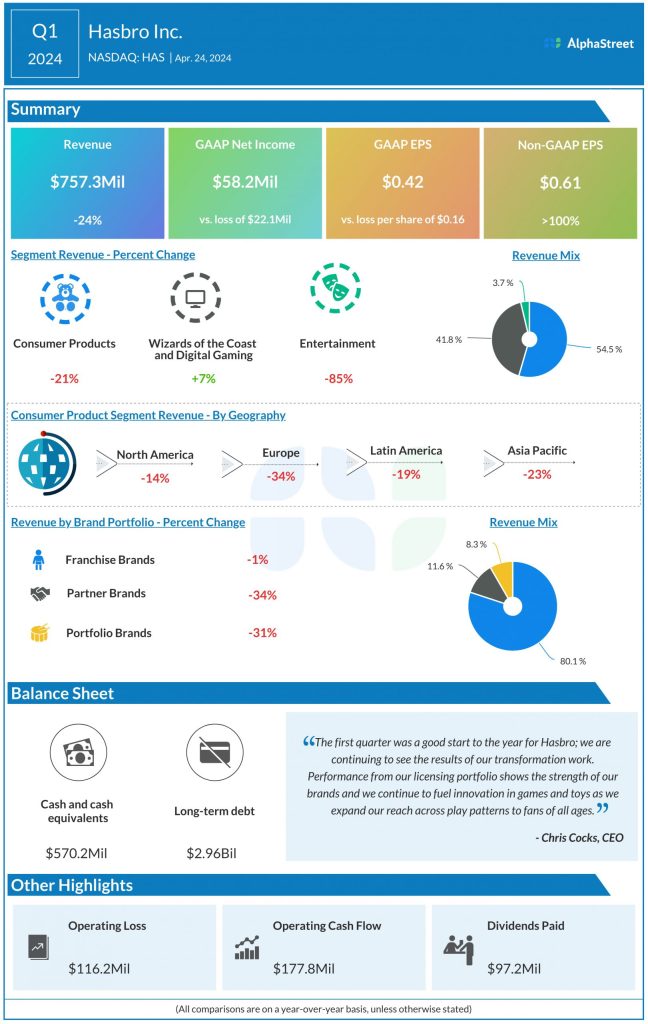

On a GAAP basis, the company reported earnings of $0.42 per share compared to a loss of $0.16 per share last year. Adjusted EPS amounted to $0.61, which exceeded estimates of $0.30.

Category performance

In Q1, Hasbro recorded a 21% decline in revenue in its Consumer Products segment, which was driven by broader industry trends, exited businesses, and reduced closeout sales due to last year’s inventory clean-up. Revenues for this segment declined across all geographic regions.

As mentioned on the quarterly conference call, within the Consumer Products segment, the company saw gains from FURBY, helped by the launch of FURBLETS last December, as well as from PLAY DOH and Hasbro Gaming. At the same time, it saw softness in the blaster category which had a negative effect on NERF, as well as action figures due to the light entertainment slate and the lapping of the success of Transformers: Rise of the Beasts last year.

Revenues in the Wizards of the Coast and Digital Gaming segment increased 7%, helped by digital licensing contributions from Baldur’s Gate 3 and Monopoly Go!. Tabletop revenue increased 5%, helped by growth in MAGIC: THE GATHERING, which benefited from shipments for the latest set release Outlaws of Thunder Junction and strong reception to the Universes Beyond Fallout Commander set.

The Entertainment segment saw revenues decline 85% due to the sale of eOne Film and TV. Excluding this impact, revenues grew 65%, driven by a renewal deal for PEPPA PIG.

Outlook

For the full year of 2024, Hasbro continues to expect revenues in the Consumer Products segment to be down 7-12%. Revenues in the Wizards of the Coast segment are expected to be down 3-5% while pro forma Entertainment segment revenue is expected to be down $15 million. The company expects adjusted EBITDA to range between $925 million to $1 billion.