Revenue and earnings beat expectations

Growth across segments

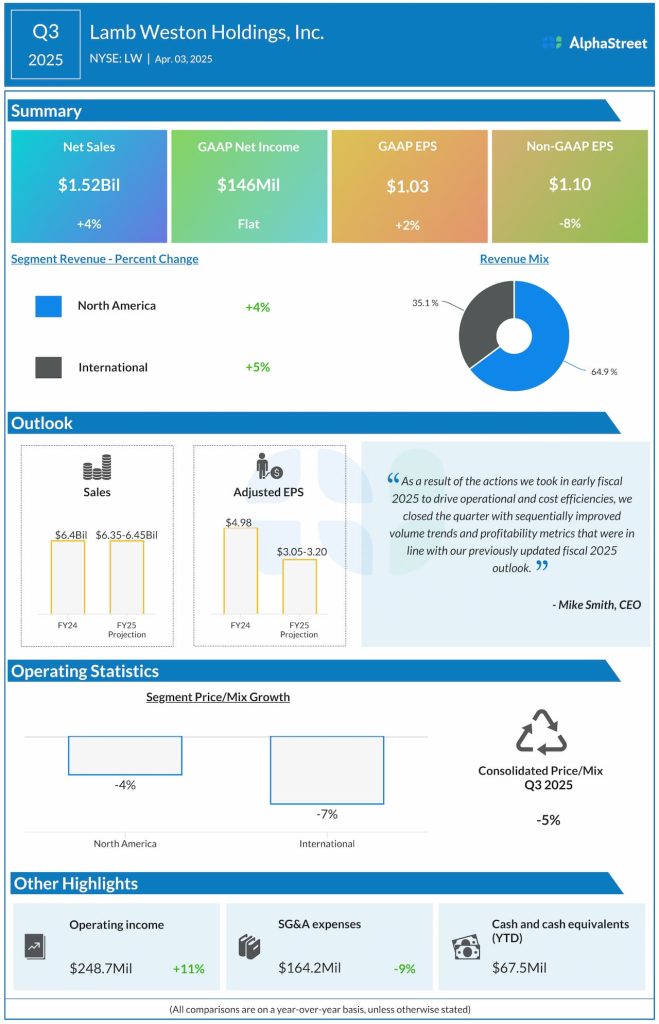

In Q3, Lamb Weston achieved sales and volume growth in both its business segments. The North America segment saw sales increase 4% YoY to $986.3 million. Volume in this segment increased 8% as the company replaced lost customer volume and won customer contracts across each of its channels.

Sales for the International segment rose 5% YoY to $534.2 million. Volumes rose 12%, led mainly by chain customer contract wins in key international markets. The volume gains were partly offset by impacts from the company’s exit from certain low-price, low-margin business in Europe last year.

During the quarter, LW’s volume gains were partly offset by softness in restaurant traffic, which the frozen potato products maker expects will continue to be a headwind.

Reaffirms outlook

Lamb Weston reaffirmed its outlook for fiscal year 2025. The company expects net sales to range between $6.35-6.45 billion and adjusted EPS to range between $3.05-3.20 for the year.