US stock market opened higher today as seen from major index futures, but turned lower following a slowdown in economic growth. Also, the dollar advanced against most major currencies. In the bond market, yields dropped during the morning trade on concerns of rising Treasury issuance, which is related to President Donald Trump’s budget-busting tax reforms.

The S&P 500 index slid 0.06% to 2,665.29, Dow 30 fell 0.25% to 24,261.45 and Nasdaq tumbled 0.20% to 7,105.52. Elsewhere, shares at Asian markets ended higher on Friday, and European stocks are trading higher.

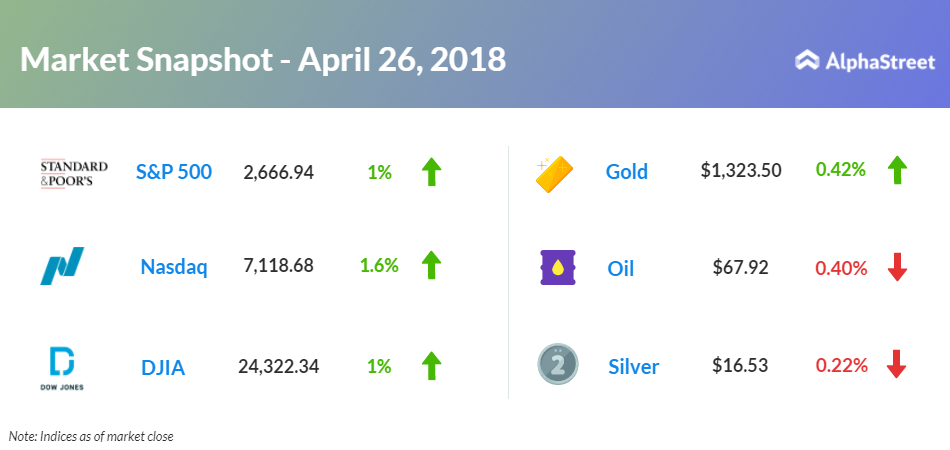

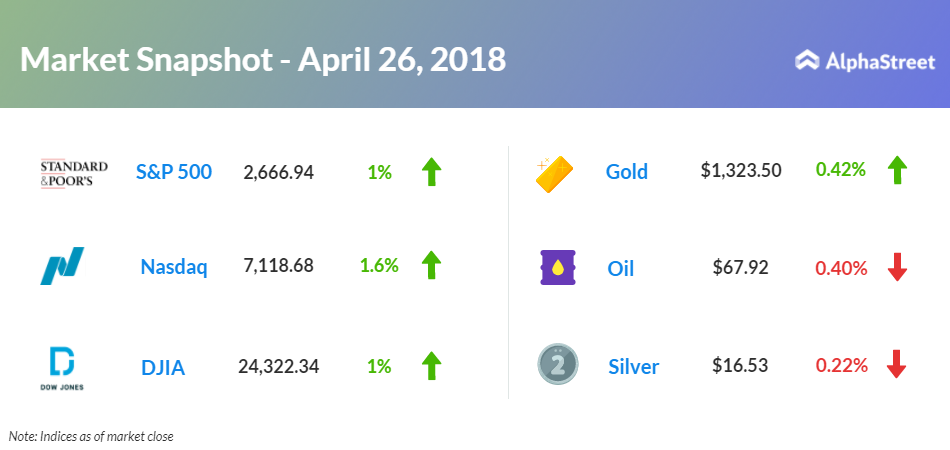

On April 26, US ended higher, with Nasdaq up 1.6% to 7,118.68. Dow rose 1% to 24,322.34, and the S&P 500 gained 1% to 2,666.94.

On the economic front, investors remained concerned after the Commerce Department’s economic growth report that slowed in the first quarter of 2018. Real gross domestic product increased 2.3% in the first quarter after jumping 2.9% in the fourth quarter.

A University of Michigan report showed that consumer sentiment index for April was upwardly revised to 98.8 from the preliminary reading of 97.8. This came in below the final March reading of 101.4. The index of consumer expectations fell to 88.4 in April from 88.8 in March, and the current economic conditions index tumbled to 114.9 from 121.2 in March.

On the earnings front, Charter Communications (CHTR) stock tumbled 11.54% after it lost 122,000 residential video subscribers during the first quarter. Exxon Mobil (XOM) slid 3.46% after its first-quarter earnings missed consensus. Chevron (CVX) stock rose 1.34% after better-than-expected first-quarter earnings. Colgate-Palmolive (CL) stock moved up 0.77% after first-quarter earnings exceeded analysts’ consensus.

Rockwell Collins (COL) moved down 0.42% after second-quarter revenue missed consensus. Cabot Oil & Gas (COG) stock advanced 2.13% after better-than-expected first-quarter earnings. DMC Global (BOOM) stock jumped 23.38% on the back of higher earnings for the first quarter. Shares of eHealth (EHTH) climbed 20.15%, thanks to the better-than-expected first quarter earnings. Flex Ltd. (FLEX) stock fell 15.74%, hurt by the earnings miss and investigating allegations of improper accounting.

Crude oil future is down 0.40% to $67.92. Gold is trading up 0.42% to $1,323.50, while silver is down 0.22% to $16.53. On the currency front, the US dollar is trading down 0.19% at 109.089 yen. Against the euro, the dollar is down 0.04% to $1.2099. Against the pound, the dollar is down 0.85% to $1.3794.