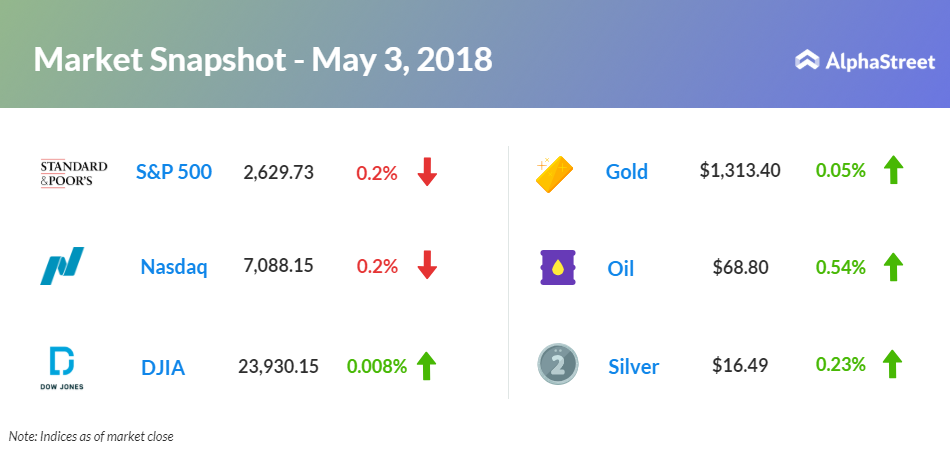

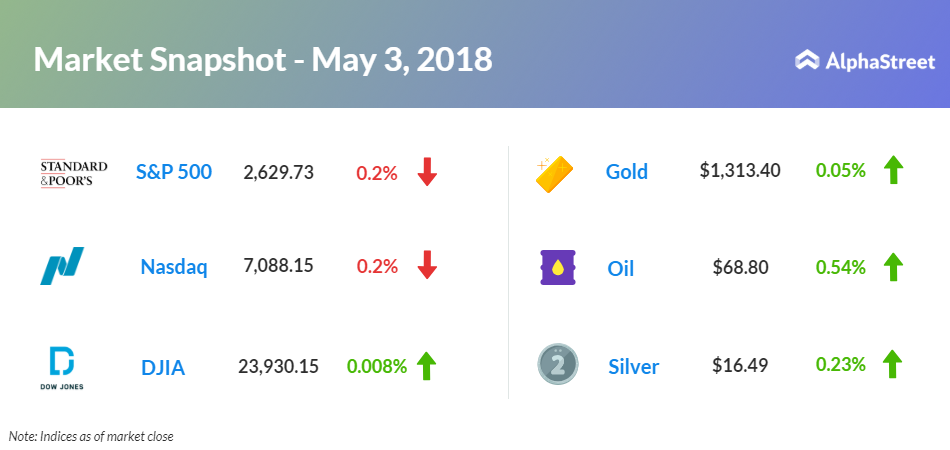

On May 3, US ended lower, with Dow moved up less than a tenth of a percent to 23,930.15. Both Nasdaq and S&P 500 inched down 0.2% to 7,088.15 and to 2,629.73, respectively.

On the economic front, the Labor Department report showed weaker than expected employment growth in April. Non-farm payroll employment increased 164,000 jobs in April after rising 135,000 jobs in March. This was helped by increases in employment in the professional and business services, healthcare, mining, and manufacturing sectors.

The report also showed that unemployment rate slid to 3.9% in April from 4.1%, which remained steady for six successive months. This is primarily due to a decline in the labor force size, which shrank by 236,000 people. Average hourly employee earnings rose 0.1% to $26.84 in April.

After announcing their earnings results today, Alibaba Group (BABA) stock slid 1.28% at 11:00 am ET despite upbeat fourth-quarter results. Celgene (CELG) stock moved up 0.75% after better-than-expected first-quarter results. Shares of Fred Inc. (FRED) tumbled 8.68% after a wider fourth-quarter loss. Ionis Pharmaceuticals (IONS) stock rose 4% after its first-quarter earnings and revenue exceeded Street’s expectations.

Twitter (TWTR) stock moved down 0.33% after it found a bug that stored passwords unmasked in an internal log. Shake Shack (SHAK) stock jumped 23.33% after lifting full-year guidance and upbeat first-quarter results. Weight Watchers International (WTW) stock increased 7.50% after raising full-year outlook and upbeat first-quarter results.

Crude oil future is up 0.54% to $68.80. Gold is trading up 0.05% to $1,313.40 and silver is up 0.23% to $16.49. On the currency front, the US dollar is trading down 0.04% at 109.145 yen. Against the euro, the dollar is down 0.47% to $1.1931. Against the pound, the dollar is down 0.41% to $1.3518.